If you are interested in learning Forex trading to make some serious profits have come to the right place. Here, we will give you a simple but complete guide on how to start Forex trading.

What is the Forex Market?

The foreign exchange market (FOREX) is where different currencies are traded around the world. When you trade Forex you are simply changing one currency into another.

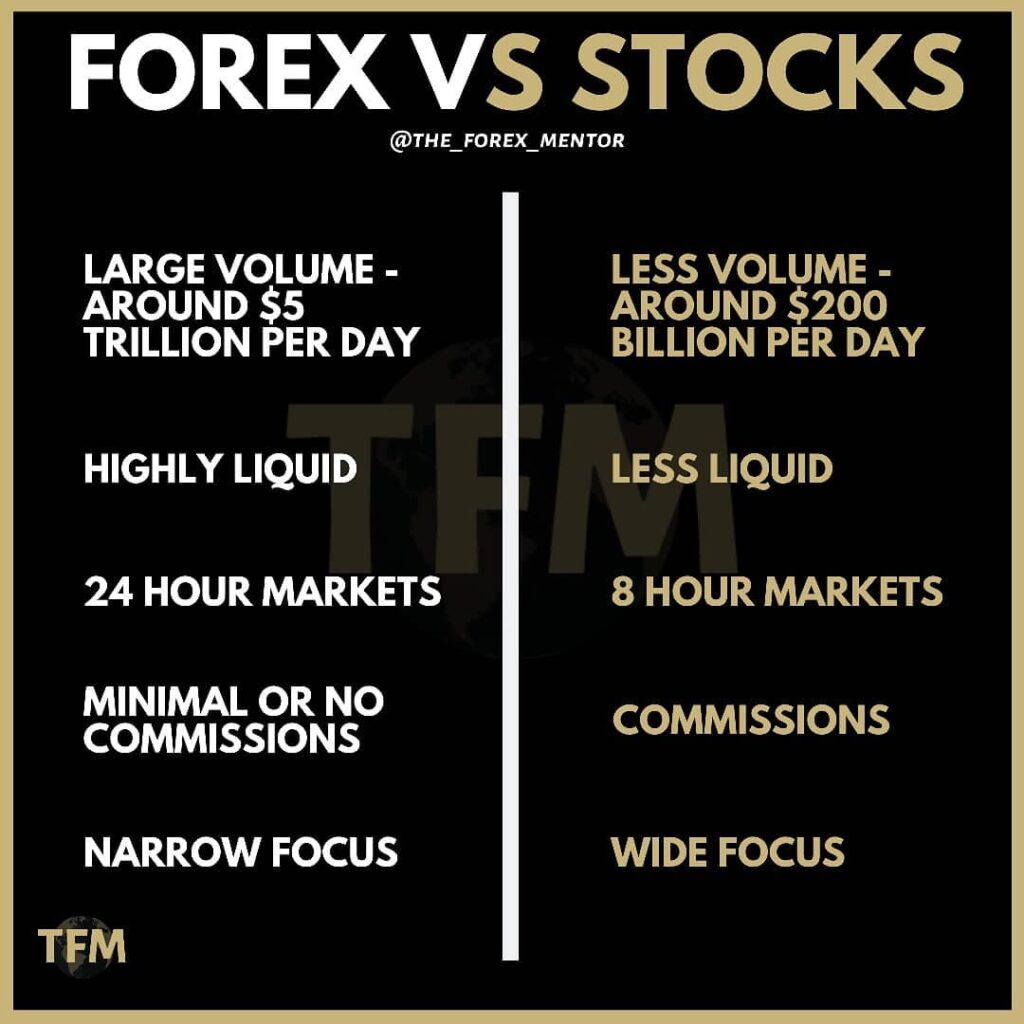

Why trade Forex over Stocks?

Simply, Forex is the largest financial market in the world. The participants in the Forex market trade more than U$5 trillion per day.

That’s roughly 25 thousand more than the stock market. Therefore, why wouldn’t you participate in the Forex market (the largest market in the world)?

The image to the right shows why the Forex market might be better than the stock market.

Can you really make money trading Forex?

You might be wondering if you can really make money trading Forex. Yes, if you do it right, you can make a lot of money. In fact, George Soros made $1 Billion dollars in profit from one trade.

Now, that is quite mind-blowing. You might not be able to make that much trading Forex but you will be able to make a full-time living or make millions of dollars if done right.

