In the world of forex trading, the forex broker you choose is a factor that will determine if you will become a successful trader or not. It is important to choose a broker who is honest and avoid brokers who are scams.

In this article, we will talk about whether forex brokers are honest. We will also talk about how to choose an honest forex broker and avoid scammy forex brokers. We will provide you with a 2 step criteria for determining if a forex broker is honest or not. We will also discuss 3 honest forex brokers that you can sign up with today.

Are Forex Brokers Honest?

Not all forex brokers are honest. There are a lot of forex brokers who are scams. They make you deposit money with them but don’t let you withdraw your money. It is very important to know how to choose an Honest forex broker and avoid forex broker scams. Now, let’s talk about how to choose an honest forex broker.

Choosing an Honest Forex Broker

There are 2 important things to consider when choosing an honest forex broker. These are regulations and reputation. All honest brokers are highly regulated by tier 1 regulators.

If you want to avoid forex scams as much as possible, you have to choose a regulated broker ideally regulated by at least 1 tier 1 regulator. Some unregulated brokers offer new traders very attractive bonuses but you should not get deceived by these brokers.

When it comes to regulations, there are different tiers of regulators in the forex industry. If the forex broker is regulated by a tier 1 regulator you can trust them more than a broker regulated by a lower-tier regulator. Below is a list of different tier regulators in the industry.

- Tier 1 (High Trust) – Australian Securities and Investment Commission (ASIC), Central Bank of Ireland (CBI), Financial Markets Authority (FMA), Commodity Futures Trading Commission (CFTC).

- Tier 2 (Average Trust) – Cyprus Securities and Exchange Commission (CySec), Isareal Securities Authority (ISA), Financial Sector Conduct Authority (FSCA).

- Tier 3 (Low Trust) – Securities Commission of the Bahamas (SCB), BVI Financial Services Commission (FSC), Cayman Islands Monetary Authority (BMA).

As you can see from the list, if the broker is regulated by ASIC or FMA, the broker is more trustworthy than a broker who is only regulated by SCB or BMA. Brokers can be regulated by multiple regulations depending on where these brokers operate.

Another factor that you should consider is a broker’s general reputation among traders. If you go talk to traders or go to a trading discussion forum you can see what brokers most traders avoid. This way you can gauge the reputation of these brokers.

Also, some brokers who are scams, do not reply to customer requests. Never ever deposit money with forex brokers that you are unsure of.

Even though it is good to know how to choose an honest broker, you do not have to go do it yourself. That’s what we are here for. We constantly review forex brokers and narrow them down to good brokers who are honest. Now, let’s talk about 3 honest brokers that are trustworthy and have a good reputation in the industry.

3 Honest Forex Brokers

1. XM Broker

XM Broker is a great broker with a good reputation in the industry. XM broker has more than 10 million clients worldwide across 190 different countries. XM Broker is also an award-winning broker with multiple awards won throughout the years of operation. XM broker is regulated by 3 different regulators which are,

- Australian Securities and Investment Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySec)

- International Finance Services Centre (IFSC)

If you are interested in trading with XM Broker click the button below.

