In this article, we will review the FXSign broker. FxSign was established in 2015, in Bulgaria and then it expanded to other European countries. Recently they have sub offices in Saint Vincent and the Grenadines. Below is the summary of this broker.

Summary

| Assets Available | 4 Asset Classes – Forex, CFDs, Metals, Crypto |

| Regulated By | Unregulated Broker |

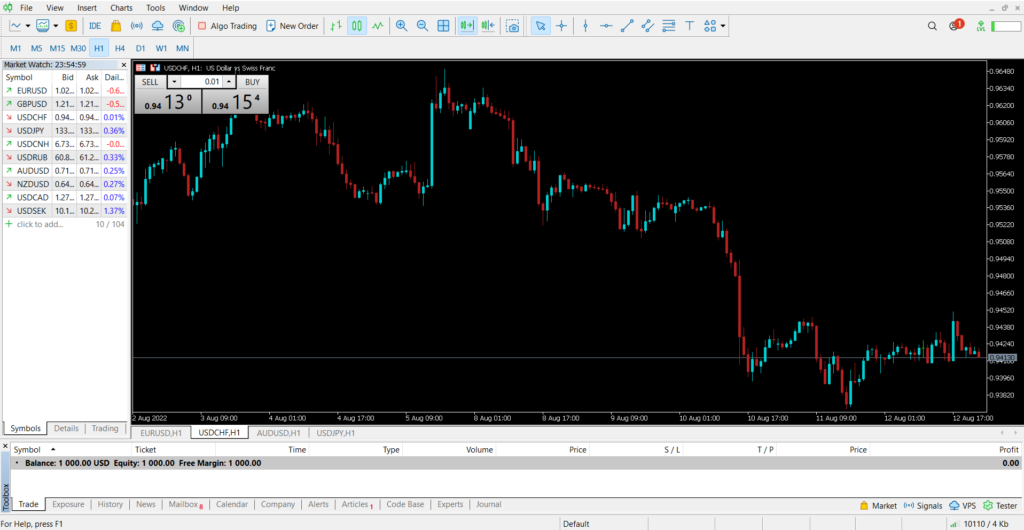

| No. of Trading Platforms | Trading Platforms based on Metatrader 5 – Availiable on desktop, web and mobile |

| Leverage | Up to 1:5000 on Selected Instruments |

| Min Deposit | Minimum Desposit Required is $1 |

| Spreads | Variable Spreads depending on the type of account – starting from 0.1 pip |

| Education Provided | Very Basic Forex Trading Education Provided |

| Methods of Payment | Bank wire transfer, BTC, USDT and Perfect Money |

Trading Platforms

FxSign provides a mobile, desktop, and web platform based on the Popular Metatrader 5 trading platform. The feature set provided by this broker is, pretty standard for the MT5 platform, some of these are:

- Supports both the traditional netting and hedging options.

- Free professional charting tools.

- More than 80+ technical indicators were provided.

- Compatible with Expert Advisors

Regulations – Is FXSign Broker Regulated?

FXSign broker is unregulated. We didn’t seem to find any regulators that Fxsign is regulated by. This puts FXSign broker in a tough spot because it’s quite hard to trust a broker with no regulations. At Fortradingbytraders we recommend brokers who are regulated by top regulators out there like the Australian Securities and Investment Commission, CySec, etc.

Account Types

FxSign Broker Provides 5 different account types. Each of these account types is suitable for different types of traders. Mainly it depends on how much money you got to invest in forex trading.

Cent

Cent account is most suitable for traders who don’t have much money to invest. The cent account allows you to start trading with only $1. The disadvantage of a cent account is that it has the largest spreads. The spread starts from 1.0 pips which can be quite high.

Standard

A standard account is suitable if a trader has a little bit more money to invest. But, it is not at all that different from the cent account. You can start a standard account with only $10. The great thing about the standard account is that the spreads start from 0.5 pips which is half of the spreads in the cent account.

Professional

To start a professional account you need to invest significantly more money. The minimum deposit for a professional account is $1000. This might not be suitable for most people but $1000 is a good amount to start with if you are serious about making income with forex trading. The spreads in the professional account start from 0.2.

Institutional

The institutional account is the most premium account that is offered by FXSign. To start an institutional account you need to deposit at least $5000. The great thing about the institutional account is that the spreads start from 0.1 pips.

Instruments Available For Trading

Forex

This broker provides you with 35+ currencies to trade with. These include all the major currency pairs and a variety of exotic currency pairs. They also provide you with tight spreads on professional/institutional accounts. They also provide leverage of up to 1:5000 which is extremely high. We highly recommend you not to trade with this much leverage.

CFDs

CFDs are another financial instrument provided by the FXSign broker. You can trade CFDs with all of the account types provided by FXSign. CFD provided includes oil and energy.

Metals

FXsign broker provides you with an option to trade popular precious metals such as gold and silver. If you are into trading these metals, it’s nice to have these options.

Cryptocurrency

The broker gives you the option to trade popular cryptocurrencies such as bitcoin, Ethereum, ripple, and many others. If you want to trade cryptocurrency this is broker is not the best broker for that. There are much better alternatives for cryptocurrency trading.

Commissions And Spreads

Commissions and spreads depend on the account type you sign up with. The broker provides you with 4 types of accounts. Cent, standard, professional and institutional accounts. Most traders are likely to sign up with a standard account or a professional account. The spread can start from 0.2 on a professional account and 0.5 on a standard account.

Leverage Provided

This broker provides you with a leverage of up to 1:5000. It is highly recommended that you do not trade with this amount of leverage. Also, you cannot get this leverage on all accounts. The cent account gives you to leverage up to 1:500. The standard account gives you to leverage up to 1:1000. The professional account gives you to leverage up to 1:500 and the institutional account only gives leverage up to 1:200.

Education Provided

This broker provides a very basic education. This is absolutely not enough to become a successful trader. But we don’t judge the broker based on the education provided. Most education provided by brokers will not give you an edge in the market. We recommend you to check out our free forex guide here to learn about profitable trading strategies.

Methods Of Payment (Deposit & Withdrawal)

There is a range of payment options, including bank wire transfer, bitcoin, USDT, and perfect Money. These are all great payment options. It’s great that this broker provides you with a range of payment options.

Is FXSign a Legit Broker – FXSign review

FXSign is not a regulated broker. It is quite a bit hard to trust a broker who is not regulated. We do not recommend you to sign up with FXSign. If you sign up with FXSign do it at your own risk. Below are brokers we recommend that you sign up with. These brokers are highly regulated and trustworthy. Also, the fx sign broker does not provide you with any advantage compared to other brokers out there.

Top 3 Forex Brokers

[ninja_tables id=”6695″]