Robert Kiyosaki, the New York Times bestselling author of Rich Dad Poor Dad, has spent a lifetime studying and teaching the principles of investing. He is most famous for his book “Rich Dad Poor Dad” and the Cashflow Quadrant.

He has built multiple companies over the years, including the Rich Dad Company and Rich Dad Global LCC. And he is dedicated to teaching financial education to his followers.

In this article, we will talk about what Robert Kiyosaki says about Forex Trading. Also, we will talk about where forex trading fits in the cash flow Quadrant.

According to Robert Kiyosaki’s teachings on becoming rich, forex trading is definitely a vehicle that you can use to get there. In the following sections, we will break down why forex trading fits into Robert Kiyosaki’s teachings. First, we will talk about Robert Kiyosaki’s cash flow quadrant, taken from one of his best-selling books.

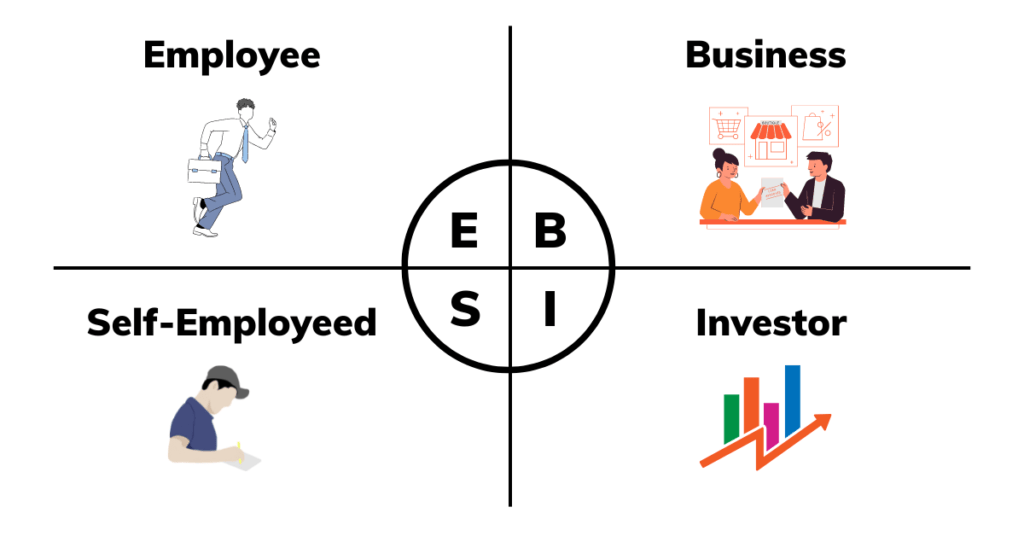

Robert Kiyosaki’s Cash Flow Quadrant

In this section, we will talk about where forex trading falls under in the Cash Flow Quadrant. The following image shows Robert Kiyosaki’s Cash flow Quadrant

As you can see from figure 1, there are 4 areas in this cash flow quadrant. These are

- Employee (E) – A person who works a job (works for money). The employee strives for security and thinks that financial success can be achieved by climbing the corporate ladder. Employee exchanges time for money.

- Self-Employed (S) – Becomes highly specialised in a certain skill and provides services related to that skill. A person who is self-employed exchanges time for money, but their hourly rate will be much higher than that of an employee. Being self-employed can definitely make you a lot of money but will not make you wealthy.

- Business Owner (B) – Makes money by creating profitable business systems. A business owner doesn’t exchange time for money. A business owner will have people making money for him/her. A business owner makes asymmetrical gains. Being a business owner can make you very wealthy.

- Investor (I) – Makes money by looking for places where they could make money work for him/her. An investor could invest in businesses, stocks, real estate, etc. An investor does not exchange time for money as well. Becoming an investor can also make you very wealthy.

As you can see, you must be on the right side of the quadrant if you want to be rich and successful. And forex trading can get you there. Now, let’s talk about where forex trading fits in this quadrant.

Forex trading is a mix between being a business owner and an investor.

With forex trading, you are your own boss and you don’t have any clients to service. If you look at a normal business, you have a product and a service. But with forex trading, you don’t have a product and you do not provide a service.

Forex trading is also not completely being an investor or maybe if you are a forex trader, you could call yourself a short-term investor.

