When it comes to trading forex, you can use plenty of different strategies to make profits. Some strategies are very profitable and some are not very profitable. One method to trade is to use candlestick patterns for confirmation of the direction of the trend. There are 100s of different candlestick patterns. The bullish engulfing patterns and bearish engulfing patterns are popular candlestick patterns among professional traders.

Using the Bullish and bearish engulfing candle is a great way to trade. These two candlestick patterns are really powerful candlestick patterns if used correctly in the right market conditions. They are an indication of market reversal depending on certain factors.

Before we get into how to trade with bullish/bearish engulfing pattern we need to talk about why learning about different candlestick patterns are very important for a trader to become successful.

What are Candlestick Patterns and Why its Important?

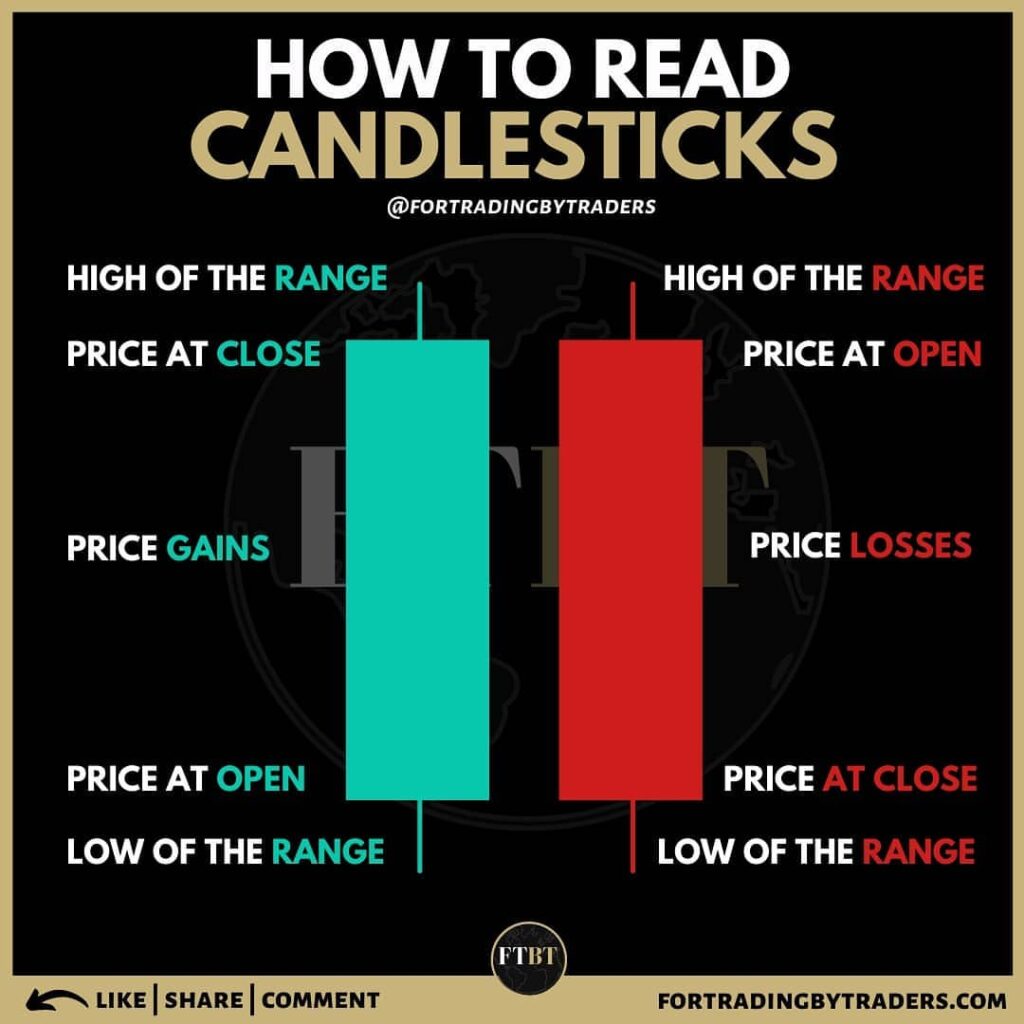

Candlestick patterns are patterns that are shown in the forex trading chart if you choose the candlestick chart. There are 4 important parts to a candlestick. These are

- High – the price at the upper shadow or high of the range

- Low – the price at the lower shadow or the low of the range

- Open – the opening price of the particular currency

- Close – the closing price of a particular currency

If the opening price is lower than the closing price the candlestick is called a bullish candlestick pattern and it is colored in green in the image above.

