In this article, we will talk about 5 forex brokers with debit card withdrawals in 2024. We will also talk about how to choose the right debit card broker for you.

What are Debit Card Brokers?

Debit card brokers allow you to deposit and withdraw money from your trading account with debit cards. Different brokers accept different types of deposit and withdrawal methods. So, it is very important that you choose the right broker who accepts debit cards as a withdrawal method.

Choosing a Debit Card Broker

There are a lot of brokers who accept debit cards as a withdrawal option but some of these brokers cannot be trusted. There are several other things you need to look for in addition to withdrawal methods when choosing the right debit card broker for you. These other things are:

- Regulations – The broker you choose must be regulated. You should never ever choose a broker who is not regulated. If the broker is not regulated you cannot trust the broker. Ideally, you should choose a broker who is regulated by a tier 1 regulator such as the Australian Securities and Investment Commission (ASIC).

- Trading Software – It is important to choose a broker who provides you with good trading software. Also, it is important to consider what software platforms the broker provides. For example, if you prefer to trade on mobile, you have to choose a broker who provides you with a mobile trading platform. If you prefer trading on the web, you have to choose a broker who provides a good web trading platform. In the next section, we will talk about brokers who will provide you with good trading software on all different platforms.

- Customer Service – It is important to choose a broker that provides good customer service. Ideally, 24-hour customer service. This is because you can contact the broker at any of your preferred times from anywhere in the world.

- Commission and Spreads – It is beneficial to choose a broker who provides with tight spread and low commissions.

- Supported Countries – Some brokers do not allow you to trade from certain countries. You have to choose a broker who is supported in the country that you are trading in.

- Minimum Deposit – This is an important factor to consider when choosing the right broker. Some broker requires a large minimum deposit while some other brokers require a minimum deposit of only $10. Depending on the amount of capital you have you have to choose the right broker.

Even though it is good to be aware of how to choose the right debit card broker for you, we have done the hard work for you. We have narrowed it down to 5 good brokers who accept debit cards as a withdrawal option.

5 Forex Brokers with Debit Card Withdrawal

1. XM

XM is a great broker for debit card withdrawals. XM is regulated by the Australian securities and investment commission (ASIC). XM was founded in 2009 and grew to have 10 million clients on its platform worldwide. XM is an award-winning broker who has won multiple awards.

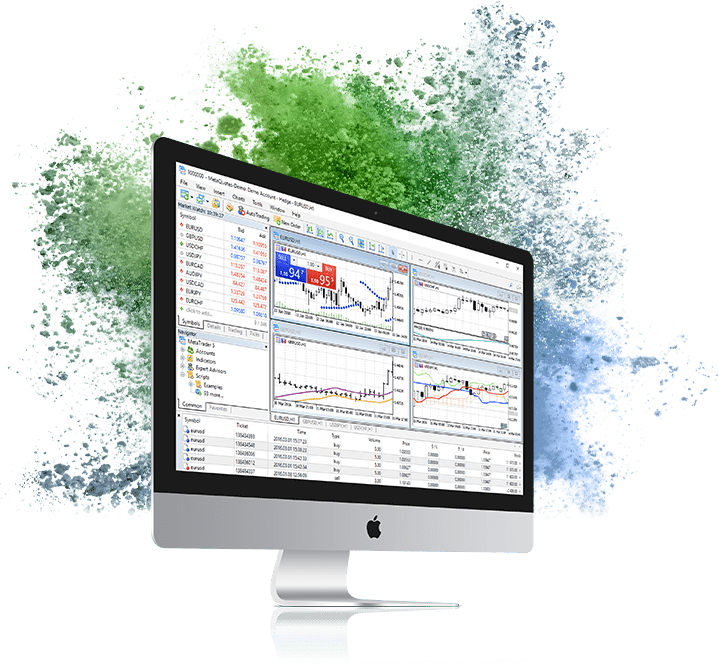

XM provides traders with trading software for all different platforms, including mobile, web, and desktop. For web and desktop, XM provides you with a MetaTrader 4/5-based platform.

For trading on mobile, XM provides traders with MetaTrader trading platform and XM mobile trading application. XM mobile trading app is rated 4 stars. With this app, you can trade on both Android and IOS. XM broker provides you with very tight spreads.

