In this guide, we will talk about forex swing trading XAUUSD using the 4-hour chart. For swing trading XAUUSD, we will be using 3 different forex trading strategies. This includes the reversal trading strategy, breakout trading strategy and trading with simple moving average (SMA) crossovers. The first two strategies that we will look at are powerful trading strategies. Now let’s talk about what XAUUSD is.

What is XAUUSD?

XAUUSD, or the gold price, is a popular currency for trading on the foreign exchange market (forex). The gold price is quoted in US Dollars and it is one of the most liquid assets in the Forex market. The US dollar is the primary reserve currency, and its rise and fall will affect the XAUUSD rate. Gold is valued in ounces, and one ounce equals one dollar.

The price of gold is highly correlated with the U.S. dollar, as well as with the yen of Japan. Gold is an excellent safe haven for investors and can protect assets from fluctuating currency markets. Since gold and the US dollar have a strong relationship, an XAU/USD position could provide a profit.

For example, the recent Russian invasion of Ukraine caused the dollar to surge higher, while the Russian rouble lost ground. If you’d had a position in XAU/USD at that time, you could have taken advantage of the opportunity. Furthermore, the XAU/USD pair follows trends and trades within a range, giving you opportunities to capitalize on buy and sell signals when they occur.

There are many ways to trade gold online. You can use MT5 trading software or a web-based platform. Either way, you can trade gold online using the XAU/USD pair. Now let’s look at 3 forex trading strategies to trade XAUSD.

3 Forex Trading Strategies for XAUSD

Trading XAUUSD Reversal

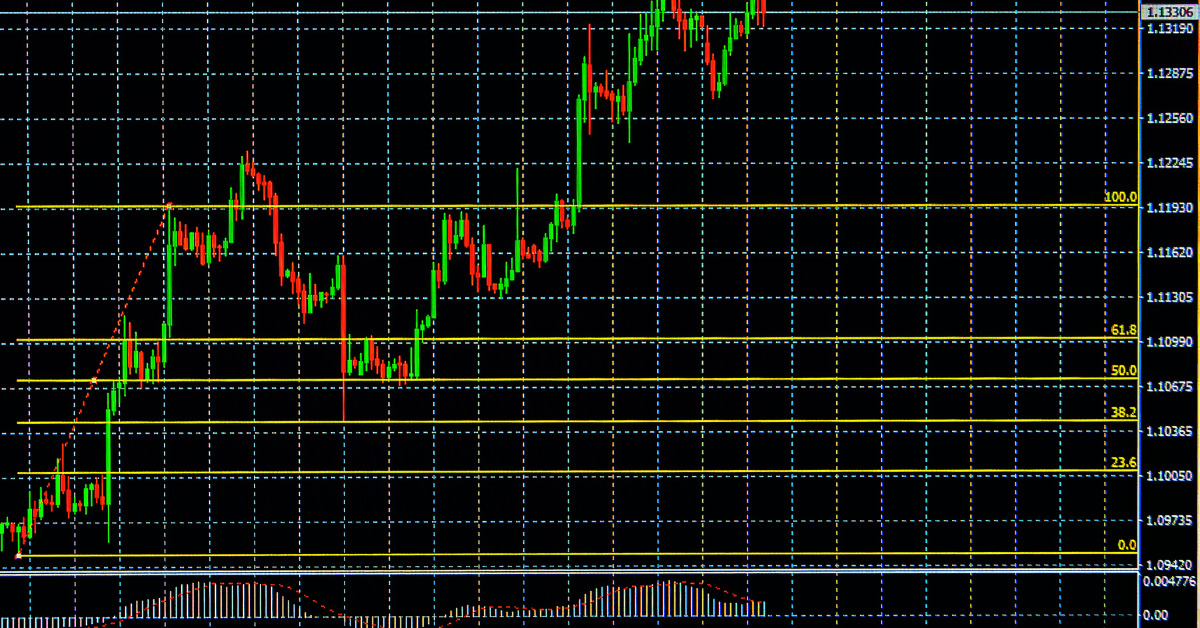

The reversal strategy is one of our favourite trading strategies. If you understand the concepts of the reversal trading strategy you can become a profitable trader. The best time to trade reversals in the XAUSUD is when the market is ranging. What does a ranging market mean? The chart below shows a ranging market (4-hour chart).

