In this article, we will talk about the most powerful forex trading strategies you can use to trade the forex markets.

In reality, there is no one strategy that is the most powerful. Every trading strategy depends on the market conditions. One trading strategy can be powerful for a trending market but weak in a ranging market. To become a profitable trader you need to learn and master a few different strategies that will help you trade all the different market conditions.

Also, what strategy to use depends on your personality and your trading style as well. What is powerful for you might not be powerful for someone else. Keep reading on to find out the best and the most powerful strategies that suits you.

Before getting into powerful trading strategies it is important that we talk about the different types of market analysis styles. These are fundamental analysis and technical analysis.

Technical Analysis vs Fundamental Analysis

Technical analysts analyze forex charts using price action or technical indicators and trade based on the signals these indicators/price action provides. Fundamental analysts trade based on the news. We personally focus on doing technical analysis.

Usually, the news is reflected in the price action. We personally do not recommend trading based on the news even though it is good to be aware of the news.

The first step you need to take is to know which path you want to use. Trading with technical analysis or fundamental analysis as your primary trading analysis style? If you are not sure, we recommend you to focus on technical analysis.

There are two main ways to do technical analysis, these are by using technical indicators or price action or you can use both in combination. We primarily use price action with a few technical indicators as well. Now, let’s talk about technical indicators.

Technical Indicators

There are hundreds of technical indicators out there. There are new technical indicators being added quite often these days. Most of these indicators are not that great. Most of them don’t work or they work for a bit and then when the market conditions change, they stop working. Only some technical indicators actually work.

There are two main ways to use these technical indicators, one is to confirm a reversal and the other is to confirm a continuation. You can also use some technical indicators as support/resistance or a trailing stop loss. Two of our favorite technical indicators are the moving average indicator and the Bollinger bands indicator.

We personally use the moving average indicator as a trailing stop loss and not much to give us signals. If you are interested in learning more about these technical indicators check out our complete free forex trading guide here. Our favorite way is to trade using price action strategies. Now, let’s talk about what price action is.

Price Action

Price action is the price movement of the markets over time. Understanding what the price movements are saying is price action trading. There are different ways to trade price action.

One method is to understand market patterns. Identifying these patterns is an important skill for a trader. There are two main types of patterns, these are chart patterns and candlestick patterns.

There are 100s of different patterns out there but you don’t need to learn everything to become a profitable trader. Another price action trading method is to use supply and demand strategies.

Before we look at some powerful forex trading strategies you need to understand what type of trader you want to be. There are 4 types of traders, these are scalpers, day traders, swing traders and position traders. To learn what type of trader you should be check out this article.

Now, let’s look at some powerful forex trading strategies.

Powerful Forex Trading Strategies

Supply and Demand Trading Strategy

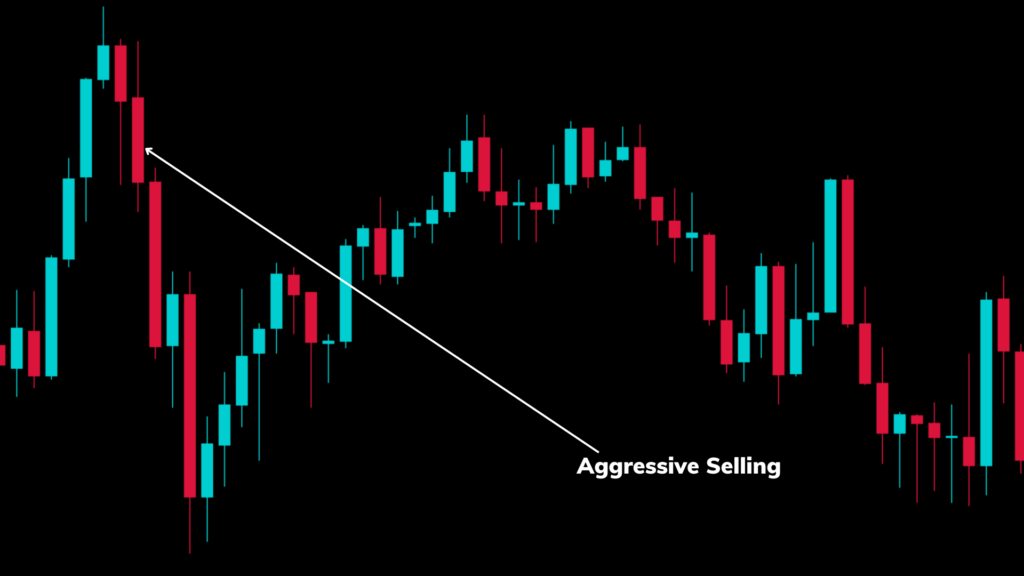

The first strategy we are going to use is the supply and demand strategy. This is one of our favourite forex trading strategies. To trade supply and demand, you need to identify supply zones (aggressive selling) and demand zones (aggressive buying). The chart below shows aggressive selling (represented by a range o of red candles).