Advantages of Trading Forex

1. 24-Hour Markets

The Forex market is open 24 hours, 5 days a week. This means you can trade whenever you want on the weekdays. The trading session begins in Sydney, then Tokyo, then London, and finally ends with the New York session. This allows you to trade on your own schedule.

2. High Volume and Liquidity

At any given time, a large volume is being traded. As you may know, participants in the Forex market trade upwards of $5 Trillion per day. Usually, the Forex market does not have many quiet hours. There is always an opportunity to execute a profitable trade.

3. Risk-Free Demo Accounts

This is my favorite advantage. If you are a beginner you can learn to trade in the real market with virtual currency given by a Forex Broker. This allows you to learn and master your trading before you start using real money.

4. Leverage

One of the great things about the Forex market is the option for leverage. You can pretty much borrow money from your broker to trade with. Leverage sure can be risky but you can use it to your advantage to make some serious profits.

5. Transactions Are Low Cost

Transaction costs are usually included in the Forex market in the form of the spread. This is the amount that the Forex broker takes in order to facilitate your trade. Different brokers charge different amounts. If you want a Broker with low transaction costs we recommend you to sign up with XM.

Types Of Analysis

There are 3 types of Analysis when it comes to Forex trading. They are:

- Fundamental Analysis

- Technical Analysis

- Sentimental Analysis

In this section, we will discuss each type of analysis in detail.

1. Fundamental Analysis

Simply, fundamental analysis is a way of determining where the price might head based on the economical status of the country. In a good economy, the currency will have a higher value. In a bad economy, the currency will have a lower value.

The best way to do fundamental analysis is to learn how to read the Forex calendar. We recommend you to check out the Forex Calendar by the Forex Factory.

2. Technical Analysis

Technical Analysis is our favorite type of analysis. The main advantage of doing this type of Analysis is that you are able to take your emotions out of the equation.

Technical Analysis is done by studying the price movements. Traders can look at the historical price movements, identify patterns and determine the current trading conditions.

This should be your primary focus when trading Forex. There are several ways to do technical Analysis and it can get really complicated. We won’t go too deep into technical Analysis in this guide, we’ll have other articles on how to do in-depth technical analysis.

3. Sentiment Analysis

Sentiment analysis takes into account the overall feeling of the participants in the Forex market about the performance of a particular currency pair. This can be a useful way to determine the feeling of the market to make appropriate trading decisions.

If you are interested in learning more about Forex Market analysis we recommend you check out this article.

Choosing a Broker

Choosing the right broker is very important when it comes to trading Forex. Most brokers in this market are not reliable and some brokers might even scam you. That’s why we created this guide to help you avoid these scams and choose the right broker.

There are several factors you need to consider when choosing a broker. These are:

- Trading Costs

- Good trade executions

- Overall Reliability

- Customer Support

- Trading Tools Provided

- Education Provided

There are a handful of great brokers out there. Currently, our favorite broker is XM. We have found them to be very reliable and they provide excellent customer support. We recommend you sign up with them.

Note that XM is not the only good broker available. There are other great brokers such as eToro and FxChoice. XM is just what we use and recommend.

Also, if you are interested in learning more about what to look for when choosing a broker, make sure to check out our guide on choosing a broker.

Top 3 Forex Brokers

[ninja_tables id=”6695″]

Using MetaTrader

MetaTrader (MT5) is a must-have trading software that is used by thousands of other traders. It is, in fact, very popular among Forex traders.

MT5 is highly customizable and provides all the trading tools necessary to help with your trading. There are several advantages of using MetaTrader, those are:

- Available in multiple languages

- Extremely good user experience

- Advanced charting capabilities

- Provides good security

Alternative to MetaTrader, Trading View

Tradingview is another popular trading platform. There are several benefits of using a trading view over a meta trader. We personally prefer the user interface of trading view over MetaTrader. That said you can always customize MetaTrader to suit your needs.

We have found that for charting purposes trading view is better compared to MetaTrader. If you are a beginner and if you signed up with Axitrader, you will get there own MT4 web-based tool or downloadable software. We recommend you stick with that.

TradingView has a free and paid version. It’s a really great tool to have for Forex traders.

Now you need to learn some basic Forex Lingo in order to understand Forex Trading.

Basic Forex Lingo

Below are some Forex terms that you must know and understand.