In a ranging market the overroll market should not be trending. But that doesn’t mean that you cannot trade reversals in a trending market. Most of the time it is a good idea to trade the trend in a trending market comapred to trading the reversals. But the strategies that we are going to talk about applies to both a trending marketing and a ranging market. Now we will look at 2 types of reversals you can expect this market to make.

Reversals Inside a Channel

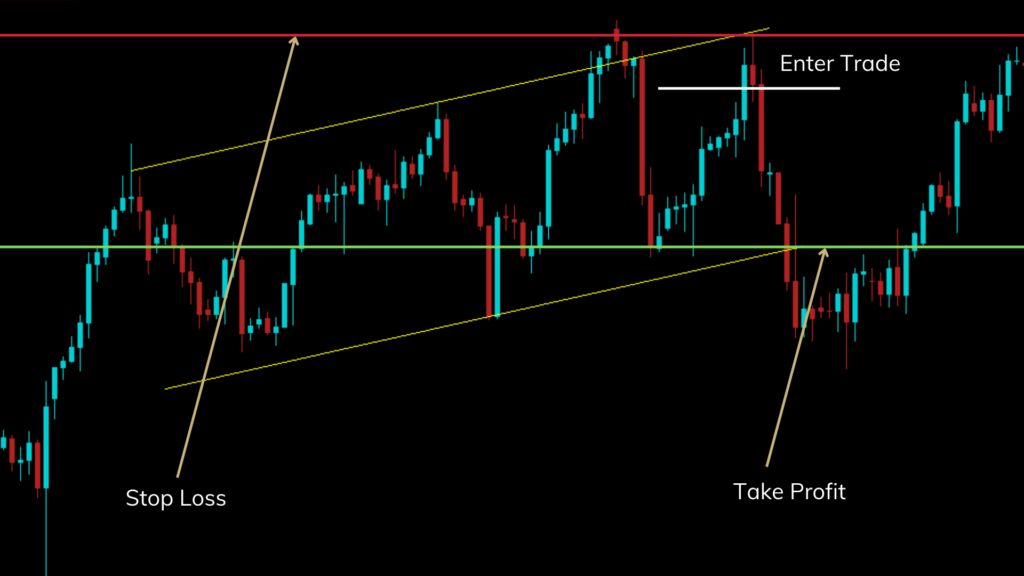

The chart above shows a reversal inside an up channel. As you can see the you have multiple opportunities to place a trade on the resistance of the channel. As you see, when the market touches the resistance level for the last time a bearish candlestick pattern is formed. This is a good time to enter a trade. You can exit the trade at the support and you can place your stoploss above the bearish candle. This is shown in the chart below.

Supply and Demand Reversals

Finding supply and demand reversals is another great way to trade the forex market. This can be done by finding the supply or demand zones in a chart. A supply or demand is a concept of aggressive selling and aggressive buying. Your goal with this strategy is to find when there is aggressive buying or aggressive selling in the market.

