In this article, we will talk about how long it takes to learn algorithmic trading. We will also talk about what algorithmic trading is and its advantages and disadvantages of algorithmic trading. We will mainly focus on forex algorithmic trading but this information can be applied to other financial markets as well such as the stock market and the cryptocurrency market.

Algorithmic trading has a lot of advantages compared to manual trading. But before you get into Algorithmic trading you need to understand manual trading. So how long does it take to learn algorithmic trading? Usually, it will take around 4-6 months to learn algorithmic trading if you have not programmed before. But if you are a programmer it will take less time.

But this doesn’t mean that you will be a profitable algorithmic trader in 6 months. Usually, this can take up to a year or more because you will need to keep tweaking and improving your trading robot to be profitable.

If you want to learn how to create an algorithmic trading robot and know more about algorithmic trading keep on reading.

What is Algorithmic Trading?

Algorithmic trading is making a trading algorithmic that will be doing trading automatically, usually 24/7. These algorithms can be programmed to trade effectively based on the user’s inputs and risk management rules. There are several advantages to using algorithmic robots to trade the markets which will discuss later in this guide.

There are several tools that you need to create your own trading algorithm.

Tools for Algorithmic Trading

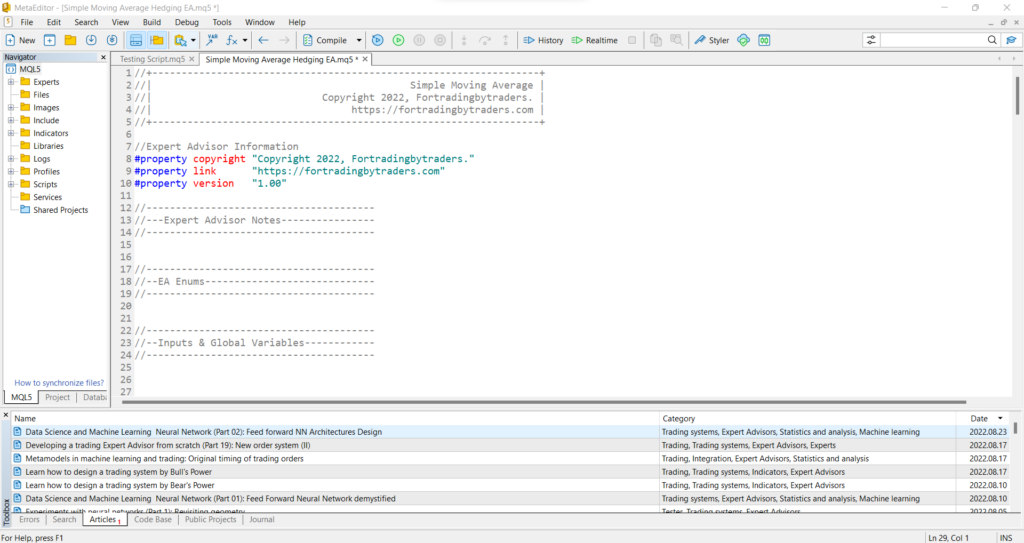

One of our favorite tools for making trading algorithms is MQL5. MQL5 is a programming language by the company Meta Quotes. It comes with the popular MetaTrader 5 trading platform. MQL5 is based on the programming language C++. Below is an image of the MQL5 code editor.

An algorithmic trading robot written in the MQL5 language can be run directly on the MetaTrader platform. You might be wondering if there are others platforms or tools for making an algorithmic trading robot.

Yes, there are quite a few out there. The two other popular languages to do algorithmic trading are python and pine script. Pine script is a programming language that is similar to that python. Pine script is used in the popular online trading platform Tradingview. We personally do not use pine script because we love using mql5. This is mainly due to our preferred trading platform being the MetaTrader 5 platform.

Python is also a great language for developing a trading robot. But with python, you might have to use an external API to get all the real-time data for the market your trade-in. If you want to get into algorithmic trading we recommend you start with Mql5 because it is easy to set up and get started.

Advantages of Algorithmic Trading

Now we will talk a bit about the advantages of doing algorithmic trading over manual trading. The biggest advantage of algorithmic trading is that algorithms don’t have emotions. The main reason manual traders fail the market is due to emotions.

If you get emotional during trading you can end up losing all your trading capital. The most common emotions felt by traders are fear and greed. A trading robot will not have any of these emotions.

Another biggest reason that manual traders fail is that they do not stick to their trading rules. This is extremely important and a trading robot can do this extremely well. If you have a profitable trading strategy it is a very good idea to code it into a trading robot. A trading robot can run this strategy 24/7 which you won’t be able to do manually.

Another big advantage is that a trading robot can be a big time saver. If you have a profitable trading robot you don’t have to stare at the charts all day. The trading robot can do that for you.

One of our favorite advantage of using a trading robot is that you can back-test your trading strategy effectively with large amounts of data. If you are not sure what backtesting is check out this guide on backtesting.

Even though there are several advantages to doing algorithmic trading there are still disadvantages. Below we will discuss some of the disadvantages of using algorithmic trading robots. But the advantages do outweigh the disadvantages if the robot is programmed correctly.

Disadvantages of Algorithmic Trading

The main disadvantage is that the trading robot can not adjust itself if the market changes significantly. This is mainly due to the robot following a set of rules. But you can always improve your trading robot over time. Also to counter this you can have multiple trading robots to trade during different market conditions.

Another disadvantage of trading robots is that the profits can be small depending on how your robot works.

Also, it is important that you be careful if you want to buy a trading robot from someone else. Most trading robots for sale are not profitable and some can even be scams. Before you consider buying a trading robot from some company you should have a good understanding of algorithmic trading and how the financial markets work.

If you are interested in learning about learning how to trade forex we recommend you check out our free guide.

How to Learn Algorithmic Trading?

The best way to start learning algorithmic trading is to download MetaTrader 5 trading platform. It comes with the meta editor which you can start coding your first algorithmic trading robot with.

Then, learn the basics of Mql5 programming. You can learn the basics from the Mql5 documentation that we highly recommend you follow when coding your trading robots. If you already know to program with C++ then you might find it very easy to understand mql5 programming. If you don’t have a good knowledge of C++ we recommend you take a basic course on C++. You can learn C++ with code academy.

After learning the basics you can start coding your first mql5 trading robot. We recommend you start by coding a simple robot that uses a technical indicator such as the simple moving average. Then you can start coding more complicated trading strategies.

Usually doing all of these will take around 6 months to a year depending on your coding experience. It is always a good idea to learn the basics of mql5 properly before you start creating a complicated algorithmic robot.

After you code your algorithmic trading robot you can start testing it on a demo account. For this, you need to sign up with a broker who provides you with a demo account where you can do algorithmic trading. For this, we recommend XM Broker.

Conclusion

Algorithmic trading is a great way to trade if you have a solid trading strategy that can be automated. Learning how to code a trading robot can also give you skills to work as a programmer ( if that interests you ). There are several advantages to creating an algorithmic trading robot.

But before you get into learning how to do algorithmic trading we recommend you learn how to trade the forex market properly manually. This way you will understand the market more which will allow you to create a profitable trading robot.