In, this article we will discuss the 4 types of traders and what type of trading style is most suitable for you. We will also talk about different trading strategies for scalping, day trading, and swing trading.

There are 4 different types of traders, these are scalpers, day traders, swing traders, and position traders. You can become a profitable trader with either style of trading. You can also choose two different types of trading styles in combination with each other. I personally prefer to swing trade but sometimes I day trade as well. Read on to find which trading style suits you the most. First, we will look at scalping.

Scalping

A scalper is a type of trader who takes a lot of trades per trading session. Some scalpers even take more than 100 trades per trading session. Scalping the markets is generally harder than day trading or swing trading. A scalper trades on the 1-minute chart or the 5-minute chart.

A scalper will look to make small profits for each trade but will take a lot of trades per trading session. Scalping is not recommended for most traders. You have to be a really good trader to become profitable scalping the markets.

Scalping requires a lot of focus and it can be stressful because it is fast-paced. Also, with scalping, most traders tend to revenge trade. Personally, I do not prefer to scalp the markets. An advantage to scalping is that you can sit down, scalp for a few hours, and finish your trading day, unlike swing trading. Another advantage to scalping is that it is easier to code an expert advisor with a scalping strategy if it is based on technical indicators.

A huge disadvantage to scalping is that it is hard to track your trades because of the number of traders you have to take. It is much easier and cleaner to track your trades when doing day trading or swing trading.

Scalping Strategy

Now let’s talk about a scalping strategy that you can use today to trade the forex markets. Personally, we try to avoid the 1-minute chart much as possible because scalping works better on the 5-minute chart. That said, there are traders who scalp on the 1-minute chart and make profitable trades.

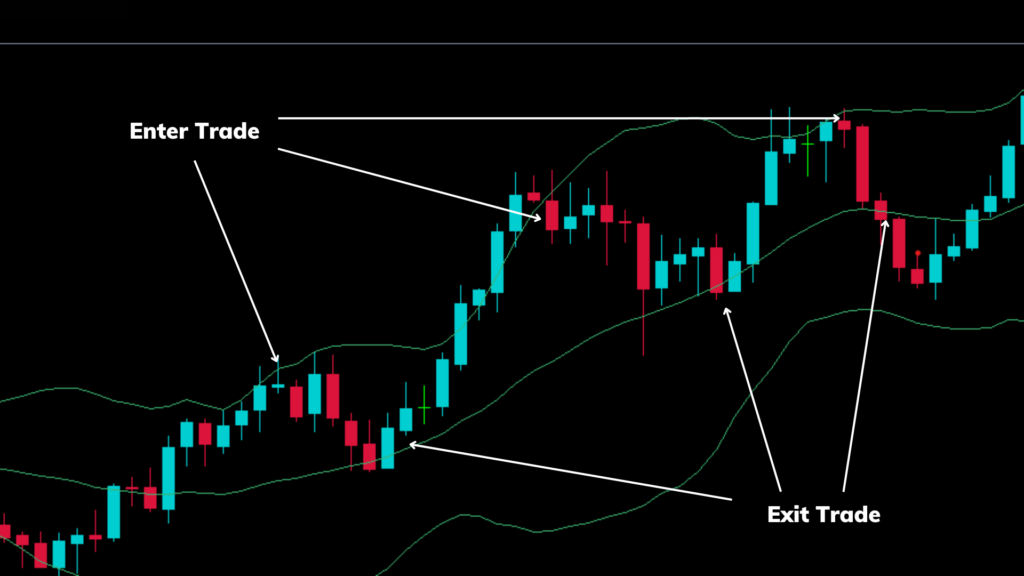

The following chart is a 5-minute chart of AUDCHF. For this strategy, we will be using one of my favorite technical indicators, the Bollinger bands. The following chart shows the Bollinger bands added. This Bollinger band has a period of 20 and a standard deviation of 2.

The key to scalping with Bollinger bands is to enter a short trade (Sell) when the market reaches the upper Bollinger band and enter a long trade (Buy) when the market reaches the lower Bollinger band. For both conditions, exit the trade at the middle Bollinger band. This is a very simple scalping strategy. This works best in a ranging market. This concept is shown below.

Day Trading

A day trader usually takes 1-3 trades a day. With day trading you will mostly trade on the 15-minute chart, the 30-minute chart, and the 1-hour chart. Day trading is suitable for people who have at least a few hours a day to trade.