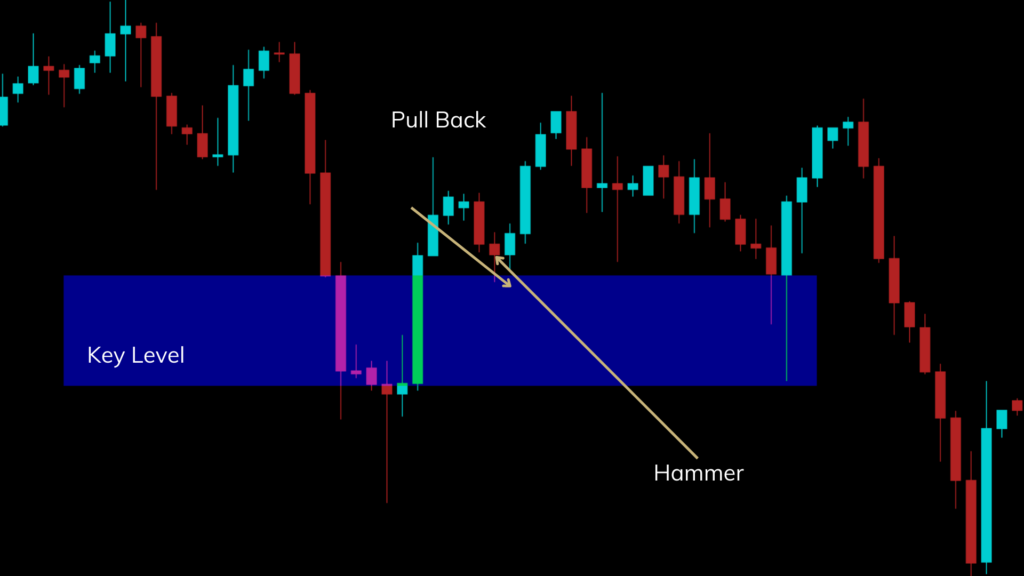

Let’s take the above chart of example. As you can see we have marked the area where aggressive buying occurs (this is demand). This area becomes a key level where the market will pull back. The chart below shows the pull back to the key level and after the pull back the market reverses. This reversal is a great place to enter a trade.

When the market pulls back and when a bullish candle is formed, this is a great place to enter a trade. As you can see from the chart the bullish candle formed is called a Hammer. If you want to learn more about single candlestick patterns, check out this guide.

You can place the trade when the candlestick pattern is formed by risking that candle, which means that you can place the stop loss below this candlestick. If you are interested in learning more about supply and demand strategy in detail check out this guide.

Trading XAUUSD Using Breakouts

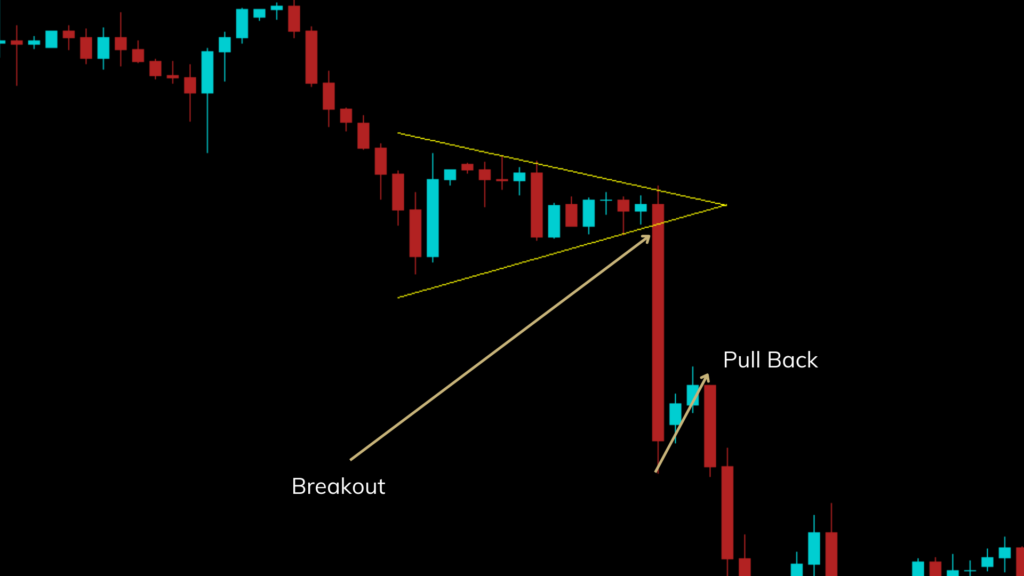

Trading the breakouts is one of our favourite trading strategies. Breakouts usually happens when there is a consolidation. When the market consolidates there is high chance that the market will breakout of that consolidation. The chart below shows an example of a breakout in the 4 hour chart (XAUUSD). As you can see the chart is forming a symmetrical triangle and at the end it breaksout.

