In this article, we will talk about the advantages of trading in the forex market.

Throughout its history, the Forex market was available most to major banks, multinational corporations, and other participants who traded in large transaction sizes such as billions of dollars.

Small-scale individual traders had little to no access to this market for a long period of time. Now, with the evolution of the internet and advanced technology, Forex trading is becoming increasingly popular. Due to this, average day-to-day people can make a full-time living trading the Forex markets.

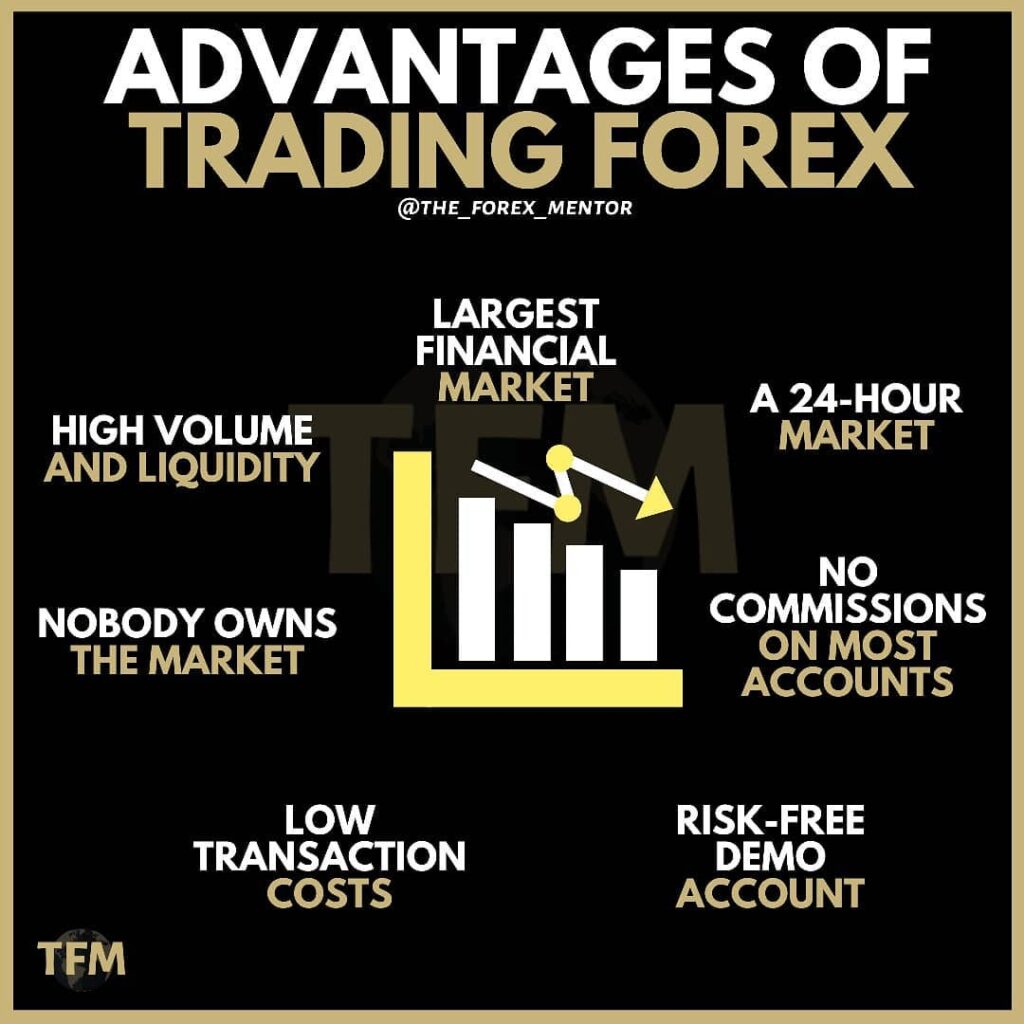

Also, trading the Forex market can be highly beneficial for you. Below are the advantages of trading the Forex market.

The Advantages of trading in the Forex market are.

- It is open 24 hours and it closes only on the weekends;

- It is very liquid and efficient;

- It is very volatile;

- It has very low transaction costs;

- You can use a high level of leverage (borrowed money) with ease; and

- You can profit from a bull or a bear market.

1. Continuous, 24-Hour Trading

The Forex market is a 24-hour market. That means you can trade anytime and anywhere you want. If you work a 9-5 job, you can trade after 5 pm without a problem.

Regardless of what time frame you want to trade at whatever time of the day, there would be enough buyers and sellers to take the other side of your trade. This feature of the market allows you to have enough flexibility to manage your trading around your daily routine.

2. Liquidity And Efficiency

When there are a lot of buyers and a lot of sellers, you can expect to buy or sell at a price that is very close to the last market price. The currency market is the most liquid market in the world, which means it’s even larger than the stock market.

Trading volume in the currency markets can be between 50 and 100 times larger than the New York Stock Exchange.

When you are trading stocks, you may have experienced events where one piece of news accelerates or decelerates the price of the underlying stock you may have bought into. Perhaps a director has been kicked out by the shareholders of a company or the company has just released a new product and big investors are buying the shares of a particular company.

Share prices can be drastically affected by the actions or inaction of one or a few individuals. So if you are relying on television reports and newspapers to get your news, most of the opportunities or warnings will have come too late for you to take advantage of by the time you get them.

