In this article, we will talk about whether you can forex trade without a broker. We will also discuss top forex brokers that you can choose from to trade in the forex market.

Can you do forex trading without a broker in 2024?

No, even though you can trade forex without a broker, you need a broker if you want to trade forex with real money. Without a broker, you can only trade with virtual currency. This is great for practicing in the forex market but not that great for making real money with forex trading

Why do I need a broker to trade forex?

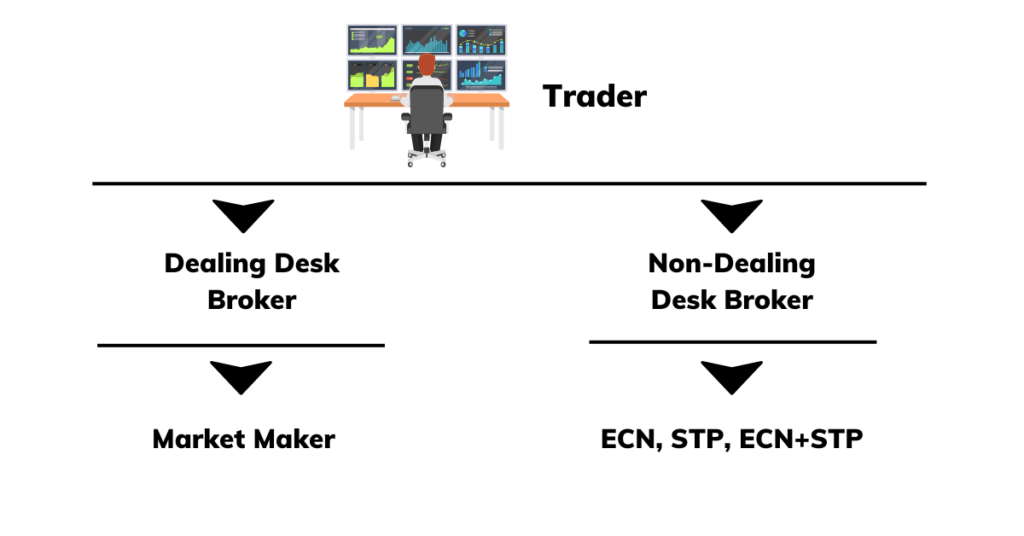

You can trade forex without a broker. But you can only do paper trading/ trading with virtual currency. You need a broker to execute your trades in the real markets. To execute real trades, you need to access market makers, ECN or STP. You can only do this through a forex broker. The figure below summarises this.

As you can see from figure 1, you need to go through a dealing desk broker or a nondealing desk broker. Now, let’s talk about what things to consider when choosing the right broker for you.

How to choose the right broker for you?

Choosing the right broker is very important when it comes to forex trading. There are a lot of broker scams out there. We continuously review brokers in the forex market, so that we can narrow down the best trustworthy brokers for you.

There are several things to consider when choosing a good broker. The following are the things that you must consider when choosing the right broker for you.

- Regulations – The broker you choose must be a regulated broker. When the broker is regulated you can trust them more. Also, it is important to note that there are different tiers of regulators in the forex market. The top brokers are regulated by tier 1 regulators like the Australian Securities and Investment Commission (ASIC)

- Trading platforms provided – does the broker provide you with good trading platforms depending on your needs? If you trade on mobile, it is a good idea to choose a broker with a good mobile trading platform.

- Customer service – this is also important to consider. It is always good to choose a broker that provides great customer service. Especially one that provides 24-hour customer service so that it doesn’t matter where you live.

- Commission and Spreads – it is always better to choose a broker that provides you with tight spreads and low commissions.

- Reputation – a broker with a good reputation among traders is a more suitable broker. Even some regulated brokers have a bad reputation in the industry. It is important to be aware of that.

- Supported Countries – Some brokers don’t provide services in certain countries. For example, if you are living in the US, you are only allowed to use a US-based broker.

- Payment Methods – The range of payment methods for withdrawals and deposits is also something you should consider when choosing a broker. Because some payment methods you want to use might not be accepted by some of the brokers.

- Minimum Deposit required – Some brokers require a high amount of deposit to open an account with them, while other brokers require a low minimum deposit. If you don’t have much capital, you will have to choose a broker that doesn’t require a high amount of deposit.

But you don’t have to worry about all of these because we have done the hard work for you. We have narrowed down the best and most trusted brokers in the industry. Now, let’s talk about 3 great brokers that you can trust and choose from.