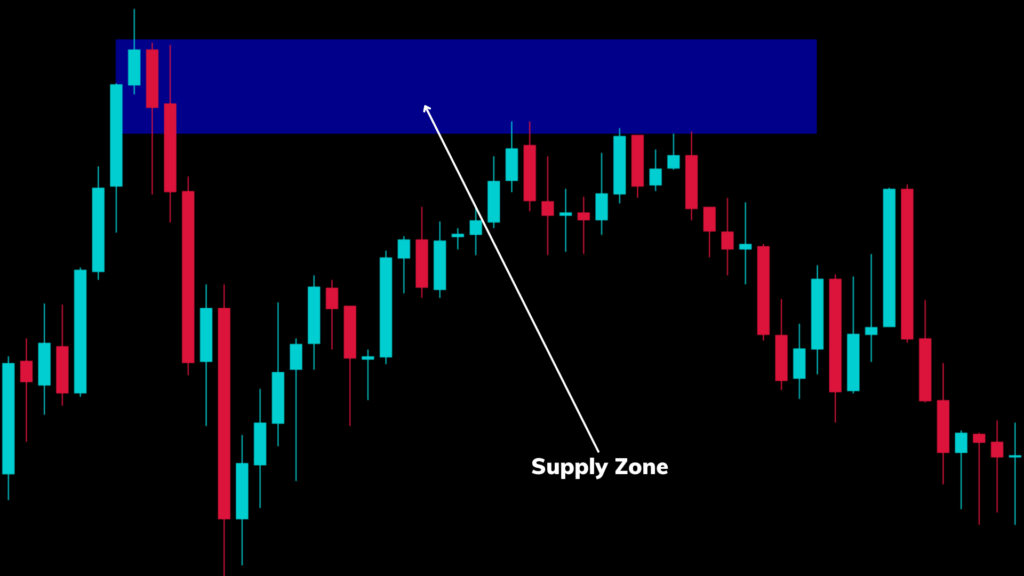

Now, let’s mark the supply zone. A supply zone is a zone where the aggressive selling starts. The blue rectangle in the chart below shows this supply zone.

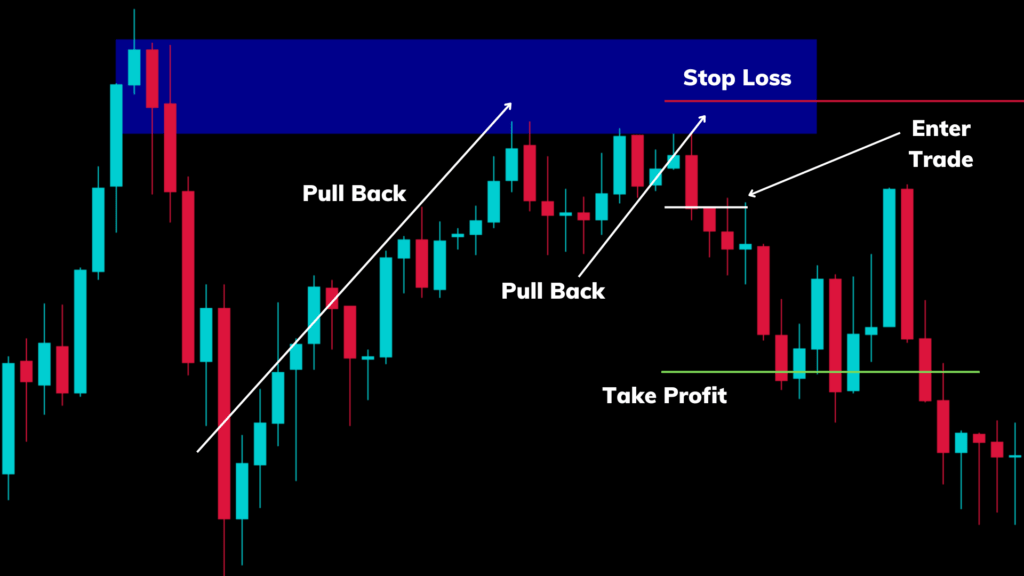

After you identify the zone, you have to wait for the market to pull back. Some supply and demand traders enter a trade after the first pullback. We don’t recommend that unless there is good candlestick pattern is formed. A less risky way is to wait for another pullback and then enter the trade. This is shown below.

