In this article, we will talk about the 5 best forex trading platforms for beginners in the UK. We will also discuss in detail why you should choose these trading platforms if you are forex trading in the UK.

Before we get into talking about the 5 best forex trading platforms, you need to understand the importance of choosing the right trading platform/broker for you.

Importance of Choosing the Right UK Trading Platform

There are 100s of trading platform/broker scams out there in the forex market. They promise that their trading platform can make you wealthy with forex trading and make you deposit your hard-earned money into their platform. But then, they will never let you withdraw your money out of your trading account with them. It is important to be aware of scams like this.

We have very specific 3 step selection criteria when choosing the right trading platform for you. The 3 steps are,

- Regulations – It is very important that the broker/trading platform you choose is regulated. We do not under any circumstance recommend an unregulated broker. And you should always stay away from unregulated brokers.

- Reputation– It is important that the broker/trading platform has a good reputation in the industry.

- Features – This is very important as well. There are several features we need to look at when choosing the right broker. Some of these include spreads, commissions, execution speed, and customer support.

But, you don’t have to worry about this because we have done the hard work for you. Below are the top 5 trading platforms for forex trading in the UK.

1. AvaTrade Trading Platform

AvaTrade is one of the best brokers and trading platform providers out there in the forex market. AvaTrade was founded in 2006 and is being regulated by 8 different regulators. If you are interested in trading with AvaTrade, click the button below to sign up. Now, let’s look at in detail the features and benefits of using AvaTrade.

Regulations

As discussed in the previous section, choosing a regulated broker is very important. AvaTrade trading platform/broker is regulated by the following regulators.

- The central bank of Ireland

- B.V.I Financial Services Commission

- Australian Securities and Investment Commission (ASIC)

- South African Financial Services Board (FSB)

- Financial Futures Association of Japan

- Abu Dabi Global Markets (ADGM)

- Financial Regulatory Services Authority (FRSA)

- Israel Securities Authority

Trading Platforms

AvaTrade provides you with 5 main trading platforms. These are the AvaTrade web trader, AvaOptions, AvaTradeGo, MetaTrader 4, and MetaTrader 5 trading platforms. Now, let’s talk about each of these trading platforms in a bit more detail.

- AvaTrade Web Trader – This is an online trading platform developed by AvaTrade. This trading platform allows you to trade on the web.

- AvaOptions – This is a powerful desktop trading platform provided by AvaTrade. You can trade a range of asset classes including forex with this platform.

- AvaTradeGo – This is a mobile trading platform developed by AvaTrade. This is great for on-the-go trading. This platform is available on both IOS and Android.

- MetaTrader 4 – This is one of the most popular trading platforms out there. MT4 is a great trading platform that supports automated trading. MT4 also has a mobile application.

- MetaTrader 5 – MT5 is the successor of MT4 with more features out of the box. This also supports automated trading as well. MT5 has a mobile application as well similar to that of MT4.

Commission and Spreads

AvaTrade does not charge a commission when you trade. This is great. The spreads are variable and depend on the currency pair that you are trading. The spreads can widen during volatile market conditions.

Customer Service

AvaTrade provides you with 24 hours a day, 5 days a week (24/5) customer service. You can contact their customer service through WhatsApp, email, or through the phone. They provide you with a range of phone numbers that you can contact depending on where you live.

Summary of AvaTrade

| Assets Available | 8 Asset Classes provided – Forex, Crypto, CFD, Stocks, Options, Indices, EFTs, and bonds. |

| Regulated By | 8 Regulators – Central Bank of Ireland, BVI Financial Services Commission, ASIC, South African Financial Services Board, Financial Futures Association Japan, Abu Dhabi Global Markets, Cysec, and Israel Securities Exchange |

| No. of Trading Platforms | 5 main trading platforms – AvaTrade Web Trader, AvaOptions, AvaTrade Go, MetaTrader 4, and MetaTrader 5 |

| Leverage | Up to 1:400 depending on the asset class |

| Min Deposit | The minimum deposit required is $100 |

| Spreads | Variable spreads depend on which instrument is traded and the market conditions |

| Education Provided | Trading courses available for beginners and advanced traders |

| Customer Support | 24/5 support through email, phone, and WhatsApp |

| Methods of Payment | Credit Card, Visa, Skrill, Wire transfer, Neteller |

2. XM Broker

XM Broker is another great trading platform provider which is regulated. XM group was founded in 2009 and has now grown to over 5 million clients worldwide. XM broker is also an award-winning broker.

