In this article, we will talk about the most profitable forex pair to trade. The forex market is the largest financial market in the world, even larger than the popular stock market.

Whether you’re new to trading forex or an experienced trader, there are some key things you should know when choosing the most profitable forex pair to trade. There are more than 50 forex pairs that you can trade in this market, but some of them are not that great to trade.

The most profitable forex pairs are the currency pairs with the most liquid and those with the lowest spreads.

Now, we will talk about the most liquid currency pairs.

Most liquid currencies

There are few currencies that carry the most liquidity. The 6 most liquid currencies are

- USD – (US Dollar)

- EUR – (Euro)

- JPY – (Japanese Yen)

- GBP – (Sterling)

- CNY – (Renminbi)

- AUD – (Australian Dollar)

The most profitable forex trading pairs

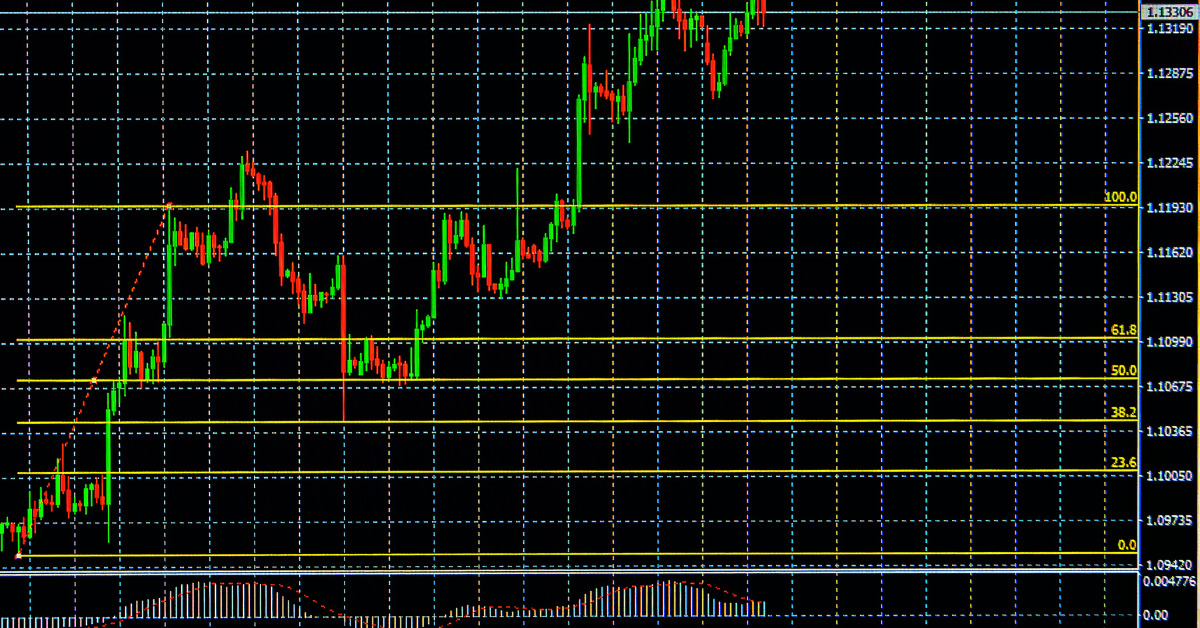

EUR/USD

Amongst the many Forex pairs, the EUR/USD is by far the most profitable currency pair to trade. It is known for its low spreads, this pair is the ideal choice for a wide range of trades. It is also one of the most liquid currency pairs in the market.

Furthermore, it is also the most popular Forex pair. This is mainly because of its low volatility. It has good intraday volatility. In addition, it is a cheap currency. A single Euro is worth 1.06 USD (at the time of writing this article).

The EUR/USD is a great example of a multi-year trend. This is due to its positive relationship with the Swiss franc. The EUR/USD is also a very liquid pair, as discussed before. This allows for tight spreads.

