In this article, we will talk about Swing Trading vs Day Trading and which is better for you in 2024. Swing trading is simply holding a trade for a couple of days to a week. With day trading you will only be holding a trade for a single day max.

Ultimately, this difference between the two types of trading is largely a matter of personal preference and your trading strategy. The pros and cons of both types of trading are discussed in this article. Personally, we do both swing and day trading but mainly day trading most of the time.

But if we see the market can keep going in the direction we predict for a couple of days, we will hold the trade, hence swing trading. We will also go through some trading strategies that you can use for both swing trading and day trading.

Pros of Swing Trading

The biggest advantage of swing trading is that you don’t have to trade every single day. This makes it suitable for traders with very busy schedules. If you work a full-time job you might prefer swing trading over day trading. That doesn’t mean that you cannot day trade while doing a full-time job.

With Swing trading, you can expect to take 2-3 trades a week. But you can take more trades if you are trading multiple currency pairs. With day trading you will be taking usually 2-3 trades per day. That’s roughly 5 – 10 times more trades per week with day trading.

Another advantage of swing trading is that you are less prone to mistakes just because you will be taking fewer trades. We have noticed that if a beginner/intermediate trader takes more trades they are more likely to be not profitable.

They usually become profitable after a couple of trades but then wipe out their profits with the next few trades, this is a common trend. But this is not always true for intermediate traders but mostly true for beginner traders. This doesn’t also mean that you should avoid day trading but it is just something you need to keep in mind when day trading.

Also, Swing trading can force you to follow your trading rules more often than day trading. Because you will know that you have fewer trades to make so you will take them carefully. Either way, it is very important that you follow your trading rules and tweak them slowly over time. Usually one variable at a time. We talk about a lot of trading strategies on this site that you can choose to follow. Now let’s talk about the pros of day trading compared to swing trading.

Pros of Day Trading

Day trading is great if you are able to trade every day (5 days a week in the forex market). Day trading is actually less risky than Swing trading. With day trading if you lose a trade you have a chance to recover by taking another trade. But with swing trading, you are holding a trade for too long and if it goes wrong there might not be another opportunity to take another trade immediately. You might have to wait till the market reopens.

In our experience day trading is usually more profitable than swing trading but that doesn’t mean that swing trading is not that profitable. We personally prefer day trading over swing trading. This is mainly because we don’t like holding trades overnight. This can go wrong when holding a trade overnight. This is the biggest risk with swing trading.

Also holding a trade overnight can mess with your sleep because you will be always thinking about the trade you are in. If you want better sleep choose day trading as your trading style but if you are able to control yourself while sleeping, swing trading might not be a bad option either.

Also, day trading is great when you are back-testing/forward-testing your trading strategy on a demo account. This is because you will be able to take more trades which will give you more data about your trading strategy. Now let’s talk about what is more suitable for you.

What is More Suitable for you?

If you are a beginner trader, we recommend you test out each trading style with the trading strategies we will discuss in the next section. The best way to test these out is using a demo account.

A very important thing we tell traders who open demo accounts is to open the demo account with the same amount of capital that you have to invest in a live account. Usually, demo accounts give you capital up to $100,000. This is really bad if you don’t have $100,000 to invest.

If you invest $100,000 you are more likely to make big profits compared to investing $1000 in your trading account. This can give you the illusion of being a profitable trader and when you open a live account you will lose all your money. This happens very often.

But eventually, you will have to open a live account. Because when trading with a demo account vs a live account your emotions will be different. You will have a lot more fear with a live account (It is recommended that you practice with a live account as well with a small amount of capital). We also recommend you check out our guide on developing a profitable trader mindset.

Also, you need to choose the right broker to trade with as well. We recommend you to go with XM (if you are not in the US) and if you are in the US open an account with eToro.

We recommend you start testing with day trading first and then swing trading. This is just because it will take you more time to swing trade than a day trade. It is always better to have quicker data and results. Always make sure you track your trades as well with a trading journal.