Regulations

XM Broker is regulated by 3 regulators. These are the Australian Securities and Investment Commission (ASIC), Cyprus Securities and exchange commission (CySEC), and Financial Sector Conduct Authority.

Trading Platforms

XM provides you with 3 main trading platforms. These are MetaTrader 5 trading platform, MetaTrader 4 trading platform, and XM mobile trading app. The MetaTrader 4 and 5 are great trading platforms that support desktop, web, and mobile trading. The XM mobile trading app was developed by XM specifically for on-the-go trading.

Commission and Spreads

The spreads and commission depending on the account type you open with the XM Broker. There are 3 account types provided by XM, these are micro account, standard account, and ultra-low account. They do not charge a commission for either account type. For both the micro account and the standard account the spreads start from 1.0. For ultra-low accounts, the spreads start from 0.6 pips.

Customer Service

XM also provides 24/5 customer support. You can contact them through email, phone, and live chat.

Summary of XM Broker

| Assets Available | 6 Asset Classes – Forex, Stocks, Commodities, Equity Indices, Precious Metals, and Energies. |

| Regulated By | 3 Regulators – ASIC, CySec, IFSC. |

| No. of Trading Platforms | 3 main trading platforms – XM mobile app, MetaTrader 4, and MetaTrader 5 |

| Leverage | Up to 500:1 depending on the asset class |

| Min Deposit | $5 |

| Spreads | As low as 0.6 pips on major currency pairs depending on the account type. Spreads are variable. |

| Education Provided | Free step-by-step guide for beginners (basic) |

| Customer Support | 24/5 support through email, phone, and live chat |

| Methods of Payment | Credit Card, Debit Card, Skrill, Neteller, Bank Wire, and Union Pay |

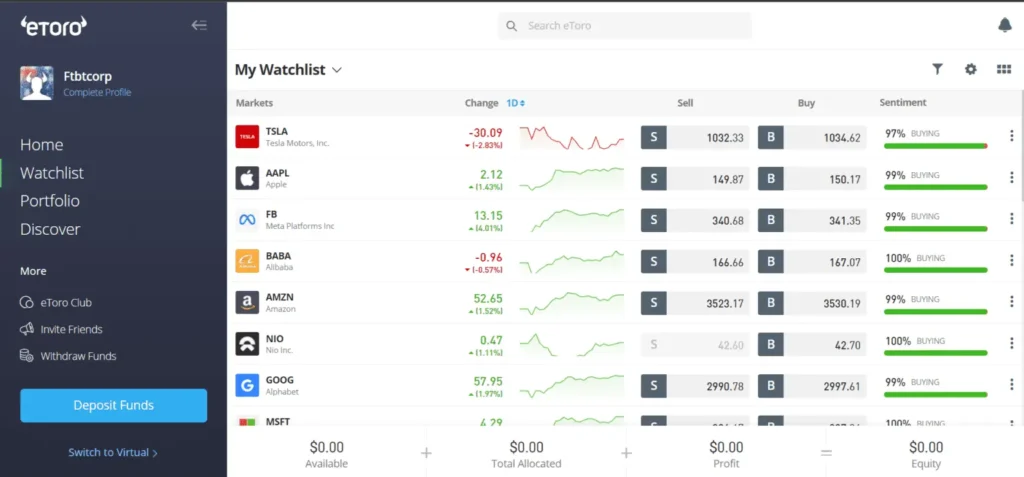

3. eToro

eToro is the most popular social trading platform provider in the industry. eToro was founded in 2007 and provides you with a great trading platform. eToro is mainly a mobile-focused trading platform even though they provide you with a web trading platform as well. Their mobile app is downloaded by more than 10 million users worldwide.