According to Robert Kiyosaki, the investor invests in an asset and paid passively. For example, Warren Buffett is in the investing quadrant. Forex trading is not a passive way of making an income.

But you can gain asymmetrical results like a real business. With forex trading, the better you get at trading and the more you grow your trading account (or the more capital you invest), you can make more money with the same amount of effort and time you put in the beginning.

Let’s say that you trade 1 hour a day, 5 days a week. Let’s say you have $10,000 in your trading account. And let’s say you are a profitable trader that makes 10% per month. That means you should be making $1000/ month.

Let’s say you put in the same amount of time (1 hour a day) and make the same amount of returns a month (10%) but you have $100,000 in your trading account. Then you will be making $10,000/month. This can be better than running a normal business for most people.

Let’s say you run a normal business that provides a service. The more your business grows, the more likely you have to put in more hours. And also you have to hire more employees.

But with trading, the more your trading account grows, you will make money with less time. This makes forex trading a very attractive way of making an income for most people.

That’s why we put forex trading between being a business and an investor. Now, you can always make forex trading passive or at least semi-passive.

If you look at investing, it is not 100% passive as well, because you have to manage your investments, so it is mostly semi-passive. Of course, you can invest in some stock and get passive dividends, but you will not be able to make a significant income doing it unless you invest millions of dollars. If you really want to make passive income as an investor, you have millions of dollars that you can invest.

To make forex trading passive, you have to first have a really good winning strategy. Then you can code your strategy into an automated trading robot. Then the robot will trade your strategy for you. This way you can make profits passively in the forex market.

But of course, this is not easy to do. This will take a lot of time and effort but can be worth it if you want to free your trading time eventually. Also, with forex trading, you can create multiple sources of income with the same amount of effort. Let’s say you have a winning trading strategy. You can make money trading this strategy and also selling trading signals that other traders can use based on this strategy.

According to Robert Kiyosaki, if you want to be rich and successful, you have to be in the 3rd or 4th quadrant (the right side). And forex trading perfectly fits into this quadrant.

So if you currently working in a 9-5 job or you are self-employed, your goal should be to move to the right side of the quadrant. Forex trading is absolutely a great vehicle for you to move to the right side of the quadrants+.

Becoming a Successful trader with Robert Kiyosaki’s principles

As Robert Kiyosaki says in his book Rich Dad, Poor Dad, you should focus on assets. Building assets. If you are working a 9-5 job or any other job, remember that your job is not an asset. That’s why, every day after you finish your job, you should focus on building assets.

With assets, you can make money work for you, instead of you working for money (Job). Never focus on climbing the ladder in your job. This is what most people think success is, “Climbing the ladder”. Why most people don’t get out of this thinking because they are not aware of other opportunities.

Forex trading skill is an asset because, with the skill of trading, you can generate money from anywhere, anytime. If you decide that you want forex trading to be your vehicle for success, you have to spend time focusing on developing your forex trading skills.

If you are working a job currently, try to reduce your liabilities, as Robert Kiyosaki says. Don’t buy expensive things while in your job. You can buy expensive things, but only when you are rich. Save much as possible from your job and invest it in your trading account.

As you may know, you can expect to make 5-15% per month returns with forex trading, if you are a profitable trader. That means that if there is more money in your trading account, the more money you will make per month with trading. Your trading account and your trading skills is the ultimate asset for you to invest in.

Robert Kiyosaki says when you see something you like which is really expensive, always say “How can I afford this instead of I can’t afford this.”. If you are a forex trader, you can reframe this question like this, “How much capital do I need in my forex account to afford this with my trading returns?.”.

Mindset is extremely important when trading and becoming a successful trader. If you want to be a successful trader, you have to focus on 3 key things. Mindset, technical analysis, and risk management. All these 3 are equally important. Most traders who focus on only one thing, out of these three fail to be successful forex traders.

If you are interested in learning all of these 3 things, check out of forex trading guide. Our trading guide is completely free and we talk about everything you need to become a profitable trader. To check it out click the button below. Remember, after going through the trading guide, it is important that you put what you learned to practice. You have to practice your trading in the live market to become a profitable trader.

Conclusion

In this article, we talked about what Robert Kiyosaki thinks about Forex trading. As we discussed, according to Robert Kiyosaki’s theories about how to get rich, forex trading is definitely a method of getting rich. So, block at least a couple of hours every day to learn trading and practice trading in the forex market if you want to be successful.