The Forex market is the largest financial market in the world. The Forex market is a 24-hour market with high liquidity. It is where the currencies of nations are bought and sold, typically via brokers.

For example, you buy Euros, pay with U.S. Dollars, or you sell Canadian Dollars for Japanese Yen. Forex prices can change at any moment in response to real-time events, such as political unrest, crude oil prices, inflation, import and export prices, or industrial production.

Currency market players typically use “Forex analysis” as a tool in predicting currency price movements to make potential profits out of the market. Forex analysis itself is divided into three main types:

- Fundamental Analysis

- Technical Analysis

- Sentiment Analysis.

Fundamental analysis uses economic and political factors as a means of predicting currency movements. Technical analysis uses reliable historical data as a means of forecasting these movements. A sentiment analyst understands and uses the overall feeling of the market. The purpose of this article is to discuss the basic principles of fundamental, technical, and sentiment analysis.

1. Fundamental Analysis

A fundamental analyst uses economic and political factors, such as housing starts, the unemployment rate, or inflation, as a means of predicting currency movements.

Fundamental analysis is concerned with the reasons or causes for currency movements. Many Forex traders who rely on the fundamental analysis plan their trading strategies around a number of key U.S. Government economic indicators. Some of these indicators are the Gross Domestic Product (GDP), Foreign Exchange Rates, Import and Export Prices, Industrial Production/Capacity Utilisation, the Composite Index of Leading Indicators, Consumer Credit, the Consumer Price Index (CPI), Retail Sales, Housing Starts, the Employment Cost Index, and Consumer Confidence.

All of these Federal economic indicators have a marked effect on both the stock market and Forex. Some of these indicators are released weekly, while others are released monthly or quarterly. Their sources include the Federal Reserve Board, the U.S. Bureau of Labour Statistics, the U.S. Department of Agriculture, the U.S. Bureau of Economic Analysis (BEA), and the U.S. Census Bureau.

Forex traders must take other economic indicators into consideration as well. The world’s leading economies (for example, the United Kingdom, Japan, France, and Germany) also release their own economic indicators that will have an impact on the Forex market.

For example, leading economic indicators in the United Kingdom include Housing Prices, Gross Domestic Product (GDP), Vehicles per 1,000 people, telephones per 1,000 People, and the Percentage of People Employed in Agriculture.

2. Technical Analysis

A technical analyst uses historical data as a means of predicting currency movements. The technical analyst believes that history repeats itself over and over again. Technical analysis is not concerned with the reasons for currency movements (for example, interest rates or inflation). Instead, it believes that historical currency movements are a clear indication of future ones. Which in most cases it is very reliable.

Investopedia states that “In a shopping mall, a fundamental analyst would go to each store, study the product that was being sold, and then decide whether to buy it or not. By contrast, a technical analyst would sit on a bench in the mall and watch people go into the stores. Disregarding the intrinsic value of the products in the store, his or her decision would be based on the patterns or activity of people going into each store.”

For example, during the back-to-school buying season, the technical analyst might observe that more people are going into clothing stores than into stores selling flowers. Likewise, the technical analyst might observe that more men are going into stores selling flowers on Valentine’s Day than into clothing stores.

Here is another example. Oil prices dramatically increase, thus creating inflation. Interest rates rise as a means of controlling inflation. One historical result of higher interest rates is less money to spend, thus slowing economic growth. Another historical result is increased foreign investment in the currency affected by the higher interest rates, thus strengthening it.

The technical analyst typically uses charts as a tool for predicting currency price movements.

The three most popular kinds of charts are:

- Line charts

- Vertical bar charts

- Candlestick charts.