Regulations

eToro trading platform/Broker is regulated by 4 different regulators. These are,

- Cyprus Securities and Investment Commission (CySec)

- Financial Conduct Authority (FCA)

- Australian Securities and Investment Commission (ASIC)

- Financial Services Authority Seychelles (FSAS)

Trading Platforms

eToro provides you with one main trading platform. These trading platforms support web and mobile. They also provide you with a copy trader where you can trade and replicate the actions of top traders in their trading platform.

Commission and Spreads

The spreads are variable and depend on the financial instruments that you are trading with eToro. The spreads start from 1 pip which can be quite high for some traders.

Customer Service

You can contact eToro customer support by opening a customer service ticket. They will contact you through email.

Summary of eToro

| Assets Available | 5 Asset Classes – Forex, Stocks, Equity Indices, Cryptocurrencies, and CFDs. |

| Regulated By | 4 Regulators – CySec, FCA, ASIC. FSAS |

| No. of Trading Platforms | 1 Main trading platform |

| Leverage | 30:1 leverage for major currency pairs for non-professional clients |

| Min Deposit | $50 |

| Spreads | 1 pip for leading forex pairs |

| Education Provided | eToro Academy provides basic education |

| Customer Support | Support through email using customer service tickets |

| Methods of Payment | eToro money account |

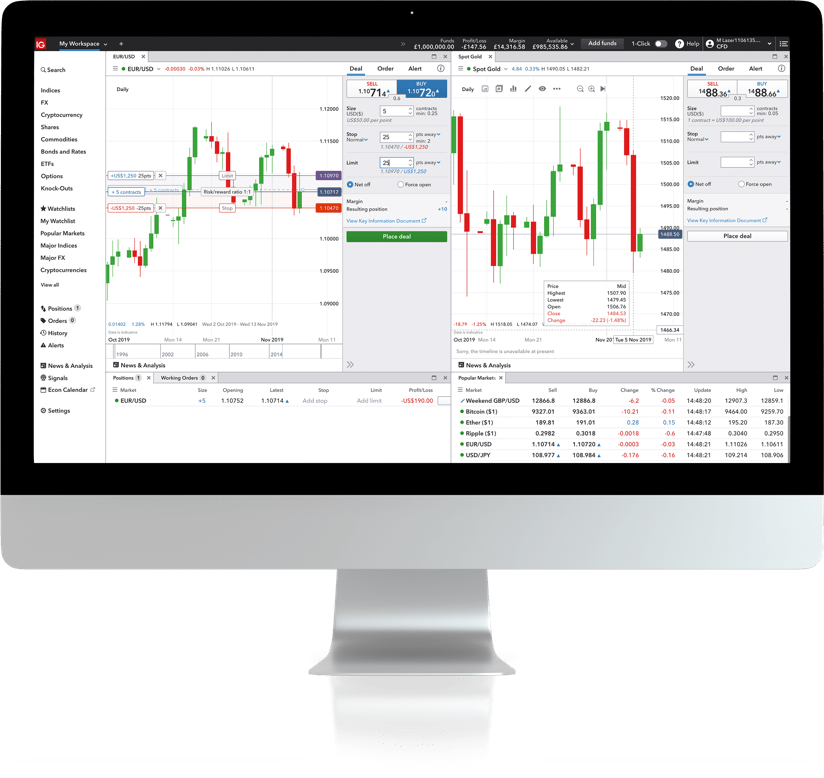

4. IG Markets

IG Markets is a trusted and regulated broker and trading platform provider. IG Markets was founded in 1974 and became one of the award-winning brokers in this industry.

Regulations

IG Markets broker is regulated by 8 different regulators. These regulators are,

- Financial Conduct Authority (FCA)

- Commodity Futures Trading Commission (CFTC)

- Australian Securities and Investment Commission (ASIC)

- Financial Services Agency (FSA)

- Monetary Authority of Singapore (MAS)

- Dubai Financial Services Authority (DFSA)

- Swiss Financial Market Authority (FINMA)

Trading Platforms

IG Markets provide you with 6 main trading platforms. These are,

- IG’s trading platform – This is a web trading platform developed by IG markets. This is shown in figure 3.

- IOS and Android App – This mobile app is also developed by IG markets. This was developed to help you trade on the go.

