In this detailed FxPro Broker Review, we will review each aspect of the FxPro broker to see if this broker is a legit broker. Below is the summary of the FxPro Broker.

Summary

Assets Available | 6 Asset Classes – Forex, Stocks, Commodities, Indices, Crypto, Futures |

Regulated By | FCA, CySEC, SCB, FSCA |

No. Of Trading Platforms | 5 Trading Platforms – MT4, MT5, cTrader, FxPro web trader and FxPro mobile app |

Leverage | Up to 1:200 |

Spreads | From 0.0 pips |

Commission | From 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Webinars and articles |

Methods of Payment | Bank Transfer, Visa, Mastercard, PayPal, Skrill and Neteller |

Open Account |

Top Forex Brokers

Best for Low Spreads | Best for Speed | Best for High Leverage |

Fusion Markets is one of the top brokers that provide traders with low spreads (Risk warning: 76% of retail CFD accounts lose money) |  BlackBull markets is a great broker that provides traders with fast executions speeds. (Risk warning: 76% of retail CFD accounts lose money) |  Exness is a highly regulated broker that is best for high leverage trading. (Risk warning: 76% of retail CFD accounts lose money) |

Broker Background

Founded in 2006, FxPro is a globally recognized online broker headquartered in London, with offices in Cyprus, Monaco, and the Bahamas.

Regulated by top-tier authorities like the Financial Conduct Authority (FCA) in UK, FxPro offers CFDs on forex, stocks, commodities, indices, crypto and futures. Known for its advanced trade execution, low latency, and high transparency, the company ensures client funds are kept in segregated accounts at major international banks for maximum security.

Trading Platforms

The FxPro broker provides traders with 5 different trading platforms. These are, MT4, MT5, cTrader, FxPro web trader and FxPro mobile app.

MetaTrader 4

MetaTrader 4 is a great platform for trading. It is very popular specially among forex traders. This trading platform is suitable for both beginner and advanced traders alike.

MT4 provides all the tools necessary to analyse the market and execute trades. The MetaTrader 4 trading platform is great for algorithmic trading as well.

MetaTrader 5

MetaTrader 5 is the successor to MetaTrader 4 trading platform. MetaTrader 5 provides you with a broader range of technical indicators. Like the MT4 trading platform, the MT5 trading platform also supports algorithmic trading.

cTrader

cTrader is a modern trading platform celebrated for its speed and transparency. Designed for both new and experienced traders, it provides a robust environment for forex and CFD trading.

Accessible on desktop, web, and mobile devices, cTrader offers a comprehensive suite of tools for in-depth market analysis. Its strength lies in algorithmic trading, empowering users to create and implement automated trading strategies.

FxPro Web Trader

FxPro web trader is FxPro’s proprietary web trading platform, designed for web use. It offers an intuitive interface, advanced charting tools, and a variety of technical indicators to cater to both novice and experienced traders. The platform also provides real-time market data, fast execution speeds, and secure trading environments.