Line Charts

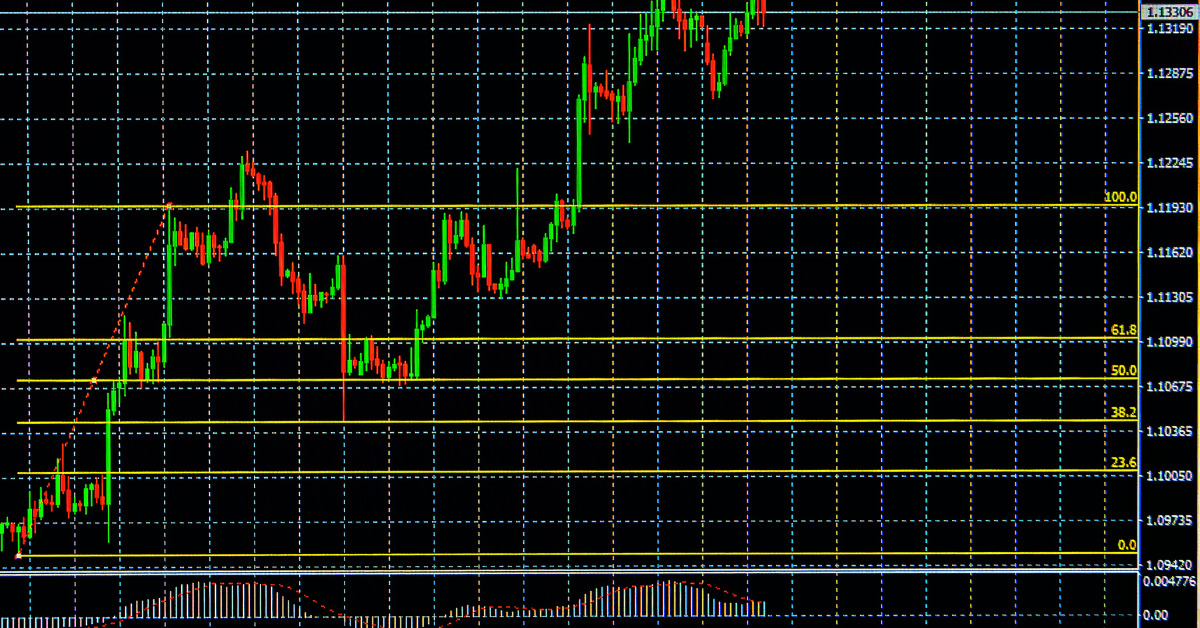

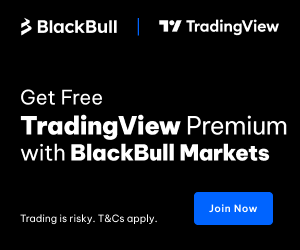

Below is a picture of a line chart that was drawn using meta trader 4

Line chart is the simplest type of graph. It is made by simply drawing a line from one closing price to the next closing price. Most successful traders don’t usually use the line chart for technical analysis.