3 Great Brokers to Choose from for Trading Forex

1. XM Broker

XM Broker is great broker who is highly regulated. The XM Broker is regulated by the Australian securities and investment commission (ASIC), the Cyprus securities and exchange commission (Cysec), and the International financial services commission (IFSC)

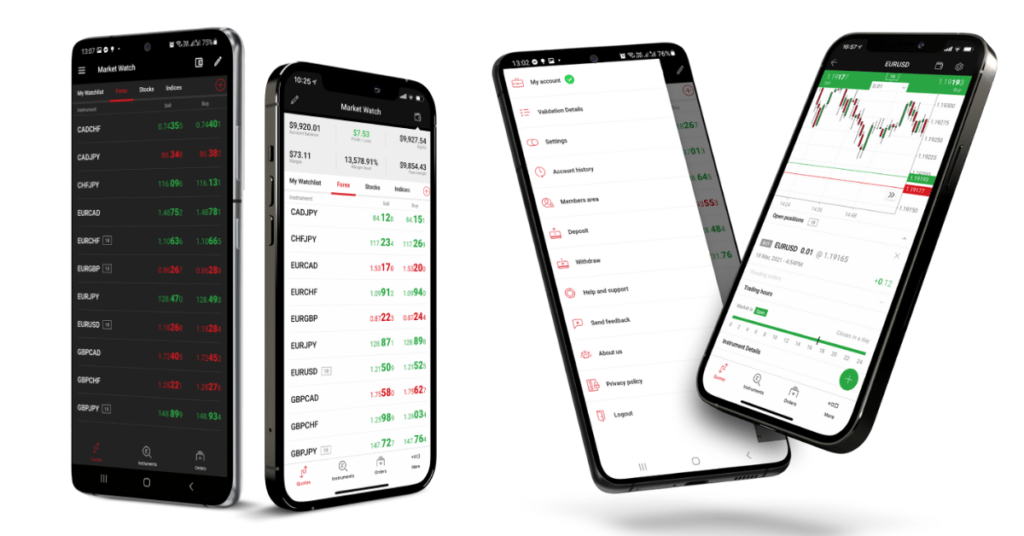

XM broker provides you with a multitude of great trading platforms. These include the MetaTrader 4, MetaTrader 5, and the XM mobile trading platform. Figure 2 shows the XM mobile trading platform.

The MetaTrader 4 and MetaTrader 5 platforms are similar to the of what MetaTrader platforms Avatrade provides as well. The spreads provided by the XM broker are variable and can be low as 0.6 pips for major currency pairs.

The XM Broker also does not charge a commission for trades you make with their platform. XM Broker provides you with 3 different types of trading accounts, these are micro accounts, standard accounts, and ultra-low accounts.

XM broker also provides you with world-class customer service. You can contact XM broker’s customer service through email, phone, and live chat.

Summary of XM Broker

| Assets Available | 6 Asset Classes – Forex, Stocks, Commodities, Equity Indices, Precious Metals, and Energies. |

| Regulated By | 3 Regulators – ASIC, CySec, IFSC. |

| No. of Trading Platforms | 3 main trading platforms – XM mobile app, MetaTrader 4, and MetaTrader 5 |

| Leverage | Up to 500:1 depending on the asset class |

| Min Deposit | $5 |

| Spreads | As low as 0.6 pips on major currency pairs depending on the account type. Spreads are variable. |

| Education Provided | Free step-by-step guide for beginners (basic) |

| Customer Support | 24/5 support through email, phone, and live chat |

| Methods of Payment | Credit Card, Debit Card, Skrill, Neteller, Bank Wire, and Union Pay |

2. AvaTrade Broker

AvaTrade is a highly regulated broker that provides traders with great services which we will talk about in detail in this section.

AvaTrade broker is highly regulated by 7 different regulators including tier 1 regulators, which are the Central Bank of Ireland, B.V.I Financial Services Commission, Australian Investment and Securities Commission (ASIC), and more (refer to AvaTrade Summary).

AvaTrade provides you with a range of trading platforms that you can use on mobile, web, and desktop. If you are interested in trading forex on your mobile device, you can use AvaTrade Go which is a mobile application developed by AvaTrade for forex trading. Figure 3 shows the AvaTrade Go mobile trading platform.

AvaTrade also provides you with a web trading platform and trading platforms based on MetaTrader 4 and MetaTrader 5.