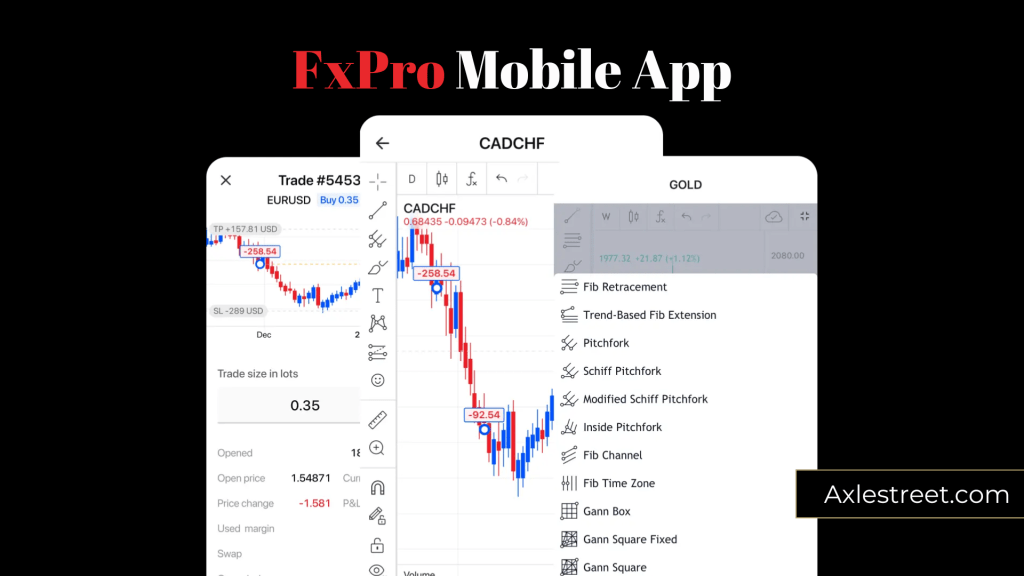

FxPro Mobile App

FxPro mobile app is FxPro’s propriety mobile trading app. This mobile application gives traders access to TradingView advanced charting and provides other features for traders. This app is available for both android and IOS users.

Instruments Available For Trading

The FxPro broker offers traders with 6 asset classes. These are Forex, Shares, Commodities, Indices, Cryptocurrency and Futures. Across these asset classes there are over 2000 tradable instruments.

Forex

The FxPro broker offers more than 70+ forex pairs to trade. These include, major currency pairs, cross currency pairs and exotics. The average spread for Forex pairs is slightly higher than industry average.

Stocks

FxPro offers a range of Share CFDs that traders can trade, including shares of over 150 companies listed in the US, the UK, and the European Economic Area.

Cryptocurrency

The FxPro broker offers traders a wide range of Crypto CFDs to trade, including popular cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin, among others.

Commodities

This broker offers traders a range of commodities. These include precious metals such as gold, silver, and copper, as well as energies like oil and natural gas.

Indicies

The FxPro broker offers traders a range of indices. These include major global indices such as the S&P 500, FTSE 100, DAX 30, CAC 40, and AUS 200.

Futures

The FxPro broker offers traders a range of Futures. These include futures such as Coca H25, Sugar H25 and Wheat Z24.

Regulations

FxPro Broker is a highly regulated broker that is regulated by 4 different Regulators across 4 different countries. FxPro Broker is regulated by

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA)

- Securities Commission of The Bahamas (SCB)

Live Trading Account Types

The FxPro broker provides 4 main account types for live trading. These are,

- Standard Account

- Elite Account

- Raw Account

- cTrader account

The table below shows the difference between these account types.

Standard -MT4/5 | Raw + – MT4/5 | Elite – MT4/5 | cTrader | |

Asset Classes | Forex, Shares, Commodities, Indices, Crypto and Futures | Forex, Shares, Commodities, Indices, Crypto and Futures | Forex, Shares, Commodities, Indices, Crypto and Futures | Forex, Futures, Commodities, Indices and Crypto |

Minimum Deposit | $100 | $1000 | $30000 | $100 |

Spreads | FX Major – from 1.2 pips, Gold – from 25 cents, Bitcoin – from 30 USD | FX Major – from 0.0 pips, Gold – from 10 cents, Bitcoin – from 15 USD | FX Major – from 0.0 pips, Gold – from 10 cents, Bitcoin – from 15 USD | FX pairs & Metals – low spread, Indices, Energy & Cryptos -marked-up floating spreads |

Commissions | $0 | $0 | $0 | $35 per $1 million traded |

Platforms Avaliable | FxPro Mobile app, MetaTrader 4/5 platform range, FxPro Webtrader | FxPro Mobile app, MetaTrader 4/5 platform range, FxPro Webtrader | FxPro Mobile app, MetaTrader 4/5 platform range, FxPro Webtrader | cTrader Platform range |

Commissions And Spreads

The commissions and spreads depends on the account type. For the standard account, the spreads starts from 1.2 pips and no commission is charged. For the raw account & elite account, the spreads starts from 0.0 pips for forex pairs and the commission charged is $3.5 per side. For more information refer to the table above.