- Progressive Web App – This is a web-based trading platform that adjusts based on the screen size.

- Pro Real Time – this is a powerful web-based charting solution for traders. IG markets is partnered with pro-real-time.

- Metatrader 4 – this is the most popular trading platform among forex traders. This has all the tools you need and also supports algorithmic trading.

- L2 Dealer – this is also a great charting platform for trading shares.

Commission and Spreads

For forex pairs, the spread starts from 0.6. IG Markets do charge a commission based on which financial instrument you are trading.

Customer Service

Provides you with 24/5 customer support. You can contact them by phone and email.

Summary of IG Markets

| Assets Available | 5 Asset Classes – Forex, Share CFDs, Indices, Cryptocurrencies, and Commodities. |

| Regulated By | 8 Regulators – FCA, CFTC, ASIC, FSA, FMA, MAS, DFSA, FINMA |

| No. of Trading Platforms | 4 Main trading platforms |

| Leverage | Up to 1:200 |

| Min Deposit | $300 |

| Spreads | From 0.6 pips on FX pairs |

| Education Provided | Basic education and market analysis |

| Customer Support | 24/5 through phone and email |

| Methods of Payment | Credit cards, debit cards, PayPal, BPay, EFT payments, and bank wire transfer |

5. BlackBull Markets

BlackBull Markets is a New Zealand-based broker that was founded in Auckland, New Zealand in 2014. BlackBull Markets is a regulated broker with clients from more than 180 different countries worldwide.

Regulations

Blackbull Markets is regulated by 2 regulators which are Financial Markets Authority (FMA) and Financial Services Agency (FSA).

Trading Platforms

BlackBull markets provide you with 4 main trading platforms. These are,

- TradingView – TradingView is one of the most popular web-based trading platforms out there. TradingView has all the tools required to do technical analysis in the markets.

- MetaTrader 4 – MetaTrader 4 is the most popular trading platform for forex trading. MetaTrader 4 also supports expert advisors.

- MetaTrader 5 – MetaTrader 5 is the successor of the MetaTrader 4 platform. It provides you with more features compared to the MetaTrader 4 trading platform.

- ZuluTrade – ZuluTrade is a copy trading platform where you can copy trades from the top traders on this platform.

Commission and Spreads

The spreads for BlackBull Markets depend on the account type you open with this broker. BlackBull Markets provides you with 3 different types of accounts. Spreads are different for these 3 accounts.

The account type you will open with BlackBull markets is based on the amount of capital you have to deposit. For ECN standard account the spread starts from 0.8. For ECN prime account the spread starts from 0.1 and for ECN institutional account the spread starts from 0.0 pips.

The commissions also depend on the type of account that you open with BlackBull Markets. The commissions range from 0 to US$ 6 per lot.

Customer Service

BlackBull Markets provides you with customer service 24 hours a day, 7 days a week. You can contact customer service through phone, live chat, and email.

Summary of BlackBull Markets

| Assets Available | 6 Asset Classes – Forex, Shares, Commodities, Precious Metals, Energy, and Cryptocurrency. |

| Regulated By | 2 Regulators – FMA, FSA |

| No. of Trading Platforms | 4 Main trading platforms – TradingView, MetaTrader 4, MetaTrader 5, and ZuluTrade |

| Leverage | Up to 1:500 |

| Min Initial Deposit | $0 |

| Spreads | Depends on the account type. For ECN Standard account the pips start from 0.8 |

| Education Provided | Basic education and market analysis |

| Customer Support | 24/7 support through phone, email, and live chat |

| Methods of Payment | Cryptocurrency, Visa, Master Card, AstroPay, Beeteller, Boleto, China Union Pay, Crypto, Deposit channel, FasaPay, FXPay 88, Help2Pay, Interac, Neteller, Skrill, OpenPayd, PaymentAsia, PicPay, PIX payment, Poli, Thai QR Payment, Transferência Eletrônica Disponível |

Conclusion

In this article, we looked at the best trading platforms for beginner traders in the UK. As discussed, we recommend AvaTrade as the trading platform that you should choose as a beginner UK trader. Also if you are interested in learning how to trade step by step, check out our complete forex trading guide here.