Below is a table summarising the difference between day trading and swing trading.

| Day Trading | Swing Trading |

|---|---|

| You hold the trade for a few hours or less | You hold the trade for days or weeks |

| Take advantage of small price movements | Take advantage of large price movements |

| More sensitive to news | Less sensitive to news |

| No overnight trading risk | Overnight trading risk |

| Spend more time on the chart | Spend less time on the chart |

| More focused style of trading | The more relaxed style of trading |

| Makes more trades | Makes less trading |

Strategies for both Swing Trading and Day Trading

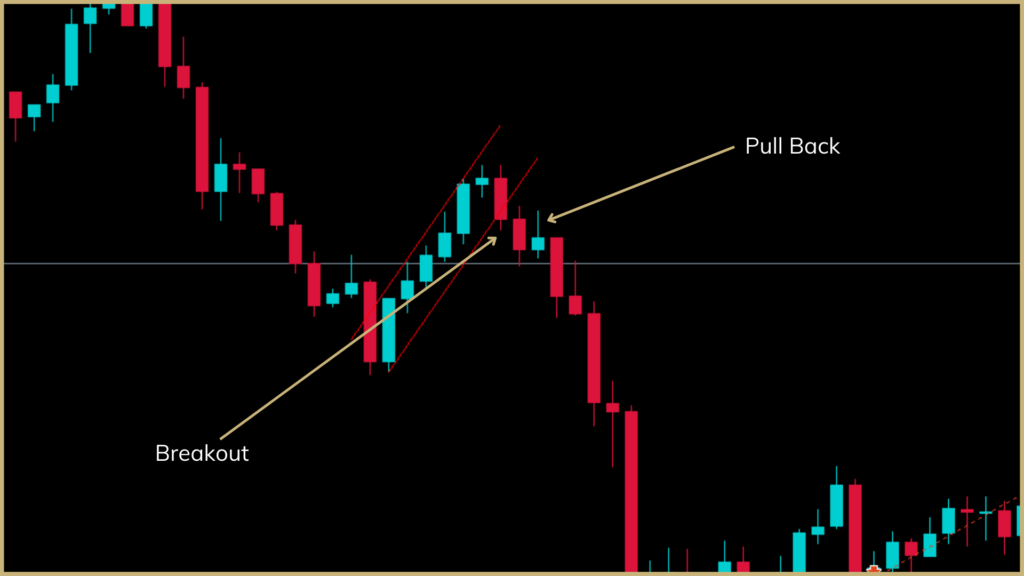

One of our favorite trading strategies is to trade the break-out and the reversals. Let’s talk about the breakout strategy briefly. These are both great strategies for swing trading and day trading.

Breakout Strategy

The chart above shows a breakout after a channel. As you can see the market slightly pulls back and then started forming a bearish single candlestick pattern. If you want to learn more about single candlestick patterns check out this guide.

After this candlestick is formed it is a really good time to enter a trade. Usually, we use this kind of candlestick pattern to confirm a reversal but they only work in certain market conditions. It is very valuable if you can remember all single and double candlestick patterns.

The chart below shows where to place the stop loss and the take profit. As you can the stop loss is placed above the bearish candlestick pattern ( called a shooting star ). The take profit will be placed based on your risk-to-reward ratio.