If the opening price is higher than the closing price the candlestick is called a bearish candlestick pattern and it is colored in red in the image above.

The image to the above right shows how to read the candlestick patterns.

In this article, we will particularly look at the bullish engulfing and bearish engulfing patterns. These are called double candlestick patterns and these patterns are very powerful if used correctly to analyze the markets.

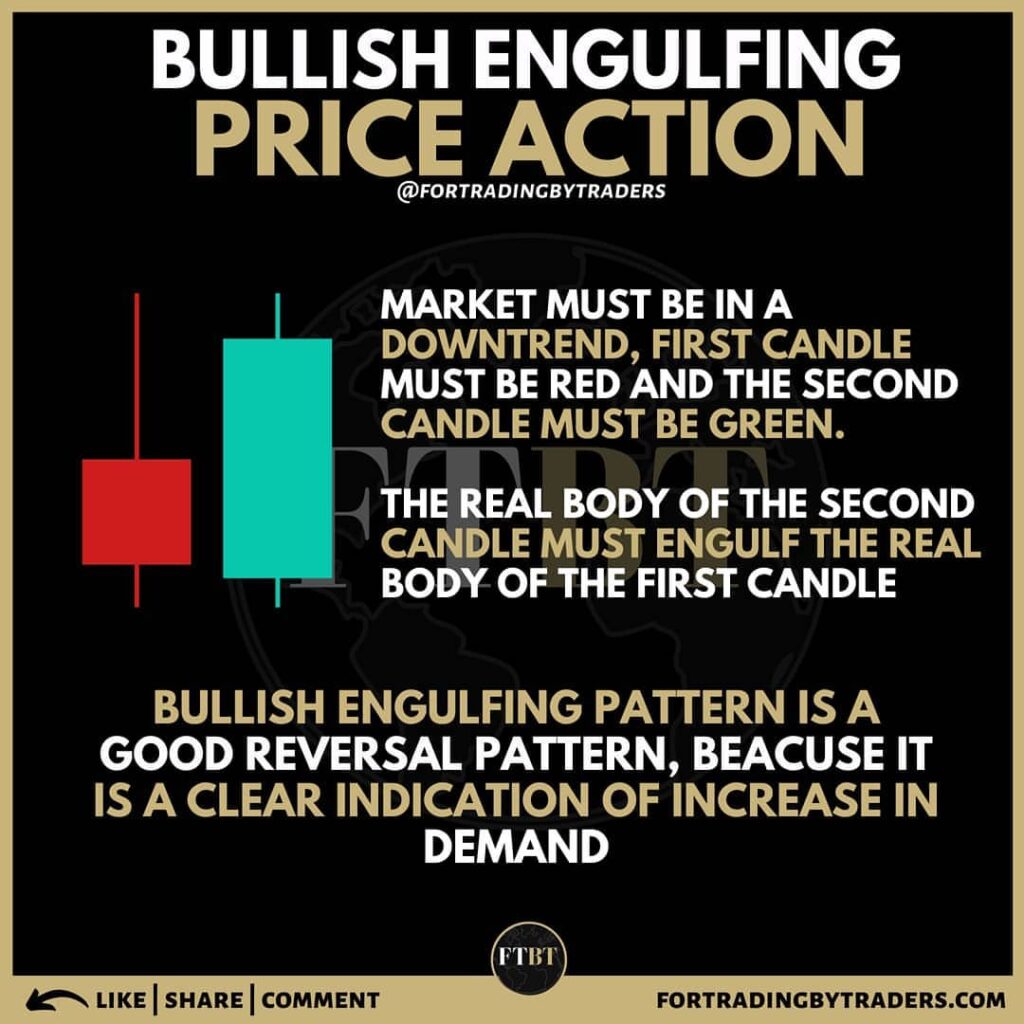

What is the Bullish Engulfing Pattern?

A bullish engulfing pattern is a double candlestick pattern where the second candle engulfs the first candle as shown in the image to the left.

For the bullish engulfing pattern, the first candlestick must be red and the second candlestick must be green. For the pattern to be applicable the market must be in a clear downtrend. Also, the length of the shadows of the candlesticks does not matter.

A bullish reversal pattern is a good reversal pattern because it is a clear indication of an increase in demand for that particular currency.