We personally don’t trade the breakout immediately beacuse this can be riskly. This can cause a fake if in some cases. The best way to trade these breakouts is to wait for a pull back after the breakout and then enter the trade. Also you can look for other confirmations to trade breakouts.

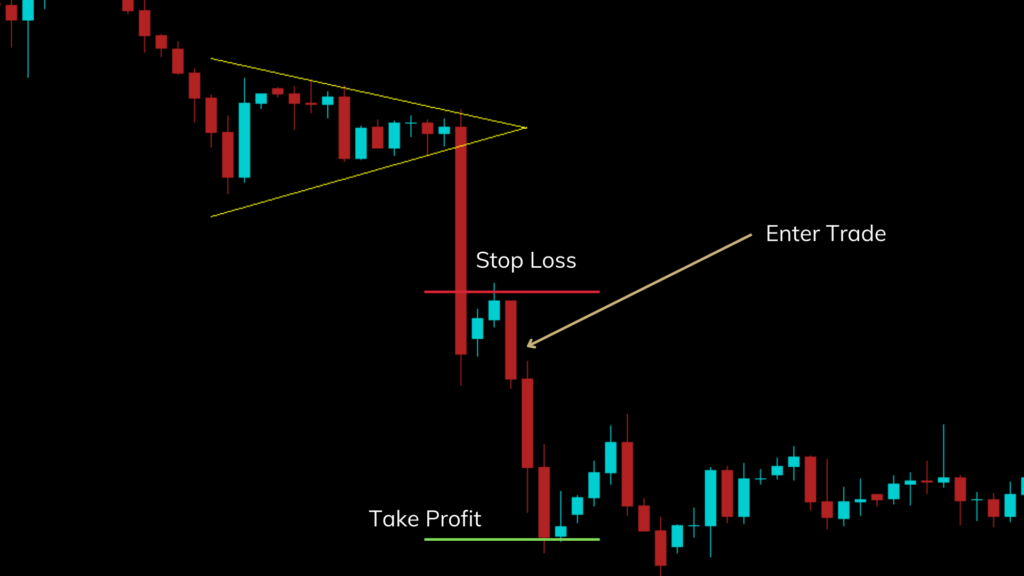

After the pullback occurs when the bearish engulfing pattern is formed you can place a trade. This is shown below with stop loss and take profit placed.

Swing Trading with Simple Moving Average

We personally prefer to trade with price action comapred to using technical indicators. But there are great trading strategies that includes using technical indicators. Our favourite technical indicator is the Simple Moving Average. In this guide we will not go deep into the simple moving average. You can read this guide to learn more about moving averages.