These are also great trading platforms, especially the Metatrader 5 (MT5) if you are trading on your desktop. MT5 has all the necessary tools to analyze the markets technically.

MT5 is the successor of the MT4 trading platform. MT4 and MT5 trading platforms also support automated trading. Both MT4 and MT5 trading platforms also have a web trader and a mobile trading platform (Android only). If you want to trade on your IOS device you can use the AvaTradeGo trading platform. Figure 4 shows the AvaTrade web trading platform.

When it comes to customer service, AvaTrade provides its customers with exceptional service. You can contact AvaTrades customer service 24/5 through email, phone, and WhatsApp. Because they provide you with 24-hour service, you can contact them at any time which is convenient for you.

AvaTrade also provides you with tight spreads which are variable. This means that it depends on which instruments you are trading and the market conditions. Also, a great advantage of trading with AvaTrade is that they do not charge commissions on any trade.

Below is a summary of the AvaTrade Broker.

Summary of AvaTrade Broker

| Assets Available | 8 Asset Classes provided – Forex, Crypto, CFD, Stocks, Options, Indices, EFTs, and bonds. |

| Regulated By | 8 Regulators – Central Bank of Ireland, BVI Financial Services Commission, ASIC, South African Financial Services Board, Financial Futures Association Japan, Abu Dhabi Global Markets, Cysec, and Israel Securities Exchange |

| No. of Trading Platforms | 5 main trading platforms – AvaTrade Web Trader, AvaOptions, AvaTrade Go, MetaTrader 4, and MetaTrader 5 |

| Leverage | Up to 1:400 depending on the asset class |

| Min Deposit | The minimum deposit required is $100 |

| Spreads | Variable spreads depend on which instrument is traded and the market conditions |

| Education Provided | Trading courses available for beginners and advanced traders |

