In this article, we will deep dive into the 5 best ECN Forex Brokers in 2024.

Top 5 ECN Forex Brokers

Broker | Review | Spreads | Regulations | Account |

1. BlackBull Markets  | From 0.0 pips | FMA, FSA | ||

2. IC Markets  | From 0.0 pips | FSA, CySEC, ASIC | ||

3. RoboForex  | From 0.0 pips | FSC | ||

4. FP Markets  | From 0.0 pips | ASIC, CySEC, FSCA, FSA | ||

5. Fusion Markets  | From 0.0 pips | ASIC, VFSC |

What is an ECN Broker?

An ECN broker (Electronic Communications Network) is a type of forex broker that gives traders direct access to other market participants. ECN brokers offer several advantages:

- Tighter Spreads: ECN brokers can provide tighter spreads than traditional brokers.

- Faster Execution: Trades placed with ECN brokers are often executed more quickly.

- Transparency: ECN brokers offer a transparent view of the market, including the best available bid and ask prices from different liquidity providers.

However, ECN brokers usually charge a commission per trade, in addition to spreads. When choosing one, you should consider:

- Regulation: Ensure the broker is regulated by a reputable financial authority.

- Platforms provided: Evaluate the trading platforms offered.

- Customer service: Assess the quality of customer support.

- Minimum Deposit: Minimum deposit required to trade with.

- Leverage: Maximum leverage provided by the broker.

Now, let’s talk about 5 great ECN brokers you can trade with.

1. BlackBull Markets

BlackBull markets is one of the top ECN Brokers in the industry. This broker was founded in 2014 in Auckland, New Zealand.

The BlackBull markets broker is regulated by two regulators. One of the regulators is a top tier regulator which is the Financial Markets Authority (FMA) in New Zealand.

The BlackBull markets broker provides traders with 6 different trading platforms, these are MetaTrader 4, MetaTrader 5, TradingView, cTrader, BlackBull CopyTrader and BlackBull Invest.

When it comes to customer service, the BlackBull markets broker provides traders with 24/7 customer support. You can contact the BlackBull markets broker through multiple contact methods.

BlackBull markets broker provides traders with 3 different account types, these are ECN standard account, ECN Prime account and ECN Institutional account.

For the ECN standard account, the spreads start from 0.8 pips, but no commission is charged. For the ECN prime account, the spreads start from 0.1 pips and the commission charged is $6 per lot. For the ECN Institutional account, the spreads start from 0.0 pips and the commissions charged is $4 per lot.

The BlackBull markets broker provides a leverage of up to 1:500. This broker is well known for its trade execution speed compared to other brokers in the industry. BlackBull markets has achieved an average execution speeds of less than 75 milliseconds.

You don’t require a minimum deposit to start trading with the BlackBull markets broker.

2. IC Markets

IC markets broker specialises in Raw spread ECN pricing for Major Forex Pairs. IC Markets broker was founded in 2007 in Sydney Australia. IC Markets is regulated by multiple regulators including the Australian Securities and Investments Commission (ASIC).

The IC Markets broker provides 4 main trading platforms for traders. These are MetaTrader 4, MetaTrader 5, cTrader and TradingView trading platform.

When it comes to customer service, the IC Markets broker provides 24/7 customer support. You can contact the IC markets broker through multiple methods, these include, live chat, email and phone. Also, they provide a help centre for commonly asked questions.

The IC markets broker provides 3 main account types. These are raw spread cTrader & TradingView account, raw spread MetaTrader account and a Standard Account. The most popular account is the Raw spread MetaTrader account. For this account type, the spreads start from 0.0 pips and the commission charged is $3.5 per lot.

The maximum leverage provided by the IC Markets broker is 1:500. For certain countries the maximum leverage is up to 1:30.

To start trading with the IC Markets broker, you require a minimum deposit of $200.

3. RoboForex

RoboForex is another great broker that provide traders with ECN accounts. The RoboForex broker was founded in 2009 in Belize. RoboForex broker is regulated by the International Financial Services Commission (IFSC) of Belize.

The RoboForex broker provide traders with 3 main trading platforms. These are MetaTrader 4, MetaTrader 5 and R trading platform. These are all great trading platforms that work on mobile, web and pc.

When it comes to customer service, the RoboForex broker provides 24/7 customer support for traders. You can contact the RoboForex broker through multiple methods including phone, email and live chat.