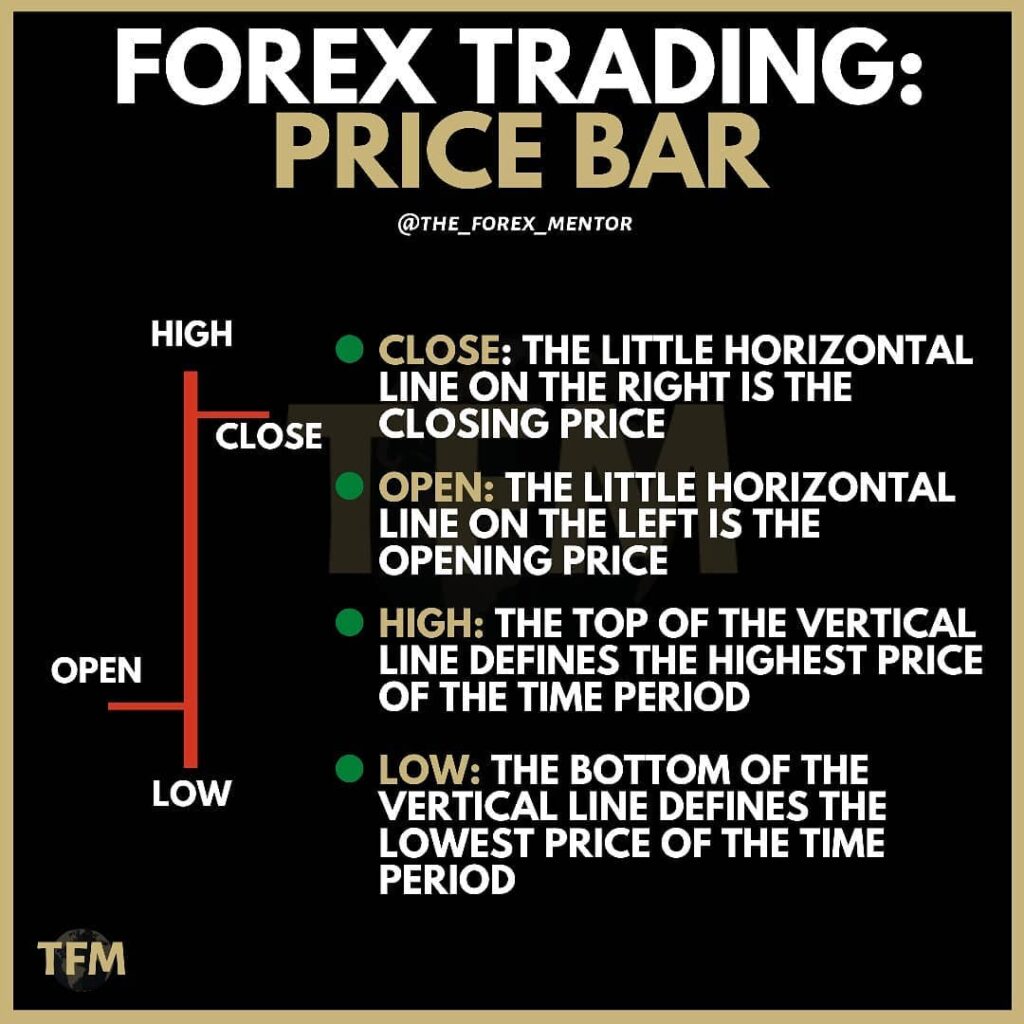

Vertical Bar Charts

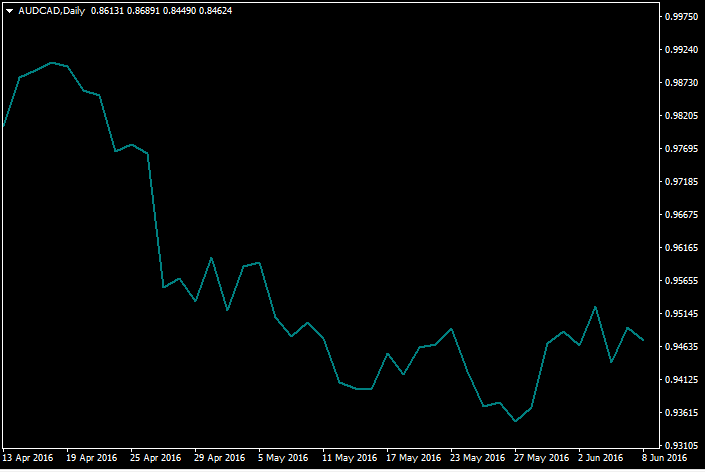

Below is a picture of a Bar chart that was drawn using meta trader 4

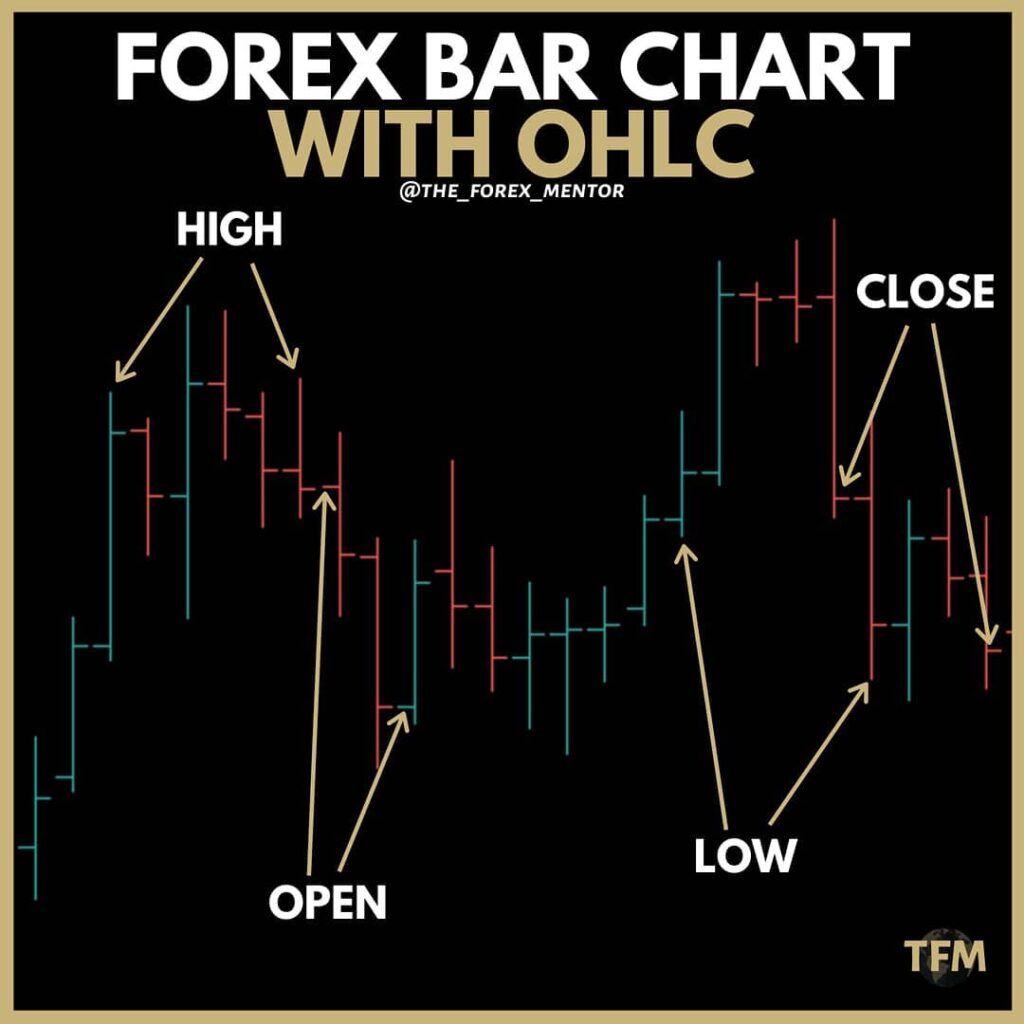

A vertical bar chart shows 4 main things. Those are the high, low, close, and open prices. The 2 diagrams below show how to read the vertical bar chart.

If you are a beginner, we recommend you save the two images below for future reference.