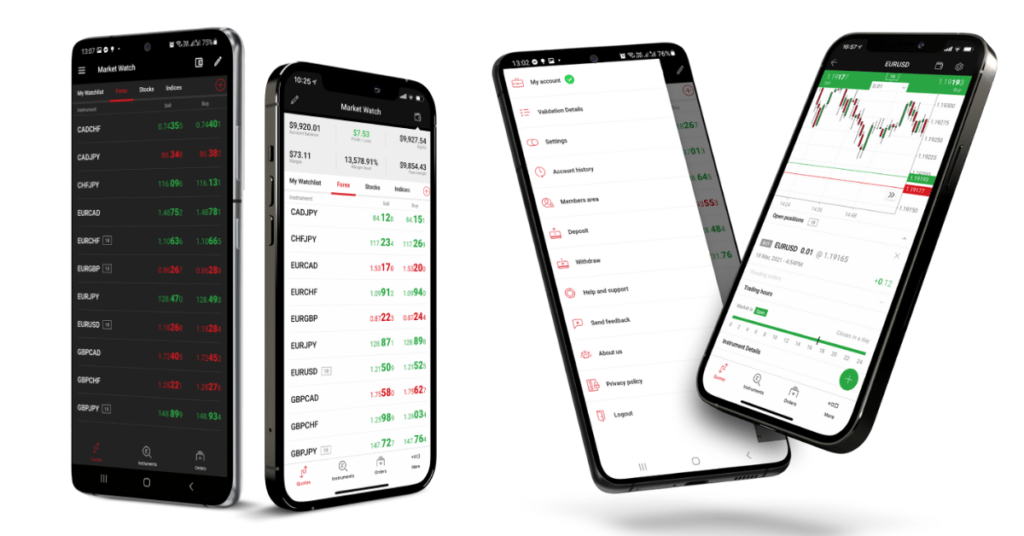

XM Broker also provides trading software for each of the different platforms. For mobile trading, XM offers a mobile trading app that works on both Android and IOS. Figure 1 shows the XM mobile trading application.

For web trading and desktop trading, XM Broker provides you with MetaTrader 4/Metatrader 5 platforms. The MetaTrader platform also works on mobile. With XM’s MetaTrader-based platform, you can trade on both windows and mac. Figure 2 shows the MetaTrader 4 trading platform.

XM Broker provides you with 3 different types of trading accounts. These account types are,

- Micro Account – Requires a minimum deposit of $5. The spreads can go low as 1 pip. The minimum trading volume allowed is 0.01 Lots in MT4 and 0.1 Lots in MT5. The contract size is 1000 per Lot.

- Standard Account – Requires a minimum deposit of $5. The spreads can go low as 1 pip. The minimum trading volume allowed is 0.01 Lots. The contract size is 100,000 per Lot.

- XM Ultra Low Account – Requires a minimum deposit of $5. The spreads can go low as 0.6 pips. The minimum trading volume is 0.01 Lots for Standard Ultra and 0.1 Lots for Micro Ultra. The contract size is 100,000 per lot for standard ultra and 1000 per lot for micro ultra.

The XM broker provides you with great customer service 24/5. You can contact XM Broker through phone, live chat, and email. As discussed before, to start trading with the XM Broker requires a minimum deposit of only $5. If you are interested in trading with the XM Broker click the button below.

2. AvaTrade

AvaTrade is an honest award-winning broker who is regulated by 7 different regulators in the industry including tier 1 regulators. These regulators are,

- Central Bank of Ireland (CBI)

- Australian Securities and Investment Commission (ASIC)

- Financial Futures Asociation Japan (FFAJ)

- Cyprus Securities and Investment Commission (CySec)

- South African Financial Services Board (FSCA)

- Abu Dabi Global Markets (DFSA)

- BVI Financial Services Commission (FSC)

AvaTrade was founded in 2006. The company’s total trading volume surpasses $60 billion per month. AvaTrade has 400,000 registered users who execute 2 million trades per month. AvaTrade has a good reputation among forex traders. To trade with AvaTrade click the button below.