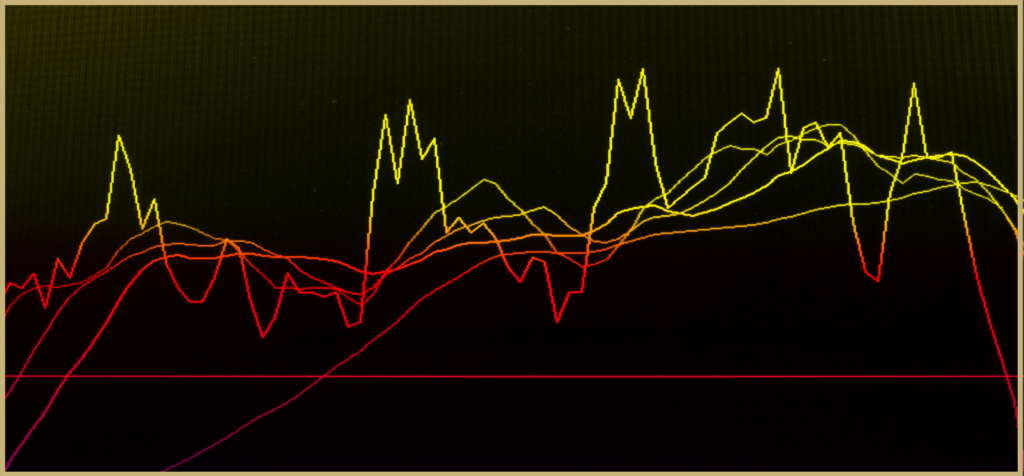

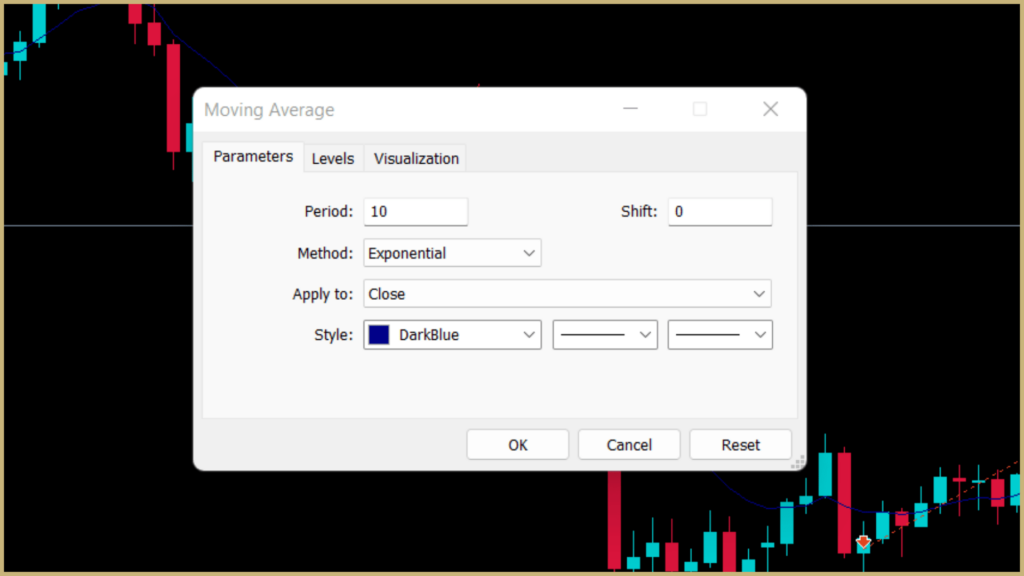

There is a simple trick that you can use to maximize your profits. This is done by adding an exponential moving average with a period of 10 as shown below. You can then use this exponential moving average as a trailing stop loss.

Place your stop loss a little bit above the exponential moving average and trail it. When the market hits the stop loss the trade will be exited but you will maximize your profits as well.

If you are interested in learning about more trading strategies we recommend you check out our free forex guide. We cover everything from trading mindset, technical analysis, fundamental analysis, profitable trading strategies, and much more.

Conclusion – Swing Trading vs Day Trading

Both Swing trading and day trading are great trading styles for you to choose from. Both can be profitable trading styles depending on your trading strategies. As discussed swing trading is more suitable for traders with full-time jobs and day trading is more suitable for traders who have a lot more time to spare.

Whichever trading style you choose, you will be on your path to becoming a profitable trader. Make sure to check out our free forex guide. If you are absolutely not sure which trading style to start with, we recommend that you start with day trading for quicker data and results as discussed previously.