Breakout Strategy

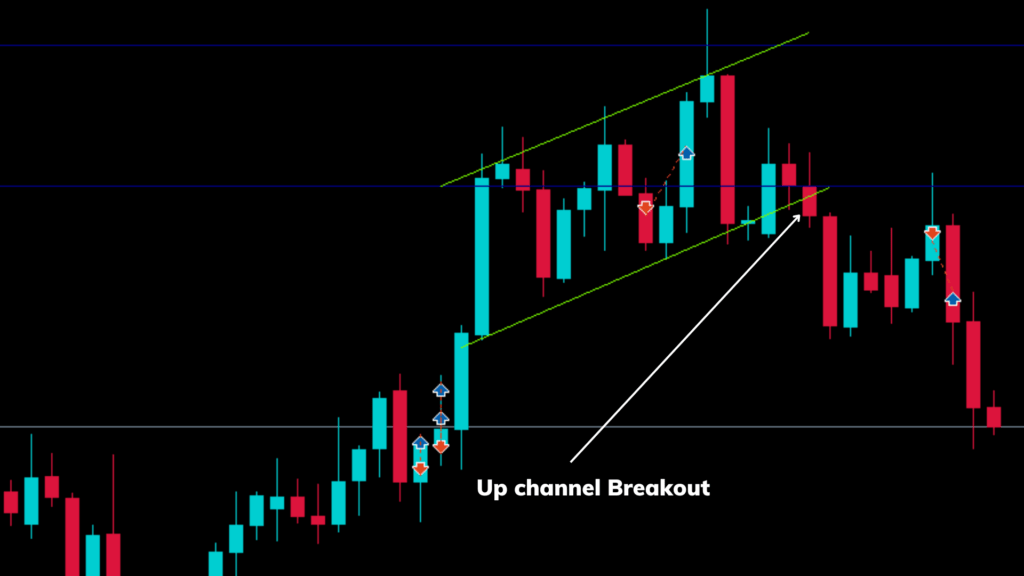

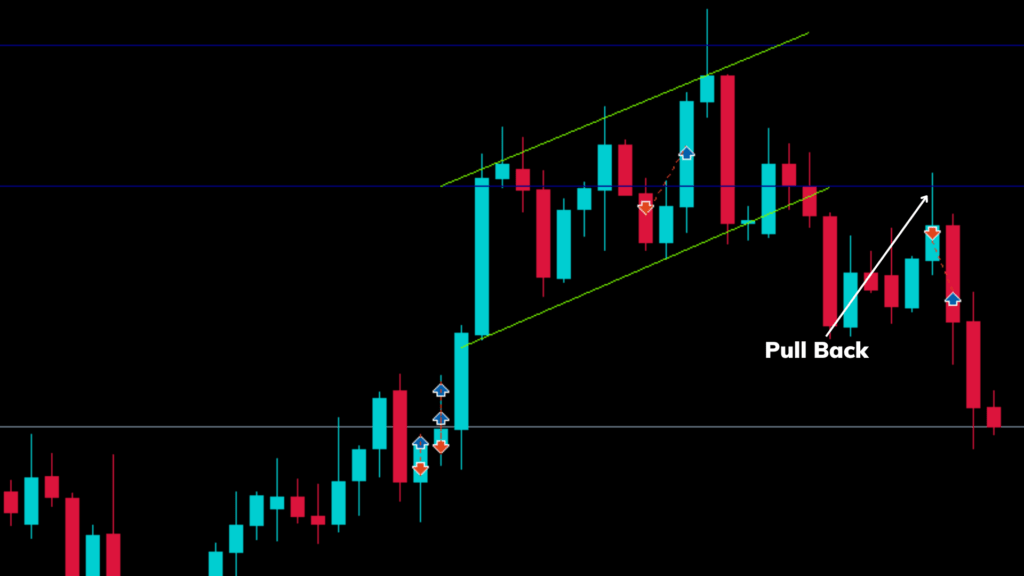

Now let’s look at a recent breakout trade that we took. The following chart below shows an up channel breakout. There are other breakout patterns as well, such as pennants, wedges, and triangles. We cover all of this in our free trading guide.

Some traders enter a trade just after the breakout. This is absolutely not a good idea because there can be a false breakout. That’s why we recommend traders wait for a pullback before entering a trade. The chart below shows a pullback. After a pullback wait for a good candle stick pattern (bearish candlestick candle in this case) to enter a trade. You can place your stop loss and take profit based on your risk-to-reward ratio.

Conclusion

As discussed in this article, there is no one most powerful forex trading strategy out there. You need to choose a few strategies that you understand well and a few strategies that work in different market conditions. Make sure you choose 2 to 3 forex trading strategies and practice trading with these strategies. If you are interested in learning how to trade the forex market step by step make sure to check out our free guide here.