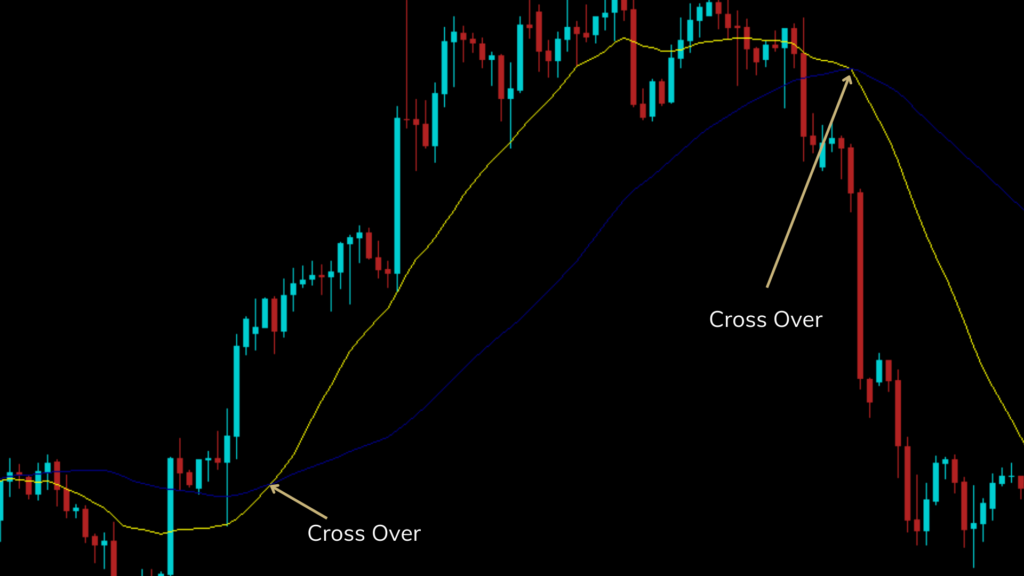

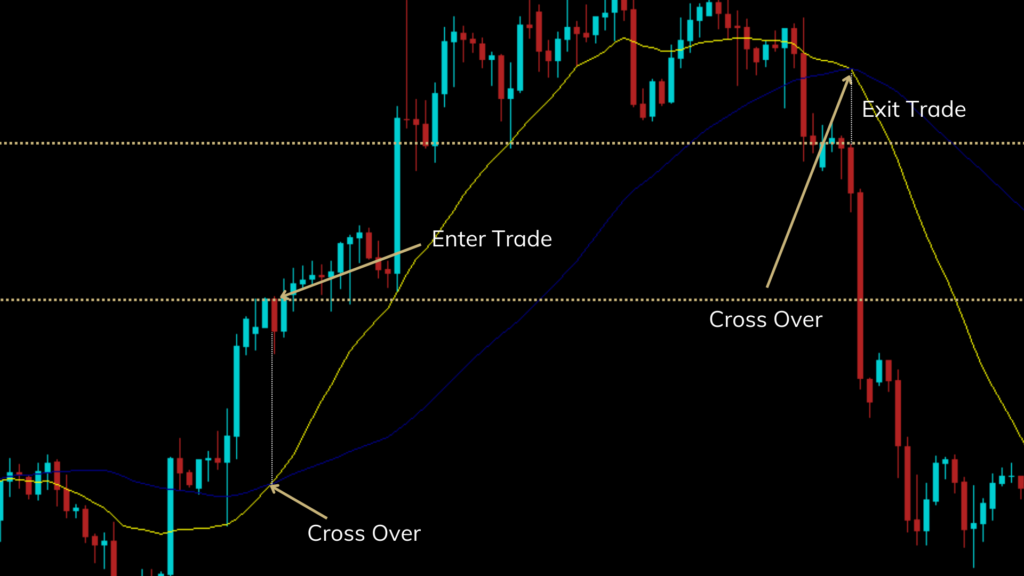

In this strategy we will be trading the simple moving average crossovers. This strategy works best in a trending market (uptrend or downtrend). As you can see from the chart below we have added two simple moving averages. We will be using a 20 period SMA and a 50 period SMA.

For this strategy you will be entering the trade when the two moving averages crosses each other and exiting when they cross again. This is shown below. We have shown where you could enter and exit the trade. When entring a trade with the cross over it is a good idea to wait tell the candle stick is closed. Then enter the trade.

Conclusion

In this guide we looked at how to Forex Swing Trading XAUUSD using the 4-hour chart. We specifically looked at 3 forex trading strategies. These were the reversal strategy, breakout strategy and simple moving average cross over strategy. The first two strategies are two of our favourite forex trading strategies. If you are new to forex trading and want to learn more about forex trading strategies, we recommend you to check out our complete guide to learning how to trade forex.