In this article, we will talk about the meaning of forex spreads. The Forex spread is a very important concept to understand since it is the difference between the selling and buying prices of an asset. This difference is used by broker companies to earn commissions.

Most traders look for small spreads, as they mean fewer commissions and higher profits. There are different types of spreads in the Forex market, such as Fixed and Floating spreads. There are also negative spreads, called Yield spreads.

Bid-ask spread and what affects the spread

The bid price is the price at which the forex market is willing to buy a currency pair. It can be seen on the right-hand side of a forex quote. For example, if you want to buy a Euro at $1.2729, the asking price is 1.2729 USD.

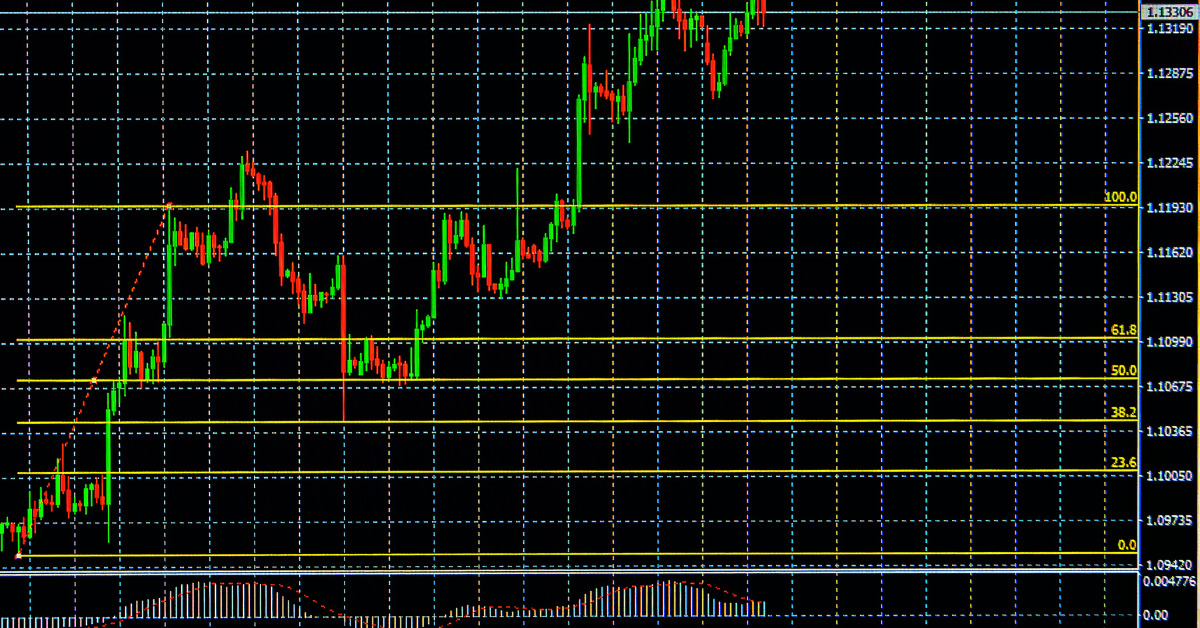

The bid-ask spread in forex is the difference between the bid and ask prices. It is the profit margin of a broker. It represents the service charge and is determined by several factors. Spreads vary greatly. The spreads of major currency pairs are typically wider than those of minor currencies.

Historically, the spreads have been expressed as pips. But now, the spreads are often expressed in other terms such as pips percent.

The current level of volatility is another factor that affects forex spread. The level of volatility is closely related to the risk of sharp fluctuations in exchange rates. In volatile markets, market makers take on more risk and quote wider prices to compensate. As a result, the prevailing dealing spread often fluctuates with wild market swings around key economic data. Therefore, it is vital to know the current level of volatility in the market before trading.

Fixed narrow spread

In the forex market, you will find two types of spreads: floating and fixed. A fixed narrow spread is a more predictable, convenient option. The floating spread can be more unpredictable. You need to consider the pros and cons of each type of spread before choosing a trading strategy. For example, a fixed narrow spread can give you more profit during periods of high volatility. This type of spread also allows you to profit from higher leverage, making it ideal for investors.

A fixed narrow spread is the best choice if you want to lower the cost of trading. Forex traders want the difference between the bid and ask prices to be as small as possible. A fixed narrow spread helps them accomplish this goal, and many traders are opting for it.

A fixed narrow spread is more secure than variable-width spreads. A fixed narrow spread eliminates the guesswork and maximizes profits. The spread is a significant cost factor in forex trading. The difference between the bid and ask price is expressed in points (pips). Usually, one pip is equivalent to one point of change in a currency pair’s value. It’s important to note that forex brokers may not maintain fixed narrow spreads, as the prices may change rapidly. A narrower spread also minimizes the risk of liquidity disruption.

Floating widespread

The floating wide forex spread is a popular type of forex spread. Unlike fixed spreads, this type of forex spread varies according to market conditions. During normal market conditions, it rarely reaches more than 4-5 points, but it can widen to 50-60 points during times of increased volatility. The drawback of this type of spread is that traders cannot predict the exact size of the spread. This can make strategy testing difficult, and it makes it difficult to use automated systems in trading.

Floating spreads are also referred to as variables because they are constantly changing. During normal market conditions, floating spreads are lower than fixed spreads, so they can be good for traders.

Floating wide forex spread increases with market volatility. The wider the spread, the higher the volatility. This can cause a loss for a trader if they don’t fully understand how this type of forex spread works. However, floating wide forex spread brokers are becoming increasingly popular. Traders should choose a broker that offers the trading environment they need and optimizes their profit margins. A good forex broker for this is XM Broker.

Liquid markets with lower spreads

In the forex market, liquidity is an important factor in the determination of the spreads on currencies. Generally, lower spreads mean lower volatility. High spreads mean higher volatility and low liquidity. When liquidity is high, prices are less volatile. However, low liquidity can lead to high spreads. In such a case, traders should avoid trading on markets with high spreads. In addition, traders should avoid trading during off-market hours.

The forex industry is growing at a rapid pace. This makes it more accessible to more investors. Liquidity also means that brokers can offer lower forex spreads. Often, they advertise 0 pips on forex trades, which can appeal to many investors. Traders should also consider whether they want a high-quality trading platform with lots of trading tools and around-the-clock customer service.

High-liquidity markets have numerous buyers and sellers and low transaction costs. The liquidity of the market is an important factor in determining the spread. High liquidity means that there are numerous buyers and sellers for any asset, and the lowest bid-offer spread is often smaller. Liquidity also means that transactions are fast and easy, and the spreads are low and stable. There are many reasons why liquid markets are more expensive than illiquid markets, and the low forex spreads on these markets are the primary reason.

Conclusion – What is the Meaning of Forex Spreads?

If you want really narrow spreads you need to choose a broker that provides you with that. This is one aspect of choosing a broker. If you are not sure what broker to choose, check out the top brokers below for forex trading.

[ninja_tables id=”6695″]