Day traders also usually check the markets a few times a day, unlike scalpers who check the market only during their trading session. An advantage to day trading compared to swing trading or position trading is that you will not hold your trades overnight. A day trader will always get out of the market before the day ends. Also, as discussed before, with day trading you can track your trades better due to lesser trades compared to scalping.

Day Trading Strategy

Now let’s look at a day trading strategy. For day trading I personally prefer to use the 30-minute chart and the 1-hour chart. One of my favorite day trading strategies is the supply and demand strategy. Now, we will look at the supply and demand strategy.

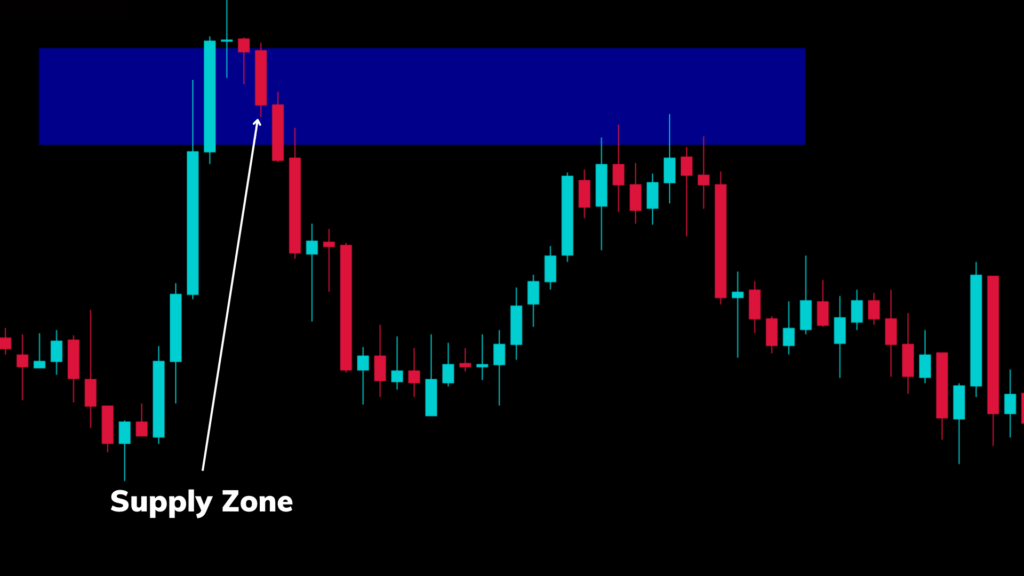

The following figure shows a supply zone marked in an AUDCHF 1-hour chart. As you can see the supply zone is a zone where aggressive selling happens (represented by a range of red candles/bearish candles). Like wise, a demand zone is a zone where aggressive buying happens (represented by a range of green candles/bullish candles).

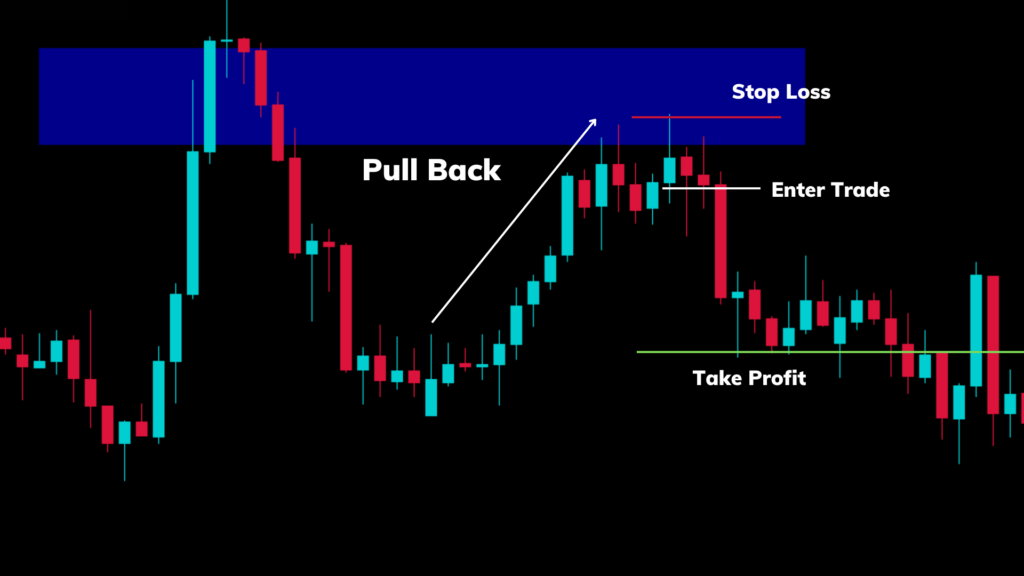

As seen in the above chart when the market pulled back to the supply zone, it stayed there for a while, and then it reversed. After the reversal occurred, you can enter a trade as shown below. You can place your take profit and stop loss based on your risk-to-reward ratio.