Base Currency, Quote/Counter Currency

Base currency is the first currency in the currency pair. Quote or the counter currency is the second currency.

The exchange rate is simply how much the base currency is worth as measured against the quote currency.

As shown in the image to the right the exchange rate is 1.51258. This means 1 GBP is worth 1.51258 USD. Ask Price, Bid Price, and Spread

The bid price is at which the market is willing to buy a specific currency at a given time in the Forex market. The ask price is at which the market is willing to sell a specific currency at a given time.

The spread is the difference between the asking price and the bid price as shown in the image to the right. Make sure to save the image for later reference.

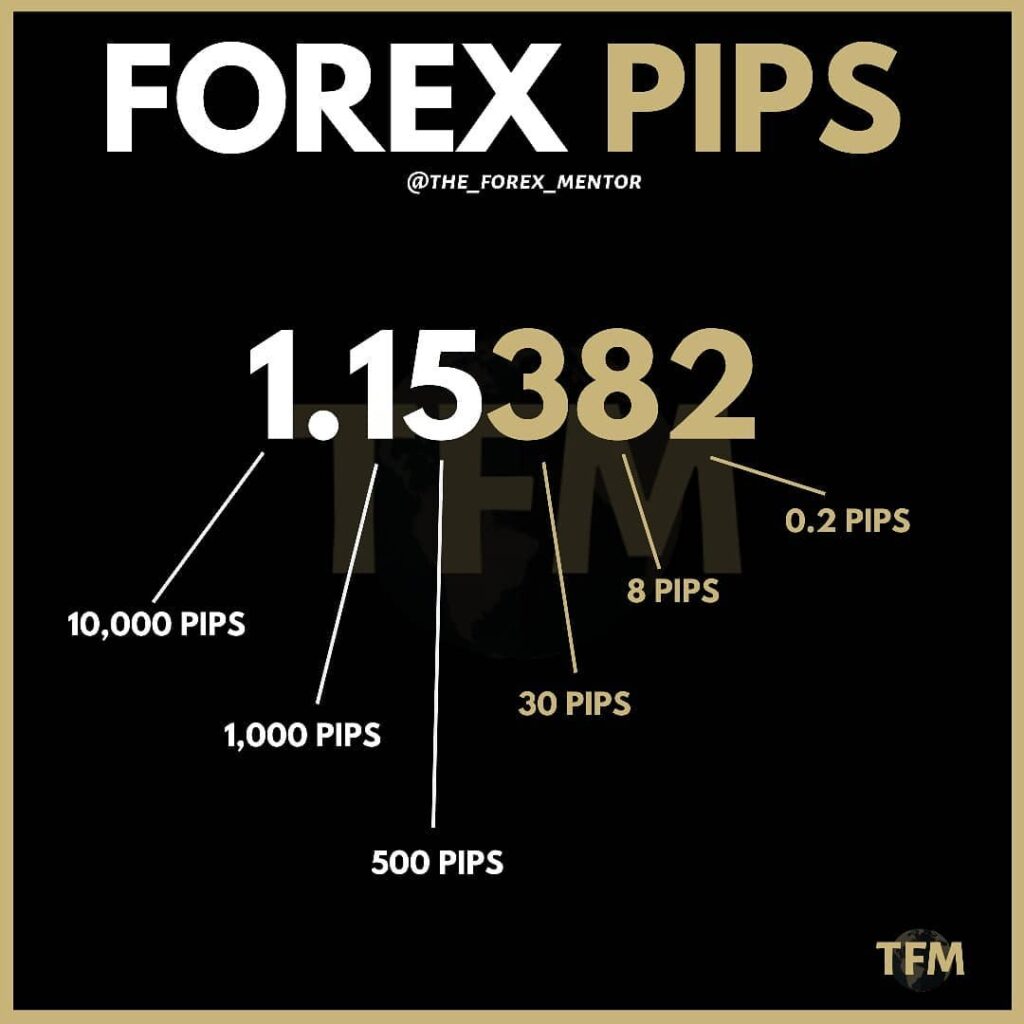

Pips and Pipette

A pip is the smallest unit of the price of a currency.

Most of the currency pairs contain 5 or 6 significant digits as shown in the image to the right.

A pip is the smallest change which is a change of 0.0001. As you can see in the image, the number is 1.15382. That means it contains 8 pips. A pipette is one-tenth of a pip. But, as a beginner, you don’t really need to worry about the pipette.