Candlestick Charts

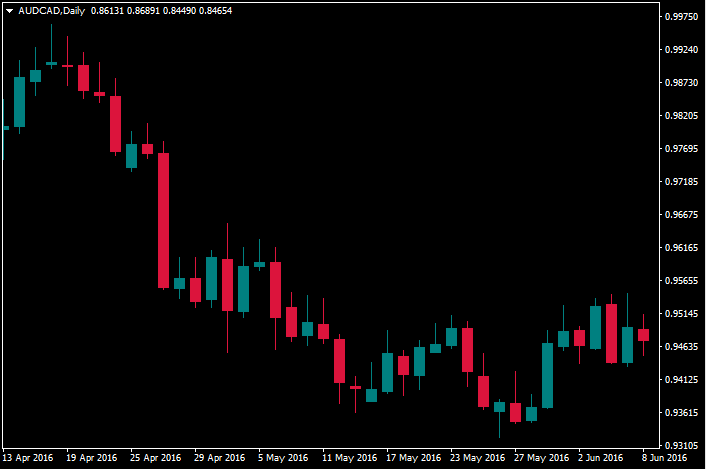

Below is a picture of a candlestick chart which was drawn using meta trader 4

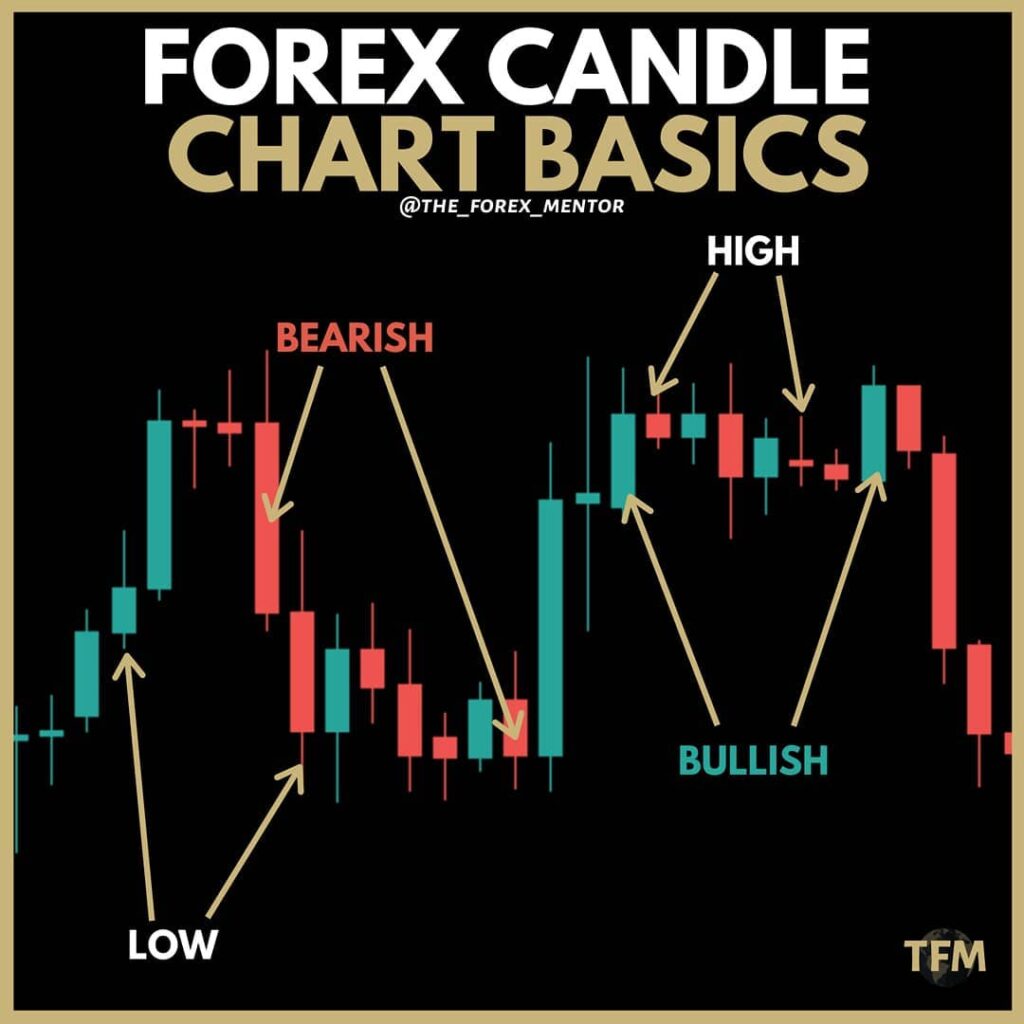

As you can see there are two types of candle sticks. The red one represents a bearish candle and the green one represents a bullish candle as shown in the image below.

Bullish means that the closing price was higher than the opening price for the particular currency pair, while Bearish, vice versa.

We recommend you save the two images below for later reference. This can come in handy if you are a beginner.