Swing Trading

I absolutely love swing trading. Swing trading is the most suitable for the majority of traders. With swing trading, you will be taking 1-4 trades a week. The biggest advantage to swing trading is that you don’t have to stare at the charts for hours on end. You can become a swing trader trading only 1 hour a day. Another great thing about swing trading is that you will take fewer trades compared to day traders & scalpers.

Also, you can track your trades easily with this trading style compared to day trading. But, if you are a beginner and you choose this trading style, it will take quite a bit of time to collect trading data due to lesser trades.

If you want to collect more trading data, it is good to do some day trading as well. The more data you have the easier it becomes to see your trading performance and what works for you and what doesn’t for you. If you are not tracking your trades currently you must check out our trading journal here. It is highly recommended that you track your trades often as possible.

The lesser trades you take, the less likely you will make mistakes in your trading and the less likely you will revenge trade (Revenge trading is a big problem among traders).

A disadvantage to swing trading is that you have to hold your trades overnight. This can sometimes interrupt your sleep because you might be thinking about your trades while you are in the bed. If you don’t want to hold your trades overnight, do not do swing trading or position trading.

That said if you are not sure what type of trader to become, my recommendation is for you to become a swing trader or a day trading. Try both of these trading styles and choose what is more suitable for you.

Swing Trading Strategy

Now let’s talk about a swing trading strategy you can use to trade the forex market. For swing trading, we will mainly be using the 4-hour chart, and sometimes the 1-hour chart and the daily chart.