Next Steps

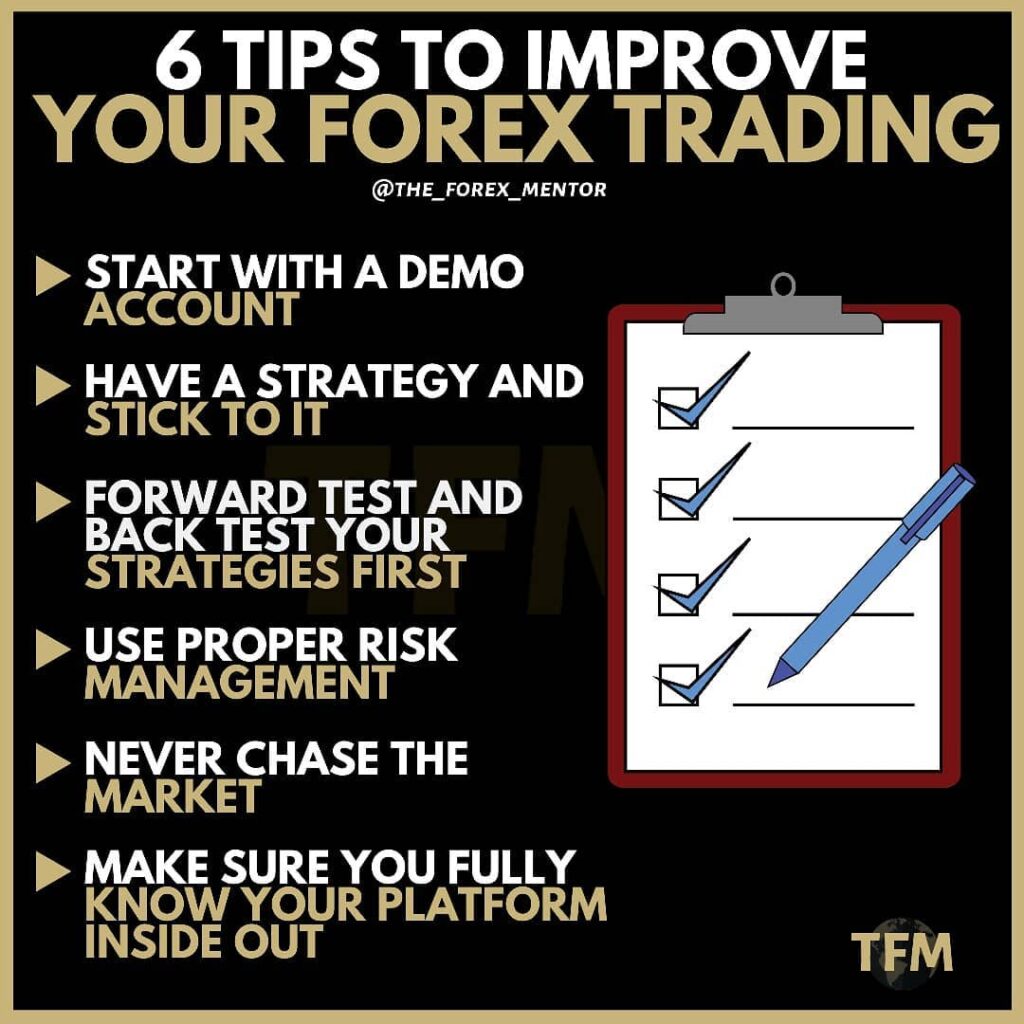

At this stage, you should have a basic understanding of Forex trading. And you should have gathered all the tools required to start learning some serious trading.

If you haven’t, go sign up with XM and they will have a link to download MetaTrader 4.

The next step is to learn some basic charting techniques and develop a trading strategy based on all types of analysis. We recommend you make technical analysis your primary focus. Also, note that this doesn’t mean that you should neglect the other two types.

There are important Technical Analysis tools that you need to learn if you want to be successful as a trader. These are:

- Trend Lines

- Support and Resistance Levels

- Japanese Candle Sticks

- Fibonacci

- Moving Averages

- And other Advanced Analysis techniques

That’s it for this basic guide. We didn’t want to make it complicated for you so we kept this guide as simple as possible. Forex trading can be complicated when you dive deep into advanced analysis techniques.