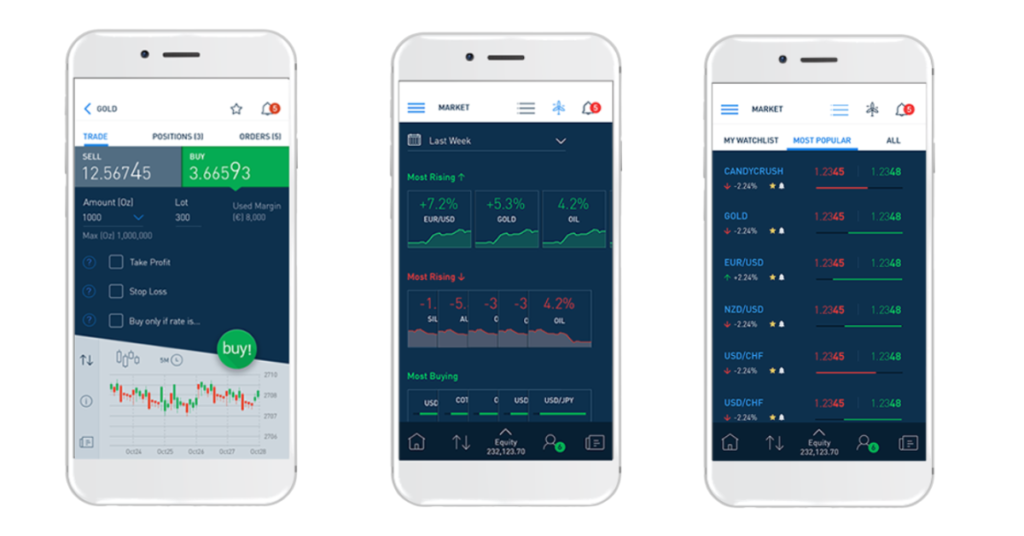

AvaTrade offers good trading software for each platform. These include software for mobile, desktop, and web. For mobile trading, AvaTrade offers a mobile trading app called AvaTrade Go. You can download AvaTrade Go on both android and IOS. Figure 3 shows the AvaTrade Go mobile application.

For trading on the web, AvaTrade offers a web trading platform called the AvaTrade web trader. Figure 4 shows the AvaTrade web trading platform.

For trading on the desktop and for algorithmic trading, AvaTrade offers trading platforms based on MetaTrader 4/5. Metatrader 4/5 is one of the best trading platforms out there.

With the MetaTrader platform, you can do automated trading as well. If you are into automated trading, it is good to choose a broker who provides you with a trading platform that supports algorithmic trading.

If you are interested in social trading or copy trading, AvaTrade provides you with a copy trading app called AvaSocial. With AvaSocial you can learn to trade with the top traders using AvaTrade and you can also copy their trades.

AvaTrade provides you with great multi Lingunial customer service 24 hours 5 days a week. AvaTrade has won multiple awards for its world-class customer service. You can contact AvaTrade customer service through email, phone, and WhatsApp.

AvaTrade provides you with variable spreads that depend on the market conditions. The average spread on AvaTrade is around 0.9 pips. AvaTrade does not charge commissions on trades you make.

To start trading with AvaTrade you need only a minimum deposit of $100. If you are interested in trading with AvaTrade broker, click the button below.

3. eToro

eToro is an honest broker with a popular mobile trading app. eToro was founded in 2007. eToro’s mobile app is downloaded by more than 10 million traders worldwide. eToro is regulated by 4 different regulators. These regulators are:

- Australian Securities and Investment Commission (ASIC)

- Financial Conduct Authority (FCA)

- Cyprus Securities and Investment Commission (CySec)

- Financial Services Authority Seychelles (FSAS)