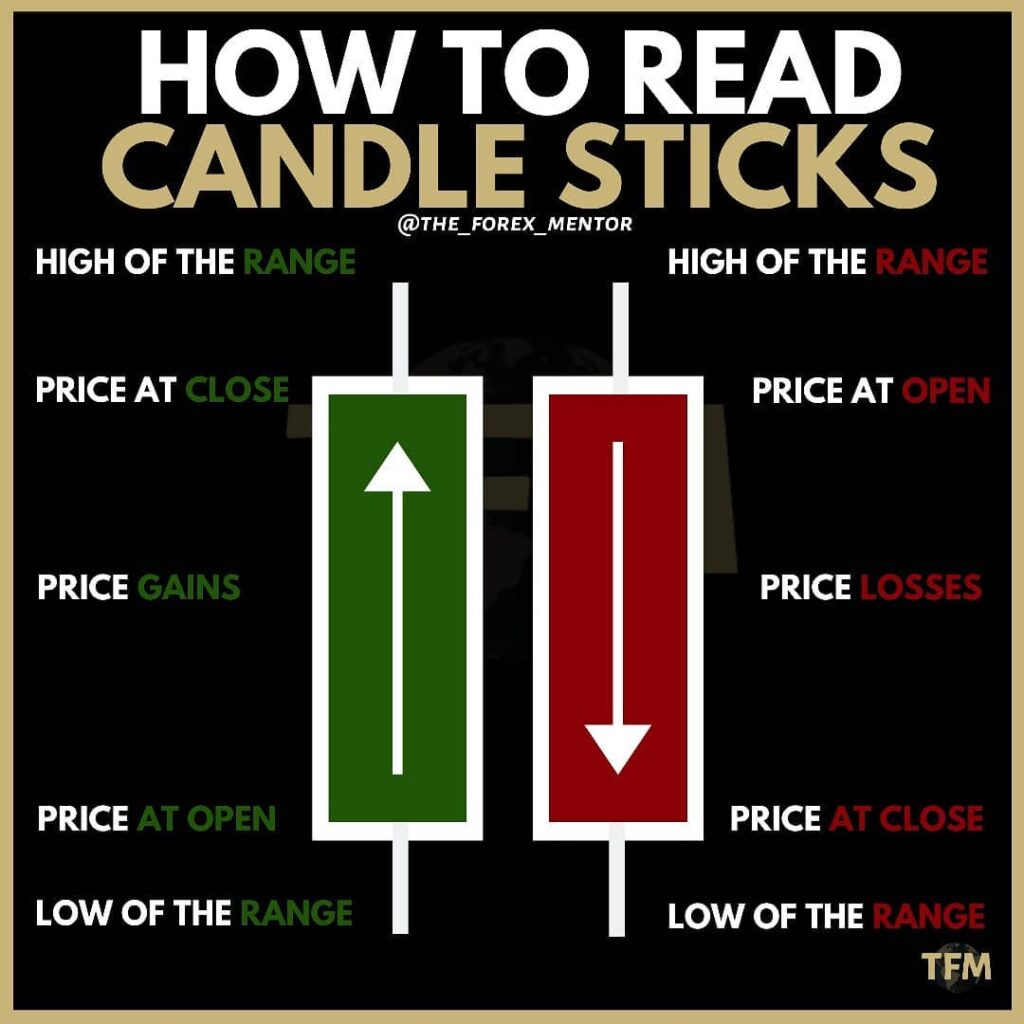

The picture to the right shows how to read the candle sticks in detail. For the green candle stick (bullish), the top horizontal line represents the price at the close while the open for the red candle stick (bearish).

3. Sentiment Analysis

Sentiment Analysis is an addition to the other two types of analysis. Sentiment analysis depends on the current feeling of the market. Successful traders usually don’t depend too much on sentiment analysis. To get good sentiment analysis, you can go to popular trading forums or communities.

Final Thoughts

Some Forex traders depend on fundamental analysis while others depend on technical analysis and some add sentiment analysis. However, many successful Forex traders use a combination of all three strategies.

However, the important point to remember here is that no one strategy or combination of strategies gives you 100% certainty that your trades will be profitable. If you are interested in learning more about forex trading, check out our complete guide.