| Customer Support | 24/5 support through email, phone, and WhatsApp |

| Methods of Payment | Credit Card, Visa, Skrill, Wire transfer, Neteller |

3. eToro Broker

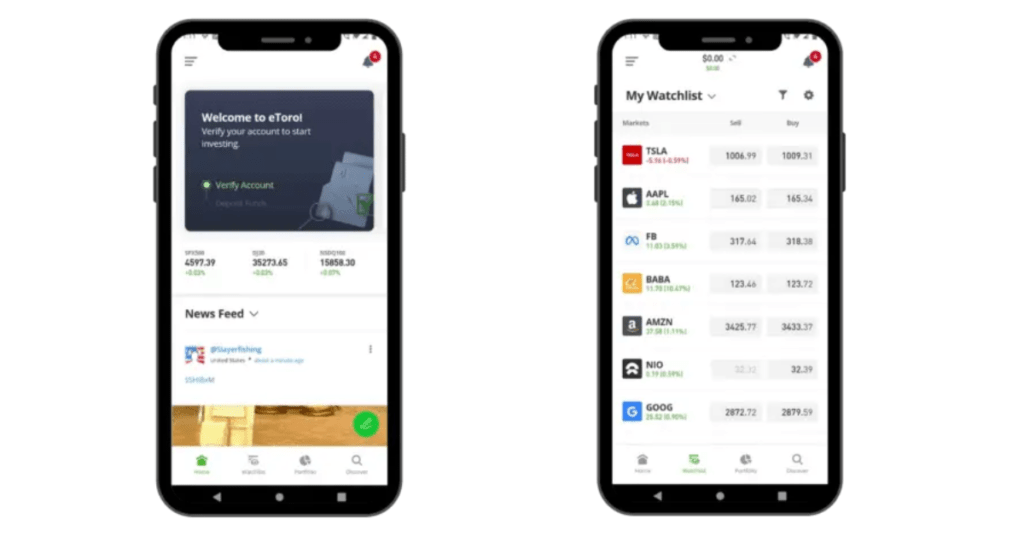

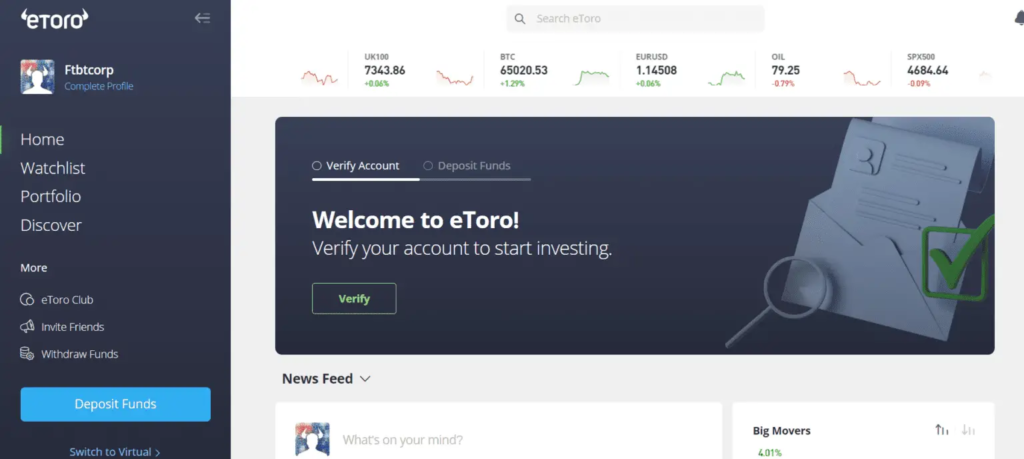

eToro broker is another great broker that is known for its mobile trading platform and its social trading platform. This broker is also highly regulated by Cysec, FCA, SIC, and FSAS.

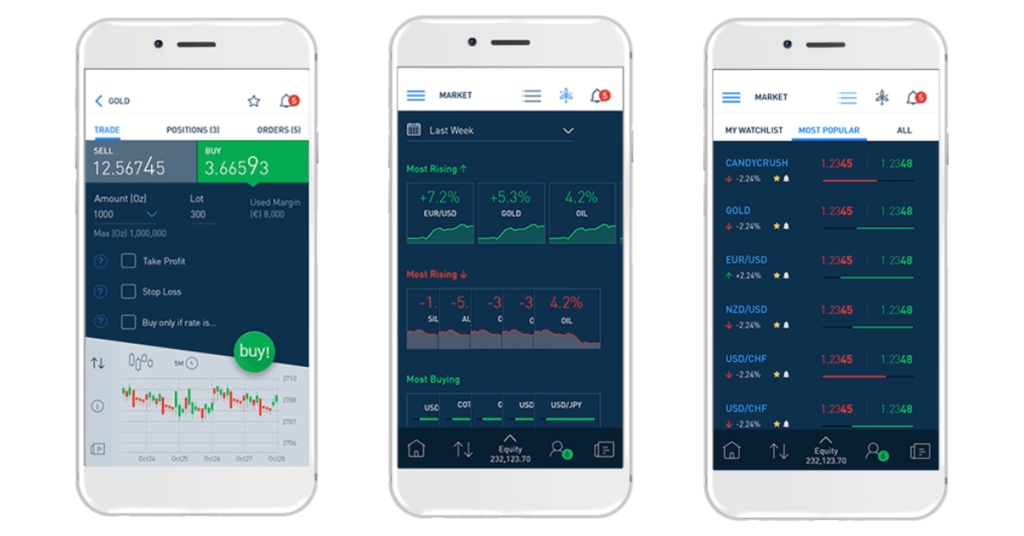

eToro broker provides you with one main trading platform that you can use to trade on mobile and on the web. The mobile app is popular among social traders. Also, the eToro mobile app is downloaded by over 10 million users worldwide. Figure 5 shows the eToro mobile app.

Figure 6 shows the eToro web trading platform. The web trading platform provides you with the same features as the mobile trading platform.

If you are interested in social trading, eToro is a great trading platform to consider. It is important to note that we do not recommend social trading.

Also, eToro does not provide you with MetaTrader 4 or MetaTrader 5 trading platforms. This means that you will not be able to build trading robots and do automated trading.

Below is a summary of the eToro broker.

Summary of eToro Broker

| Assets Available | 5 Asset Classes – Forex, Stocks, Equity Indices, Cryptocurrencies, and CFDs. |

| Regulated By | 4 Regulators – CySec, FCA, ASIC. FSAS |

| No. of Trading Platforms | 1 Main trading platform |

| Leverage | 30:1 leverage for major currency pairs for non-professional clients |

| Min Deposit | $50 |

| Spreads | 1 pip for leading forex pairs |

| Education Provided | eToro Academy provides basic education |

| Customer Support | Support through email using customer service tickets |

| Methods of Payment | eToro money account |

Conclusion

In this article, we discussed whether you can do Forex Trading without a Broker in 2023. As discussed you cannot make real money in the forex market without a proper broker. Also, we discussed 8 important things to consider when choosing the right broker for you.

We also recommended you 3 top brokers that you can work with today. Make sure to check them out below.