The EUR/USD is able to boast the most number of trades per hour of any pair currently in the forex market. This is a significant advantage for traders. The EUR/USD is also a cinch to trade, no matter what time of the day or night you are.

The EUR/USD also has the largest quote size. This means that traders have access to a large volume of information. It is therefore possible to make profitable trades, irrespective of whether you have a lot of money or not. EUR/USD is one of the currencies in our portfolio of currencies that we trade.

Aside from the EUR/USD, the British Pound and the US Dollar are great currency pairs to trade as well.

GBP/USD

Often referred to as ‘The Cable’ by forex traders, the Great Britain Pound (GBP) and the US dollar (USD) is another popular currency pair to trade. In addition to being one of the most profitable currencies, it is also less volatile.

The GBP/USD is influenced by the strength of the British and American economies. It is also affected by the Bank of England’s (BoE) interest rates. It can also be influenced by the announcement of the European Central Bank’s (ECB) policy decisions.

The relationship between Europe and the EU is likely to get more interesting with the effects of the Brexit vote. This relationship will be based on historical ties. It is also expected to stay in place because of the potential for trade.

This pair has one of the lowest volatility amongst the most popular pairs. It is considered a safe haven, especially when trading in uncertain markets. It is commonly used as a measure of the global appetite for risk.

AUD/USD

AUD/USD is one of the most popular Forex pairs. Since we are trading from Australia, AUD/USD is one of our staples. This pair is a great choice for traders who want to make money trading on the fluctuations of the American market.

This pair has some of the lowest levels of volatility. It’s also one of the most stable pairs. This means that traders will have an easy time trading it.

The AUD/USD is heavily influenced by the global commodities market. This means that a slump in commodity prices could lead to a slump in the value of the Australian dollar. This can affect the overall economy of the country.

The AUD/USD is also affected by the interest rate differential between the Reserve Bank of Australia and the US Federal Reserve. If the American interest rates go down, the USD would weaken against the Australian dollar. This means that buying the Australian dollar would be cheaper.

Another reason that AUD/USD is popular is that it has a very predictable price action. This means that you can expect to see a high volume of trade opportunities each week. It’s also good for trading the Asian markets.

Minors vs Major Currency Pairs

The currency pairs discussed in the previous section were major currency pairs. The majors are the ones that are the most traded. They are a combination of two or more of the largest economies in the world, that’s what makes them profitable pairs to trade.

The minors are those less widely traded pairs and are often more volatile, which makes it risker to trade compared to the major currency pairs.

In addition to the major and minor pairs, the foreign exchange market includes exotic currencies. These are smaller developing country currencies that are not part of the majors. They are generally traded against the US Dollar. They also have wider spreads and are more expensive to trade and we usually do not trade these currency pairs.

Now let’s talk about some exotic currency pairs.

Exotic currency pairs

Generally, exotic currency pairs are traded at a lower volume and are less liquid than the majors. This can make them more difficult to trade. They also tend to be more volatile and can incur higher transaction costs. However, they can be advantageous to traders who are looking to avoid the US Dollar.

Exotic currency pairs are generally traded against the US Dollar, as discussed previously. This is because the US Dollar is still the most widely held reserve currency. In order to trade against an exotic currency, you’ll need to have higher margins in your brokerage account.

The biggest advantage of trading exotics is that they are not as correlated to other financial instruments. For example, if you are a bull on industrial growth, you may find it beneficial to trade a commodity-linked currency pair.

The best way to trade an exotic is through a reputable forex broker like BlackBull Markets. In addition to a wide range of trading options, you’ll be able to use technical analysis to make accurate trading decisions. You can use this to make sure you’re not trading the wrong currencies.

While there are many pros and cons to trading exotics, the best approach is to determine which pairings will work for your trading strategy.

Conclusion

As discussed in this article, you should first focus on the major currency pairs, as they tend to be the most profitable due to high liquidity and lower spreads.