Choosing the right broker, is one of the most important things to consider when trading. There are several factors to be taken into account when choosing your broker. Some of these are, regulations, commissions on trades, methods of payment, platforms provided, speed of trade execution, etc. In this XM Broker review, will discuss in detail about each of the important factors that you must consider when trading with the XM broker.

Summary

Assets Available | 4 Asset Classes – Forex, Stocks, Commodities Indices. |

Regulated By | CySEC, ASIC, FSC, DFSA |

No. Of Trading Platforms | 3 Trading Platforms – MetaTrader 4, MetaTrader 5 and XM mobile trading app |

Leverage | Up to 1:1000 |

Spreads | From 0.8 pips |

Commission | 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Videos, articles and other educational materials |

Methods of Payment | Credit Card, Debit Card, Skrill, Neteller, Bank Wire and Union Pay |

Open Account |

Broker Background

XM Group was founded in 2009 and currently has over 10+ million clients worldwide. XM is an award-winning trading platform. It is also highly regulated by tier 1 regulators such as Australian Securities and Investment Commission (ASIC).

There are 2.4 billion+ trades executed with the XM Broker. Now let’s discuss each aspect of this broker, starting with the trading platforms provided by the XM Broker.

Trading Platforms

XM provides an award-winning trading platform. XM provides trading platforms that work on desktop, mobile and on the web. The desktop and the web platforms are based on the popular Meta Trader 5 trading platform.

Metatrader 4 Platform

With the XM Broker, you can trade on the popular Metatrader 4 platform. MT4 is the most used trading platform in the world for trading currencies. MT4 provides you with all the tools necessary to analyse the markets and execute trades. This also supports algorithmic trading as well.

Metatrader 5 Platform

Metatrader 5 trading platform is the successor to the MT4 platform. MT5 is quickly replacing MT4 as the main trading platform for forex traders. MT5 provides more tools and better algorithmic trading capabilities to traders. With the XM Broker, you can trade on either MT4 or MT5 based on your preference.

XM Mobile Trading Platform

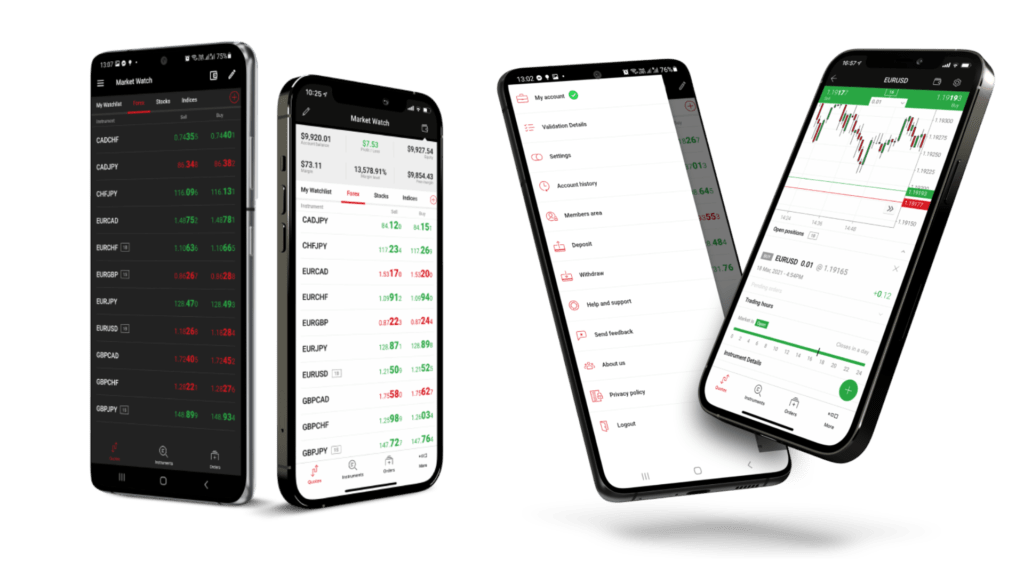

There are two main types of mobile trading platforms that are provided by the XM Broker. One is based on the Metatrader mobile trading platform, and the other one is XM’s own mobile trading application. Both of these platforms supports android and iOS. The following figure 2 shows the XM Mobile trading platform.

Instruments Available For Trading

XM provides 6 different asset classes/instruments for trading. Available instruments in XM are Forex, stocks, commodities, equity indices, precious metals and energies.

Forex

They offer more than 55 currency pairs for you to trade which includes majors, crosses and exotics. They also provide you with up 1000:1 leverage. They don’t have hidden charges and provides very low/ tight spreads.

Stocks

You get several benefits of trading stocks with XM, these include speculation on market up trends or down trends. There are also no extra fees. They also allow you to access to over 1000 different stocks. That said, this platform is not the best for stock trader. The main focus of XM is Forex.