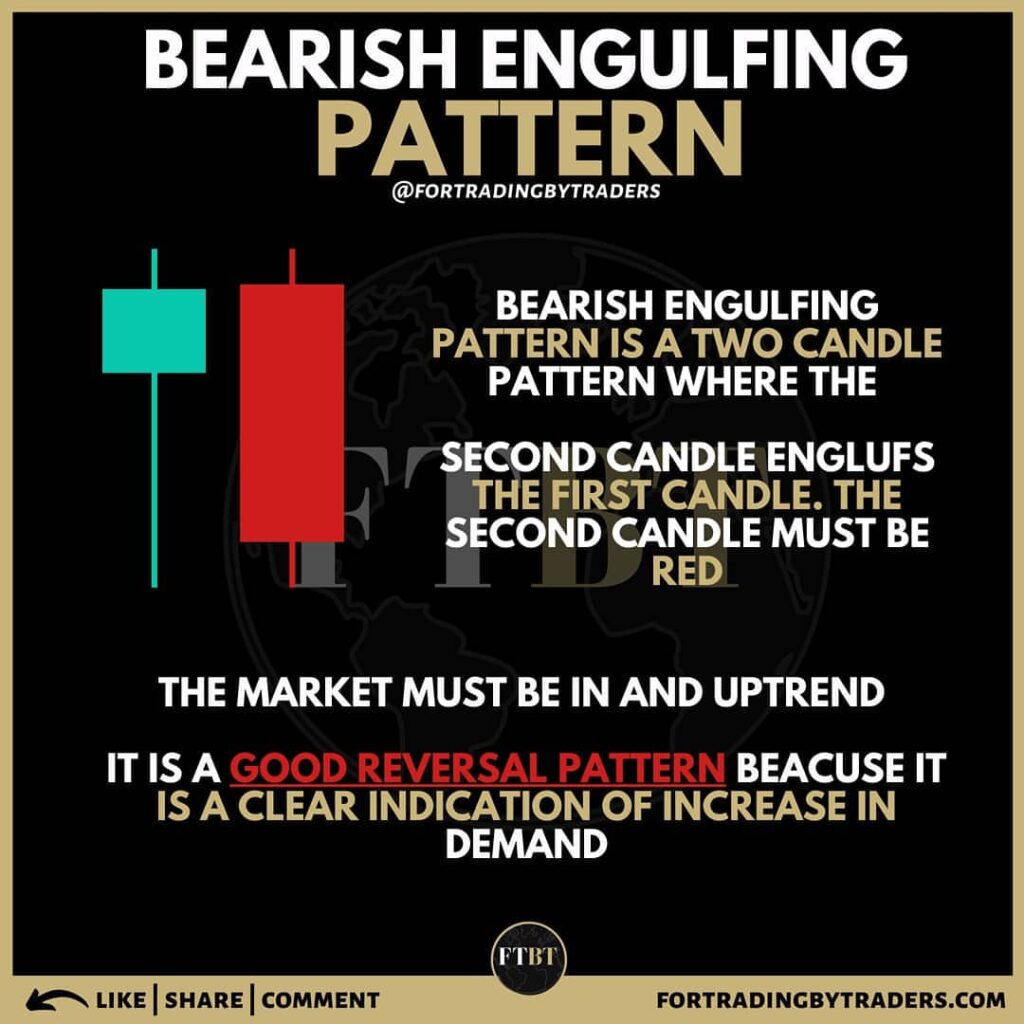

What is the Bearish Engulfing Pattern?

A bearish engulfing pattern is a double candlestick pattern where the second candle engulfs the first candle as well similar to the bullish engulfing pattern. The image to the right shows a bearish engulfing pattern.

For the bearish engulfing pattern, the first candlestick must be green and the second candlestick must be red. For the pattern to be applicable the market must be in a clear uptrend. Also, the length of the shadows of the candlesticks does not matter.

A bearish reversal pattern is a good reversal pattern because it is a clear indication of an increase in demand for that particular currency.

How to Predict the Market using Bullish/Bearish Engulfing Pattern?