XM provides 3 different account types, these are micro account, standard account, and ultra-low account. You get the lowest spreads with the ultra-low account. The spreads for this account type start from 0.6 pips. On all 3 account types, XM broker does not charge any commission.

XM provides 24/5 world class customer service. You can contact the XM broker through email, phone, and live chat. For you to start trading with XM broker, they require only $5 as a minimum deposit. If you are interested in trading with XM broker, click the button below.

2. AvaTrade

AvaTrade is one of the best brokers out there for debit card withdrawals. AvaTrade is a highly regulated broker that is regulated by 7 different regulators in the industry. These regulators include the Australian securities and investment commission (ASIC), the Cyprus securities and exchange commission (CySec) and etc.

AvaTrade provides you with trading software for each of the platforms. If you want to trade on the web, AvaTrade provides you with a web trader (Figure 2).

If you prefer trading on a mobile phone, AvaTrade provides you with a mobile trading platform called AvaTrade Go. If you prefer trading on the desktop/pc, AvaTrade provides you with MetaTrader 4 and MetaTrader 5 trading platforms. MetaTrader 4 and 5 platform also supports automated trading if you are interested in creating or using automated trading robots.

AvaTrade provides you with 24/5 customer service. You can contact AvaTrade customer service through email, phone, and WhatsApp.

AvaTrade also provides you with tight spreads. The spreads are variable which means that it depends on the market conditions. AvaTrade also does not charge a commission on your trades. For you to start trading with AvaTrade, they only require a minimum deposit of $100. If you are interested in trading with AvaTrade click the button below.

3. BlackBull markets

BlackBull Markets is a New Zealand-based broker that provides you with an option to use debit cards as a withdrawal method. Blackbull Markets broker is regulated by the Financial Markets Authority (FMA).

Blackbull markets provide you with trading platforms on the web and desktop. Blackbull markets recently launched a mobile trading app but it is still under development.

BlackBull markets also provide you with an option to use TradingView as your web trader (figure 3). Tradingview is a great platform for trading. Tradingview also has a mobile application that you can use. If you like using TradingView as your trading platform, the BlackBull Markets broker is a good option.

BlackBull markets provide you with 3 different account types based on how much you can deposit. If you have at least $20,000 to deposit, the spread starts from 0.0. If you have only $2000 to deposit, the spread starts from 0.1.

If you have less than $2000 to deposit in your trading account, the spread starts from 0.8. BlackBull markets charge a commission based on the type of trading account you open with them. Depending on the amount of capital you have for trading, you can choose the account suitable for you.

BlackBull provides you with great customer service which operates 24/7. You can contact their customer support through mobile, email, and phone.

4. FP Markets

FP Markets broker was founded in 2005 and is regulated by the Australian Securities and Investment commission. FP markets provide you with trading software to trade on all different platforms.

For trading on the web and desktop, FP markets provide you with the MetaTrader 4 and MetaTrader 5 trading platforms. For trading on mobile, they provide you with a mobile trading application that is downloaded by more than 100,000 users worldwide.

You can contact FP markets customer service anytime because they provide 24/7 customer service. You can contact them by phone (Toll-free), email, and live chat.

For a zero-commission account, the spread starts from 1.0 pips. For an account that charges a commission ($3 per lot), the spreads start from 0.0 pips. Both account types require a minimum deposit of $100 dollars.

5. AxiTrader

AxiTrader was founded in 2007 and grew to have a customer base of 60,000+ customers worldwide. AxiTrader is regulated by the Australian securities and investment commission (ASIC) and Financial Conduct Authority (FCA). AxiTrader only provides you with Metatrader 4-based platform.

AxiTrader provides you with 3 account types, standard account, pro account, and elite account. With pro and elite accounts the spreads start from 0.0 pips.

For a standard account, the spread starts from 0.9 pips and there is no commission charged for trades. With a pro account, they charge a commission of $7. And for an elite account, the commission charge is $3.5 but the spreads starts from 0.0 pips.

AxiTrader provides 24/5 customer service. There are 4 methods of contact. You can contact their customer service through, phone, email, live chat, and social media accounts.

Conclusion

In this article, we talked about forex brokers with credit card withdrawals. We discussed 5 good brokers that allow you to withdraw using credit cards. If you are interested in a broker with credit card withdrawal, you can’t go wrong with any of these forex brokers.

Also, if you are interested in learning how to trade forex step by step make sure to check out our completely free guide.