To learn how to develop a trading plan in forex, you must first understand what money management rules you need to follow and what your starting point, travel direction, and end goal are.

Your trading plan should be set up as a checklist. You will decide whether to enter a trade if all of your boxes are checked, or hold off until you see a trading edge. You can format your trading plan as a checklist to help you make quick decisions about your trades.

Developing a trading plan

The first step in becoming a successful trader is developing a trading plan. Developing a plan ensures you make informed decisions. Your plan should outline safe and risky exit points.

Without a plan, you may make the mistake of entering and exiting trades abruptly. It should also be specific as to why you are exiting a trade. Developing a trading plan is crucial for successful forex trading.

A good trading plan also includes criteria to manage your money. It is important to set objectives for yourself and modify them based on your feedback. Each trader’s trading style and psychology are unique, so a plan should reflect this.

The trading plan should include objective criteria for entry and exit. Using a trading plan can help you focus on your trading goals and maximize your profits. When creating a plan, don’t forget to include the market you’ll be trading and your risk tolerance.

A trading plan is similar to a road map. It gives you an overall plan for your trading and helps you organize your research and find trading statistics. Once you’ve created a trading plan, you should regularly review it and make sure you’re following it.

Remember to make a note of any trade set-ups that work out well for you. While a trading plan can be rigid at first, it should gradually become more flexible as you gain experience. It is important to have a trading plan because it gives you a solid foundation to trade on, and helps you recover from a bad trade.

Once you’ve made a trading plan, you should keep it in a physical copy. This will help you stay on track with your goals and prevent you from making impulsive decisions.

By trading objectively with a trading plan, you will have more confidence and experience. You’ll be able to make better decisions and make more money. If you follow your plan, you’ll be more successful in the long run.

The next step in developing a trading plan in forex is determining how often you will trade. While you’ll likely be a day trader, a long-term Forex trader should consider illustrating the plan on a weekly basis.

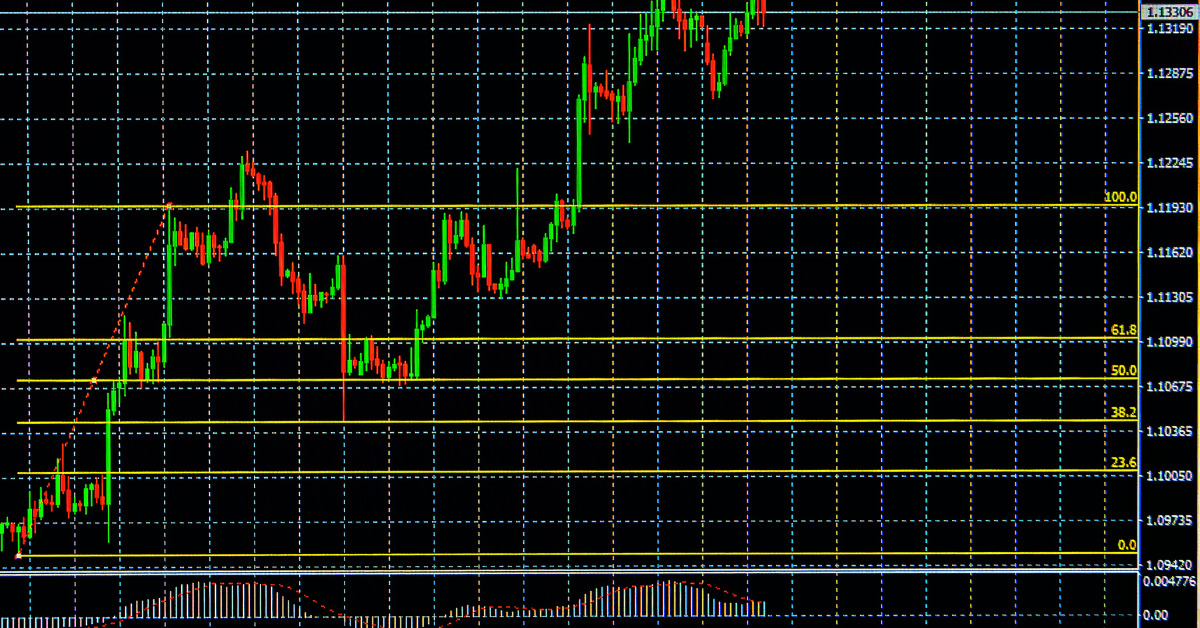

In addition to determining when to enter and exit a trade, a good trading plan will also include a clear description of entry signals. For instance, if you use multiple indicators, you should include all of them in your entry signal.

Developing a trading plan in forex is vital for success in forex trading. Having a trading plan makes you more organized and prevents you from making silly decisions or making irreversible mistakes. It also allows you to evaluate your wins and losses objectively.

Developing a trading plan also helps you overcome emotional responses that can hinder your ability to make wise decisions. So, what are you waiting for? Create a trading plan today and be successful in the forex markets!

Money management rules

You should have a thorough knowledge of money management rules when developing a trading plan in the forex market. It is important to remember that forex trading involves a large amount of risk and can lead to the loss of your entire trading account.

Therefore, you should only use capital that you can afford to lose. This way, you will be less emotionally affected when you lose and will have more time to think strategically.

In a trading plan, you should include criteria for money management methods, such as risk and profit targets. These rules are essentially your personal inventory. Depending on your investment goals, you may choose to trade in forex alone, in stocks, futures, or options.

But if you have limited resources, you should stick to one market. Never try to trade in multiple markets at once. This is why a trading plan is so important.

Proper money management gives you the edge in growing your trading account. Without a logical strategy, forex trading is more like gambling than business. A proper money management strategy will make you a successful forex trader. Money management strategies are essential to every trading plan.

Many novices fail to grow their trading accounts because they lack knowledge and do not apply proven money management principles. By applying proven money management principles, novice traders can significantly increase their trading accounts.

Identifying your starting point, travel direction, and end goal

While creating a trading plan, it is important to identify your objectives so you can measure your progress along the way. A common mistake people make is setting general trading goals, such as “be more disciplined” or “improve my trade strategy.”

It is essential to break down these broad objectives into specific, process-oriented goals. Then, follow those goals to the letter. If you want to become a profitable trader make sure to get our complete guide for learning how to trade in the Forex market.

Top Forex Brokers

Best for Low Spreads | Best for Speed | Best for High Leverage |

Fusion Markets is one of the top brokers that provide traders with low spreads (Risk warning: 76% of retail CFD accounts lose money) |  BlackBull markets is a great broker that provides traders with fast executions speeds. (Risk warning: 76% of retail CFD accounts lose money) |  Exness is a highly regulated broker that is best for high leverage trading. (Risk warning: 76% of retail CFD accounts lose money) |