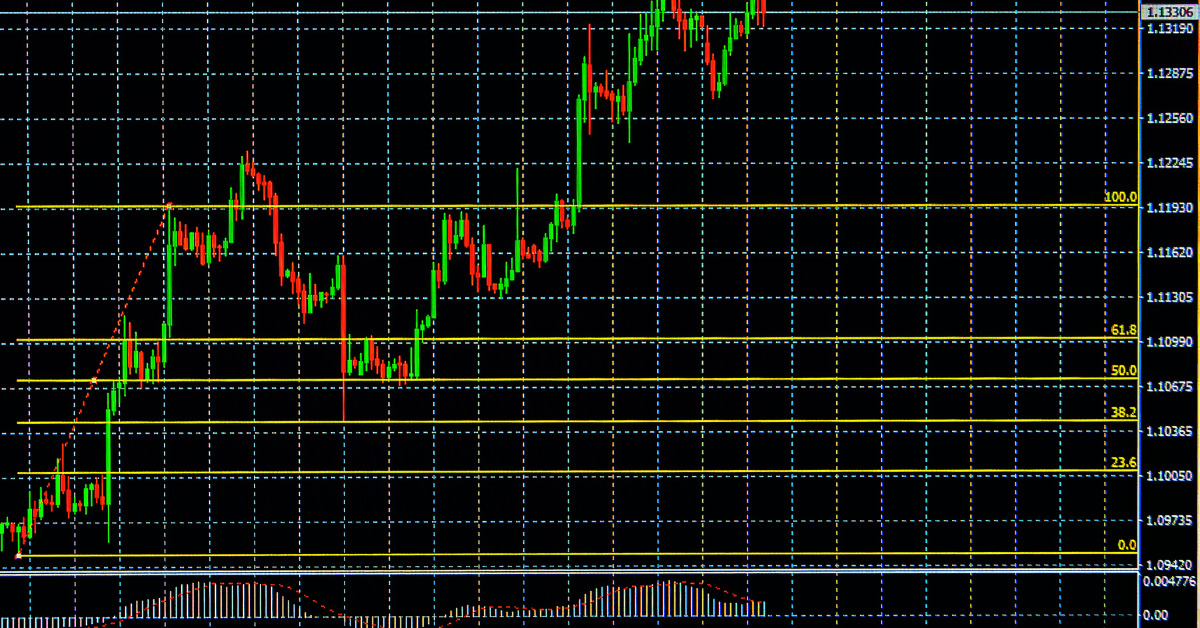

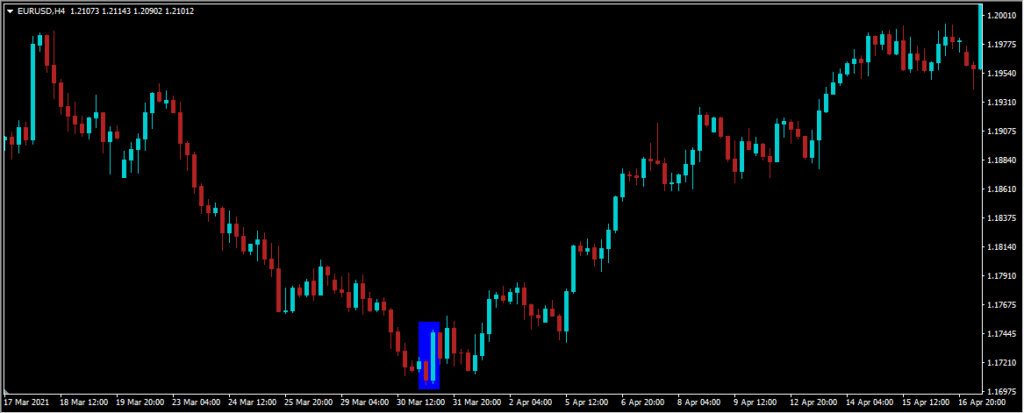

Since both the bullish and bearish engulfing patterns are reversal patterns, you enter a trade when you confirm that there is going to be a reversal in the market. Let’s look at an example now. Below shows a candlestick chart for EURUSD.

As you can see above, the market was in a clear downtrend before the bullish engulfing pattern appeared. After the appearance of the bullish engulfing pattern which is highlighted by blue, the market reversed its direction.

To trade with the bullish engulfing pattern you can enter the trade after the formation of the bullish engulfing pattern. Place the stop loss and take profit based on your risk-to-reward ratio. We recommend having a risk-to-reward ratio of no more than 1:3.

You can always adjust the stop loss and take profit based on how market trends. Always try to watch the trade if there are any other reversal patterns that will cause a reversal again. If not you can keep your stop loss and take profit where it is.

Also, if these patterns appear in a channel at the resistance or support, the confirmation of the trend can be stronger.

Conclusion

The ability to analyze the forex market with bullish and bearish engulfing patterns is a very valuable skill for a trader. Both the bullish and bearish engulfing patterns are very powerful market reversal patterns that can be used to predict the market direction. If you reached this point, we highly recommend you go back and read this article once more. Also, make sure to check out our complete step-by-step guide on learning how to trade forex.