The table below shows the comparison of FxPro with other brokers for the low spread account.

| FxPro | Fusion Markets | BlackBull Markets | |

| Commisions | $3.5 per side | $2.25 per side | $3 per side |

| Spread | from 0.0 pips | from 0.0 pips | from 0.0 pips |

As seen from the comparison the commission charged by the FxPro account is higher than other brokers.

Leverage

The FxPro broker provides a leverage of up to 1:200 for retail traders. For professional clients the leverage provided by the FxPro broker is up to 1:10000.

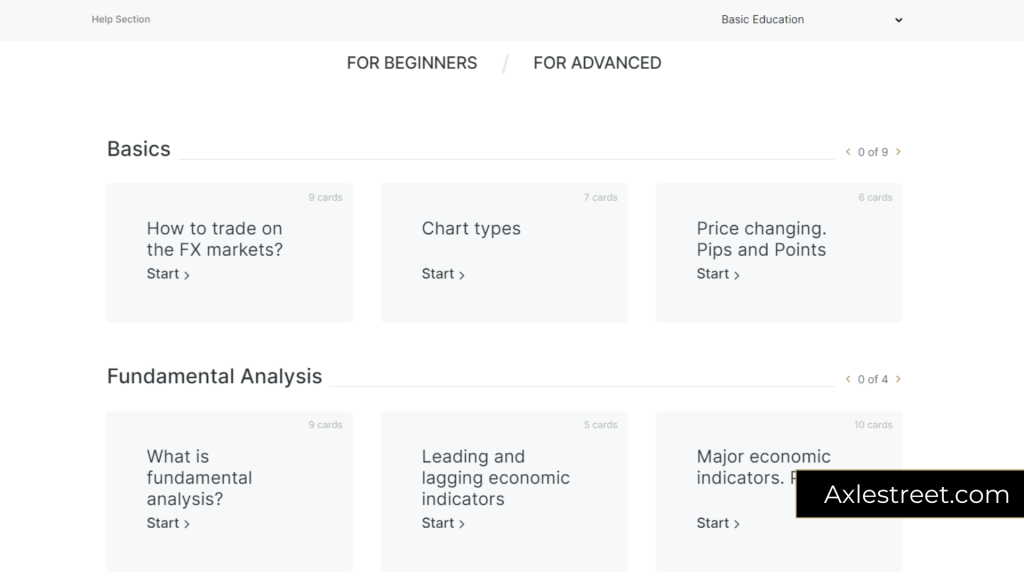

Education Provided

The FxPro broker provides basic trading education. These include articles, webinars and educational videos. The figure below shows a part of the trading education provided by the FxPro broker.

Minimum Deposit

The minimum deposit required to open an account with the FxPro broker is $100. This minimum deposit is higher compared to many other brokers. The table below compares the minimum deposits among two other brokers with FxPro.

| FxPro | FBS Broker | Fusion Markets | |

| Minimum Deposit | $100 | $5 | $0 |

Awards

The FxPro broker is an award winning broker with more than 100 awards won from multiple bodies. The figure below shows some of the awards won by the FxPro broker.

Methods Of Payment (Deposit and Withdrawal)

There are several deposit and withdrawal options provided by the FxPro broker. These are, Bank Transfer, Visa, Mastercard, PayPal, Skrill and Neteller. It is important to note that not all these methods are available in every country.

Customer Service

When it comes to customer support, the FxPro broker provides traders with 24/5 customer service. Traders can contact the FxPro broker customer support through multiple contact methods. These are:

- Live Chat

- Phone

Trading Tools

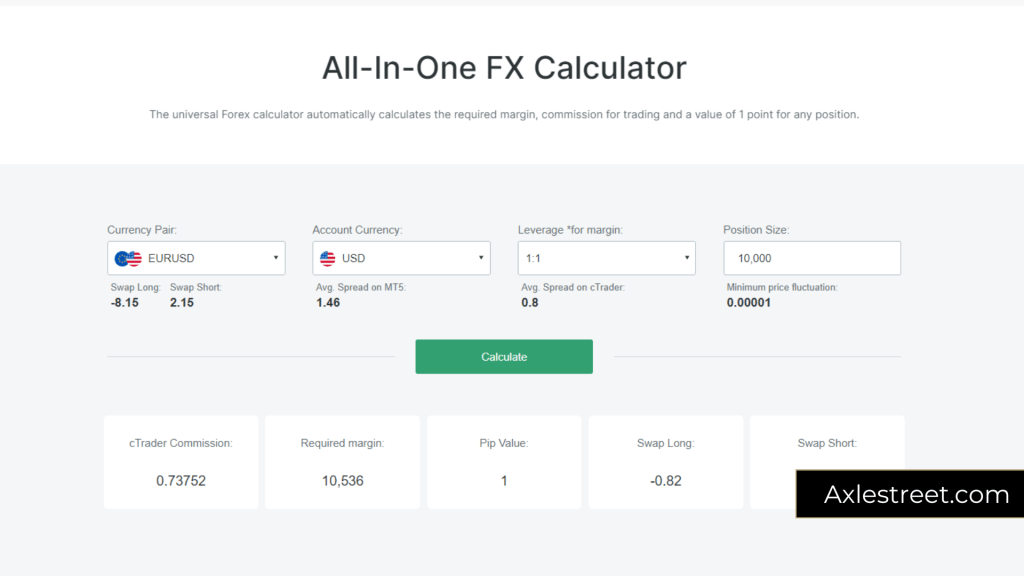

The FxPro broker provides traders with an all in one FX calculator. Traders can use this calculator to calculate commission, required margin, pip value, swap long and swap short. The figure below shows the FX calculator provided by the FxPro broker.

Demo Accounts

FxPro provides free demo accounts where you can practice forex trading with virtual funds in a risk-free environment. It’s an excellent opportunity to gain hands-on experience and test your trading strategies without any financial risk. It is important to note that almost all the brokers provide demo accounts for traders.

Pros & Cons

The table below shows the Pro’s and Cons of the FxPro broker

| Pros | Cons |

| Multiple Regulations | Does not accept US Clients |

| Good standing in the industry | Only 24/5 customer support |

| Average Fees |

Is this broker legit?

Yes, the FxPro broker is a legit broker that is regulated by top tier regulators. FxPro broker also provide great features for traders as well. But if you want to trade with a low fees broker the FxPro broker might not be the ideal choice for you.

FxPro Alternative Brokers

FxPro is a good broker but there are better alternatives to the FxPro broker depending on your needs. They are the following.

- Fusion Markets – Fusion Markets provides traders with much lower fees than the FxPro broker.

- BlackBull Markets – BlackBull Markets provides traders with faster execution speeds and more tradable instruments than the FxPro broker.

- FBS Broker – FBS Broker is a great broker that provides retail traders, depending on the country, with high leverage of up to 1:3000..

Our Evaluation Methodology

We assess brokers through a comprehensive rating system that involves examining more than 100 data points across key categories. Our approach includes the following:

- Trust and Regulation – We verify each broker’s regulatory status and licenses to ensure they operate under the supervision of credible financial authorities, ideally tier 1 regulators.

- Cost Analysis – We scrutinise trading fees and compare them against industry standards by setting up and trading within live accounts.

- Platform Performance – We evaluate the trading platforms’ functionality, user interface, and available tools by conducting hands-on testing.

- Instrument Availability – We assess the diversity and range of tradable assets offered by each broker.

- Customer Service – We test the accessibility and competence of customer support by reaching out via various channels.

- Transaction Methods – We review the deposit and withdrawal options, focusing on fees and processing times.

- Account Variety – We analyze the different account types, considering their features, minimum deposit requirements, and execution methods.

- Educational Resources – We examine the quality and breadth of educational materials provided to help traders improve their knowledge and skills.

Conclusion

In this article, we reviewed FxPro broker in depth to determine its legitimacy. We concluded that FxPro is indeed a legitimate broker that offers great features for traders but is not ideal for those seeking low-fee trading.