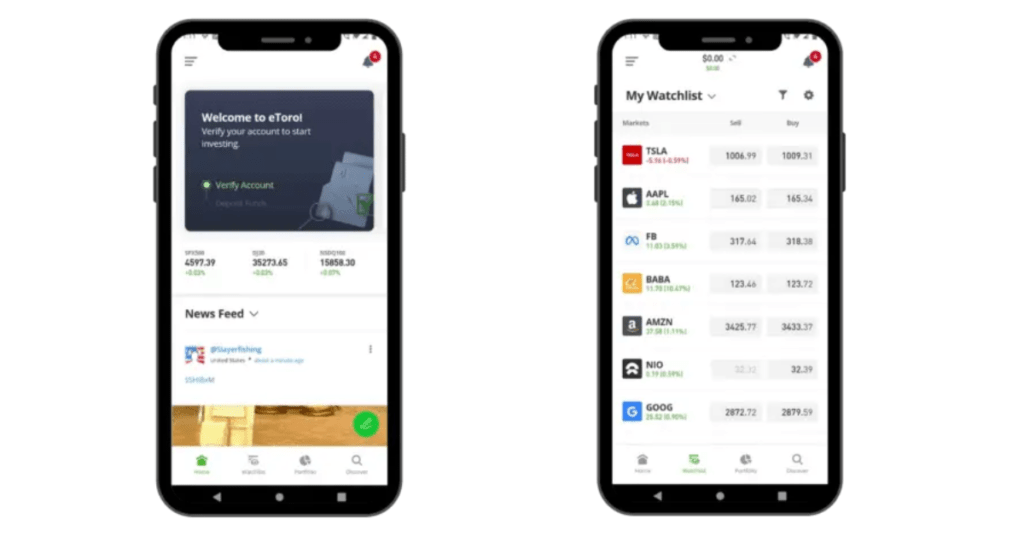

eToro provides you with good mobile trading and a web trading platform. eToro does not provide a Metatrader-based platform, which means you cannot do automated trading with eToro. eToro’s mobile trading application is well known for its copy-trading (social trading) feature. Figure 5 shows eToro’s mobile trading application.

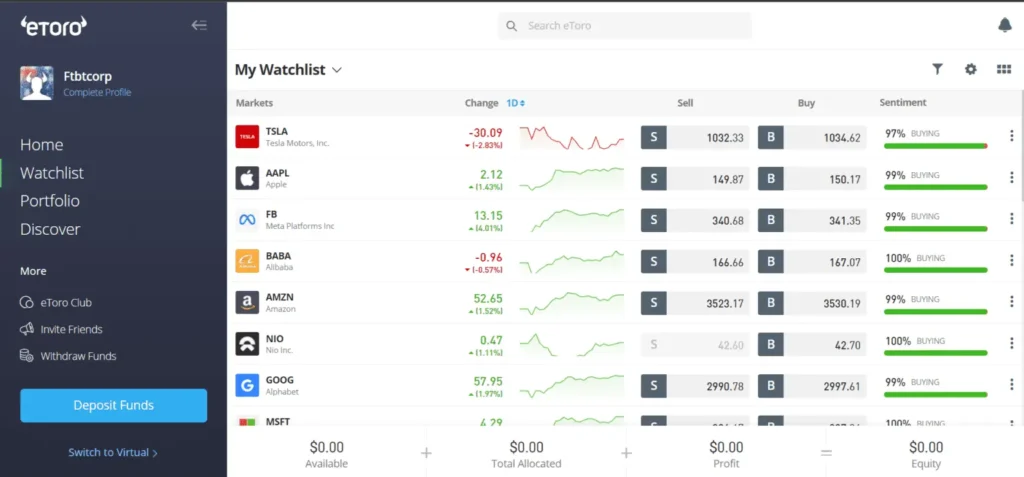

eToro’s web trading application has similar features to that of eToro’s mobile trading application. eToro’s trading software provides a range of features, including copy trading features and portfolio trackers.

Figure 6 shows eToro’s web trading application.

Etoro provides you with great customer service as well. You can contact eToro through email or live chat with any questions you have about eToro’s trading platform.

eToro provides you with decent spreads that can go low as 1 pip for EUR/USD currency pair. eToro does not charge any commission as well.

In many countries, you can start trading with eToro with a minimum of $50 in your trading account. In the United States, you can start trading with eToro with a minimum of $10. If you are interested in trading with eToro click the button below.

Conclusion

In this article, we talked about whether forex brokers are honest. As discussed there are two things to consider when determining if a forex broker is honest or not. These are their regulations and their reputation in the industry. There are many forex broker scams going around. Therefore it is very important that you know how to avoid these scams.

We also, provided you with 3 honest brokers you can sign up for and start trading today. These 3 brokers are honest brokers that provide you with great features for forex trading.

If you are new to trading and want to learn how to trade step by step, check out our free trading guide. In our trading guide, we cover everything you need to know to go from a beginner trader to a profitable forex trader.