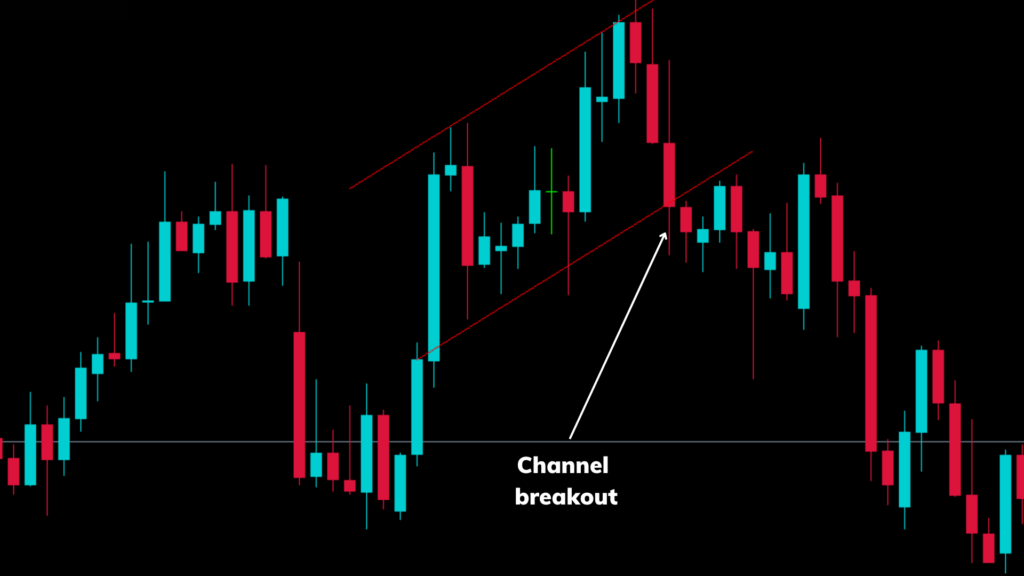

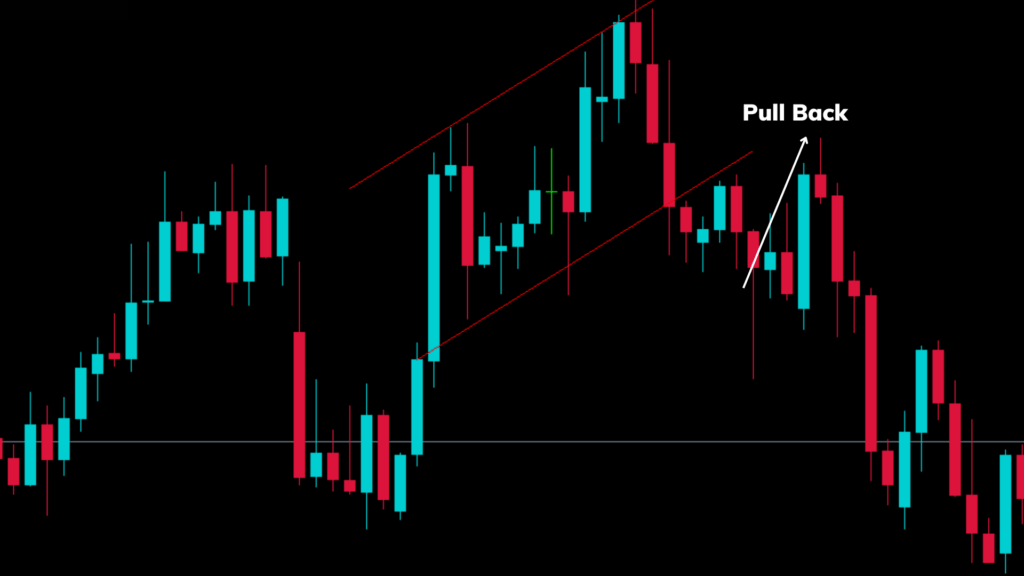

One of our favorite swing trading strategies is the breakout strategy on the 4-hour chart. You can also apply this strategy to day trading as well. Now, let’s look at this breakout trading strategy. The chart below shows an up-channel breakout on AUDCHF 4-hour chart.

As seen in the above chart, the market broke out of an up channel. Most novice traders will trade the breakout immediately, this is a bad idea. Sometimes it will work but sometimes a false breakout might happen. To reduce the risk of losing a breakout trade, it is a good idea to wait for a pullback to happen close to the channel. The chart below shows the pullback.

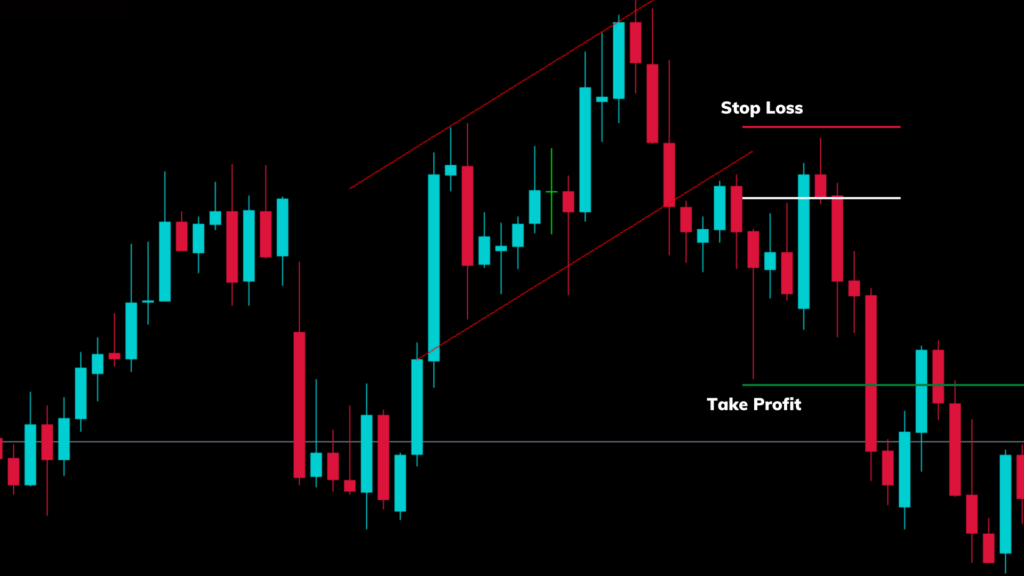

After the pullback, wait for a good bearish candle. Then you can place the trade like shown in the figure below.

Position Trading

A position trader holds their trades for weeks, months, or even years. This type of trader is more of a long-term trader or an investor. Position trading is quite risky and doesn’t work that well in the forex market. Position trading is more suitable for the stock market.

I personally do not position trade and do not recommend this type of trading to forex traders. But if you like the idea of position trading, it’s better for you to try this trading style in the stock market rather than the forex market. Also, the crypto market is pretty good for position trading as well.

Conclusion

As discussed in this article, there are four types of traders, scalpers, day traders, swing traders, and position traders. As discussed, swing trading will be the most suitable type of trading for most traders. But, if another trading style excites you more than swing trading, go with that style of trading.

If you read this article you should be able to decide for yourself what trading style suits you the best. If you are interested in learning how to trade the forex market step by step for free make sure to check out our free forex trading guide here.