The value of currencies on the other hand is affected by so many factors and so many participants that the likelihood of any one individual or group of individuals drastically affecting the value of a currency is minute.

Because of its sheer size, the currency market is hard to manipulate. The ability for people to engage in ‘insider trading’ is virtually eliminated. As an average trader, you are less disadvantaged. You are likely to be playing on relatively equal ground along with all the other traders and investors with whom you are competing.

Note about price gaps:

For those people who have already traded in other markets, you probably know about price ‘gaps’. ‘Gaps’ occur when prices ‘jump’ from one price level to another without having taken any incremental steps to get there.

For example, you may be trading a share that closes at $10 at the end of today but due to some event that happens overnight; it opens tomorrow at $5 and continues to go downwards for the rest of the day.

Gaps bring about another degree of uncertainty that may meddle with a trader’s strategy. Probably one of the most worrying aspects of this is when a trader uses stop-losses. In this case, if a trader puts a stop-loss at $7 because he no longer wants to be in a trade if the share price hits $7, his trade will remain open overnight and the trader wakes up tomorrow with a loss bigger than he may have been prepared for.

After looking at a couple of Forex charts, you will realize that there are few price ‘gaps’ or none at all, especially on the longer-term charts like the 3-hour, 4-hour, or daily charts.

3. Volatility

Trading opportunities exist when prices fluctuate. If you buy a share for $2, and it stays there, there is no opportunity to make a profit. The magnitude of the level of this fluctuation and its frequency is referred to as volatility. As a trader, it is volatility that you profit from.

Large volume transactions and high liquidity combined with fewer trading instruments generate greater intraday volatility in the currency market that can be exploited by day traders. The high volatility of the currency market indicates that a trader can potentially earn 5 times more money from currency trading than from trading the most liquid shares.

Volatility is a measure of the maximum return that a trader can generate with perfect foresight. Volatility for most liquid stocks is between 60 and 100. The volatility for currency trading is 500.

Therefore, currencies make a better trading vehicle for day traders than equity markets.

4. Low Transaction Costs

A currency transaction typically incurs no commission or transaction fees. For a forex trader, the spread is the only cost he or she needs to cover in taking on a position. In addition, because of the currency market’s efficiency, there is little or no ‘slippage’ costs.

‘Slippage’ is the cost involved when traders enter the market at a price worse than the level they wanted to get into. For example, a trader wants to buy a share at $2.00 but by the time, the order gets executed, he gets to buy the shares at $2.50. That fifty cents difference is his slippage cost. Slippage cost affects large-volume traders a lot.

When they buy large quantities of a commodity, it oversupplies the market with buy orders. This applies pressure on the price to go up. By the time they get to buy all the quantities they wanted, the average price they got their commodities would be higher than the price they intended to get them for. Conversely, when they sell large quantities of a commodity, they oversupply the market with sell orders.

This applies pressure for the price to go down. By the time they finish selling all their commodities, their average selling price is less than what they initially intended to sell them for.

Due to lower transaction costs, minimum slippage, and strong intraday volatility, individuals can trade frequently at small costs. As an approximate, you may only expect to have a spread of 0.03% of your position size, depending on the broker you use. To give you an example, you can buy and sell 10,000 US Dollars and this will only incur a 3-point spread, equivalent to $3.

5. Leverage

There are not a lot of banks or people who would lend you money so that you can use it to trade shares. And if there are, it would be very hard for you to convince them to invest in you and in your idea that a certain share is going to go up or down. Therefore, most of the time, if you have a $10,000 account, you can only really afford to buy $10,000 worth of stocks.

In currency trading, however, because you use ‘borrowed money, you can trade $10,000 of a currency, and you only need anywhere between fifty (For a margin lending ratio of 200:1) to two hundred dollars (For a margin lending ratio of 50:1) in your trading account. This makes it possible for an average trader with a small trading account, under $10,000 to be able to profit sufficiently from the movements of the currency exchange rates.

6. Profit From A Bull And Bear Market

When you are trading shares, you can only profit when the price of a stock goes up. When you suspect that it is about to go down or that it is just going to be moving sideways, then the only thing you can do is sell your shares and stand aside. One of the frustrations of trading shares is that an individual cannot profit when prices are going down.

But, in the currency market, it is easy for you to trade a currency downward so that you can profit when you think it is going to lose value. This is easy to do because currency trading simply involves buying one currency and selling another, there is no structural bias that makes it difficult to trade ‘downwards’. This is why the currency market has been occasionally referred to as the eternal bull market.

Final Thoughts

As you can see, trading the Currency/Forex Market can be highly beneficial for you than trading any other market. If you are interested in learning how to trade, check out our complete guide for learning how to trade in the forex market.

Top 3 Forex Brokers

Best for Low Spreads | Best for Speed | Best for High Leverage |

Fusion Markets is one of the top brokers that provide traders with low spreads (Risk warning: 76% of retail CFD accounts lose money) |  BlackBull markets is a great broker that provides traders with fast executions speeds. (Risk warning: 76% of retail CFD accounts lose money) |  Exness is a highly regulated broker that is best for high leverage trading. (Risk warning: 76% of retail CFD accounts lose money) |