RoboForex provides traders with 5 main account types, including an ECN account. For the ECN account, the spreads start from 0.0 pips and the commissions charged is $20 per 1 million USD of traded volume.

For the ECN account, the maximum leverage provided by the RoboForex broker is 1:500 like the BlackBull markets broker.

To start trading with RoboForex broker you only require a minimum deposit of $10.

4. FP Markets

FP Markets is another broker that provides ECN account for traders. FP markets was founded in 2005 in Sydney, Australia. Over the years, FP Markets has grown significantly and now has offices globally. FP Markets is regulated by top tier regulators such as the Australian Securities and Investments Commission (ASIC).

FP Markets gives you a choice of really good trading platforms to work with. They have the popular MetaTrader 4 and MetaTrader 5, plus the more advanced Iress platform for experienced traders. You can use them on your computer, through your web browser, or even on your phone.

When it comes to customer service, FP Markets provides 24/7 customer support to answer any questions you have. You can get in touch with them easily by phone, email, or live chat.

FP Markets offers a bunch of different account types to suit your trading style. One of these is their Raw spread account, which is an ECN account. This is great for traders who want super-tight spreads. With a Raw spread account, spreads can be as low as 0 pips, but a $3 per lot commission is charged.

For the Raw Spread account the maximum leverage is 1:30.

To start trading with the FP Markets broker, you require a minimum deposit of $100.

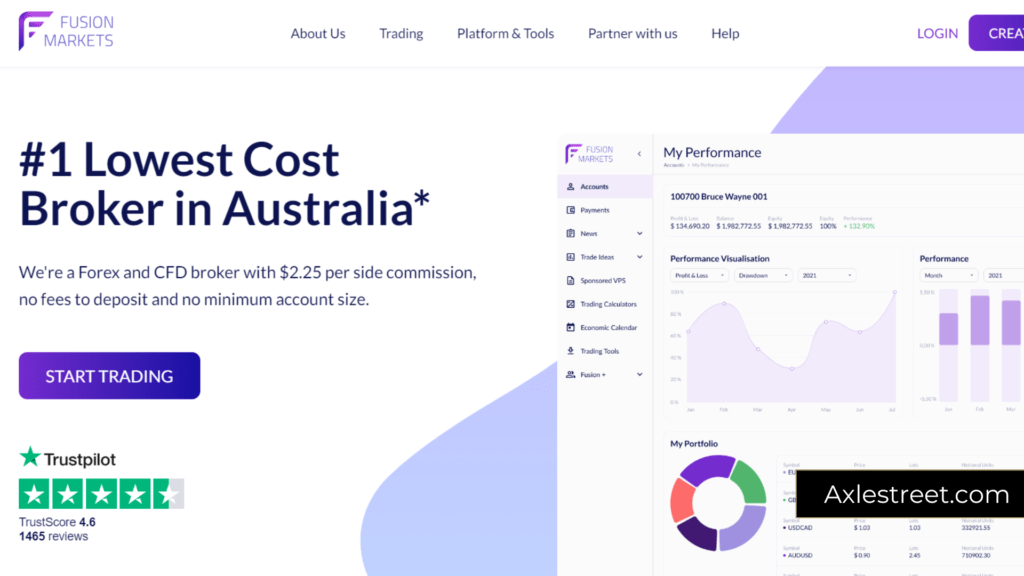

5. Fusion Markets

Fusion Markets is another broker that provides an ECN account for traders. Fusion markets was founded in Melbourne, Australia in 2017. Fusion Markets is regulated by a tier 1 regulator, which is Australian Securities and Investments Commission (ASIC).

The Fusion Markets broker provides traders with 5 main trading platforms. These are MetaTrader 4, MetaTrader 5, cTrader, TradingView and Duplitrade trading platform.

When it comes to customer service, Fusion Markets provides 24/7 customer support. You can contact the Fusion Markets customer support through live chat, phone and email like the other brokers in this article.

Fusion Markets broker provides traders with several account types including a Zero Account which is their ECN account. For the zero account, the spreads start from 0.0 pips and the commissions from $2.25 per side.

The Fusion Markets broker provides a leverage of up to 1:500 like the BlackBull Markets broker.

To get started trading with the Fusion Markets Broker, you don’t require a minimum deposit.

Conclusion

In this article, we covered 5 brokers who provide ECN accounts for traders. These brokers not only provide ECN accounts but are also regulated by tier 1 regulators in the industry. If you want to trade with a Top broker that provides an ECN account, click the button down below.