Commodities

You get the same benefits as trading stocks when trading commodities. At the time of writing this article they have less than 10 different commodities to trade with.

Equity Indices

XM broker provides several types of equity indices to trade with. These include indices like, S&P 500, ASX200, Nikkei 225 and many more. This broker is good for both long term and short term trading strategy.

Precious Metals

They allow you to trade precious metals such as gold and silver with 500:1 leverage. They don’t charge you extra fees when trading these metals. Other metals they provide include platinum and palladium.

Energies

Energies provided by XM mainly includes oil and gas. XM allows you to trade on a margin as low as 5 USD with no extra fees.

Regulations

XM Broker is regulated by 3 regulators including tier 1 regulators, these are,

- Australian Securities and Investment Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySec)

- Financial Services Commission of Belize (IFSC)

Account Types

There are 3 main account types provided by the XM Broker. These are,

- Micro Account

- Standard Account

- XM Ultra Low Account

The following table shows the differences between these account types.

| Micro Account | Standard Account | XM Ultra Low Account |

|---|---|---|

| Base Currency Options – USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN | Base Currency Options – USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN | Base Currency Options – EUR, USD, GBP, AUD, CHF, PLN, HUF |

| Contract Size – 1 Lot = 1,000 | Contract Size – 1 Lot = 100,000 | Contract Size – Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 |

| Negative balance protection – Yes | Negative balance protection – Yes | Negative balance protection – Yes |

| Commission – No | Commission – No | Commission – No |

| Spread on all majors – As Low as 1 Pip | Spread on all majors – As Low as 1 Pip | Spread on all majors – As Low as 0.6 Pip |

| Maximum open/pending orders per client – 200 Positions | Maximum open/pending orders per client – 200 Positions | Maximum open/pending orders per client – 200 Positions |

| Minimum trade volume – 0.01 Lots (MT4) 0.1 Lots (MT5) | Minimum trade volume – 0.01 Lots | Minimum trade volume – Standard Ultra: 0.01 Lots Micro Ultra: 0.1 Lots |

| Lot restriction per ticket – 100 Lots | Lot restriction per ticket – 50 Lots | Lot restriction per ticket – Standard Ultra: 50 Lots Micro Ultra: 100 Lots |

| Hedging allowed – Yes | Hedging allowed – Yes | Hedging allowed – Yes |

| Islamic Account – Optional | Islamic Account – Optional | Islamic Account – Optional |

| Minimum Deposit – $5 | Minimum Deposit – $5 | Minimum Deposit – $5 |

Commissions And Spreads

XM has very tight spreads, which can be low as 0.6 pips on all major currency pairs. Spreads are higher for other currency pairs. The thing to keep in mind is that XM doesn’t operate with fixed spreads, but operates with variable spreads.

There is a major advantage for using a broker with variable spreads. That is, they do not apply trade restrictions around the time of news releases. Another feature XM provides is something called fractional pip pricing. This allows you to trade with much tighter spreads.

Spreads also depends on the account type you open with the XM Broker. Currently, the spreads for EURUSD is 0.7 for the XM ultra low standard account. For standard accounts, the spreads for EURUSD is 1.6.

Leverage

XM provides flexible leverage between 1:1 and up to 1000:1. Even though this is the case, we do not recommend you to use too much leverage when trading. The more leverage you use, the riskier it gets. But if you are confident about your trading, having access to high leverage can be an advantage.

Education Provided

Another great feature about XM is the education they provide. They have a great guide for beginners. Even though they don’t teach up-to-date trading strategies to be profitable, it is still a great way to get started with Forex trading. Also, their education is completely free. XM also provides free webinars that bring on professional forex traders. You can access XM webinars here.

Awards

XM Broker has won a range of awards for it’s customer service and broker services. XM Broker has won the best broker award by the World Finance Forex Awards in 2023. XM also won the best broker award by Axlestreet.

Methods Of Payment (Deposit and Withdrawal)

XM provides you with a range of payment methods for you to deposit and withdraw money from the broker. The methods of payment includes Credit Card, Debit Card, Skrill, Neteller, Bank Wire and USTD (Tether). These methods are valid when you deposit or withdraw from your XM trader account.

Demo Account

XM does provide a demo account, like most other brokers do. They provide you with a virtual balance of $100,000 to trade with. It’s a good way to practice your trading, but you still need to remember that trading with virtual balance is only taking virtual risk. Therefore, eventually you got to trade with real money. We personally do not recommend you to demo trade for more than couple months, because it does not help with your emotional strength when it comes to trading.

Do We Recommend XM?

XM is a great and a trustworthy broker. We do recommend XM. They provide you with great features and great customer support. If you want to use XM as your broker and get bonuses, click the button below.