In this article, we will talk about 5 best Forex Brokers for traders in South Africa.

To be a top broker in South Africa, the broker must be regulated by the Financial Sector Conduct Authority (FSCA). The Financial Sector Conduct Authority (FSCA) is the primary regulator of financial markets in South Africa. Its role is to promote and facilitate fair, efficient, and transparent financial markets.

In addition to regulations, we also considered other factors as well when choosing the best forex brokers in South Africa. These factors are, customer support, fees, trading platforms, speed of trade execution and more.

Below are 5 Best forex brokers in South Africa.

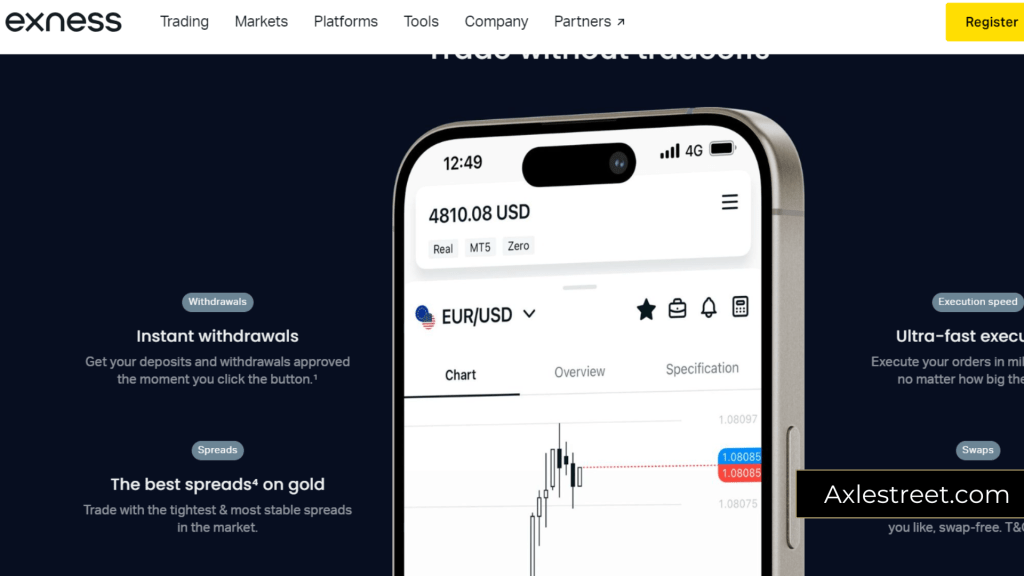

1. Exness Broker

Assets Available | 5 Asset Classes – Forex, Commodities, Stocks, Indices and Cryptocurrency. |

Regulated By | FSA, CySEC, FCA, FSCA, FSC, FCS, CMA |

No. Of Trading Platforms | 3 Trading Platforms – MetaTrader 4, MetaTrader 5 and Exness trader app |

Leverage | Up to 1:2000 |

Spreads | From 0.0 pips |

Commission | From 0% |

Min Deposit | $10 |

Demo Account | Yes |

Education Provided | Educational videos and articles |

Methods of Payment | Bank cards, global electronic payment systems, and local payment methods |

Open Account |

The Exness broker is a great broker that is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. The Exness broker was founded in 2008 and has a main office in Cape Town, South Africa.

This broker is a high leverage broker that offers South African traders with a maximum leverage of up to 1:2000.

Exness broker offers four main account types for live trading. These are standard account, pro account, zero account, and raw spread account.

The commission and spreads depends on the account type. The standard account and the pro account does not charge any commission. The spreads for the standard account starts from 0.2 pips and the spreads for the pro account starts from 0.1 pip.

For the zero and raw spread account, the spreads start from 0 pips. The commission charged for zero account is from $0.05 each side per lot, and the raw spread account is up to $3.50 each side per lot.

The Exness broker provide traders with 3 main trading platforms. These are the MetaTrader 4, MetaTrader 5 and Exness trader app.

When it comes to customer support, the Exness broker provides 24/7 customer support. You can contact the customer support through phone, email and live chat.

To start trading with the Exness broker, you only need a minimum deposit of $10 which is applicable for only for the standard account. To trade with other account types, you require a minimum deposit of $200.

If you are interested in learning more about the Exness broker, check our full review here or watch the video below.

2. AvaTrade

Assets Available | 7 Asset Classes – Forex, Crypto, Stocks, Commodities, Indices, ETFs, bonds. |

Regulated By | ASIC, FSCA, FSA, ADGM, FRSA, ISA, CySEC, CBI |

No. Of Trading Platforms | 8 Trading Platforms – TradingView, MT4, MT5, AvaOptions, AvaSocial, DupliTrade and ZuluTrade |

Leverage | Up to 1:400 |

Spreads | Around 0.9 for Majors |

Commission | 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Trading courses provided |

Methods of Payment | Credit/Debit Cards, Bank Wire Transfer, Neteller, Skrill, WebMoney, PayPal |

Open Account |

AvaTrade is another great broker that is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. AvaTrade broker was founded in Dublin, Ireland in 2006.

AvaTrade boasts a massive global customer base of 400,000, who generate over two million trades every month.

The AvaTrade broker offers traders with 8 different trading platforms. Including the popular MetaTrader 4 and MetaTrader 5 trading platforms.

AvaTrade also offers a mobile trading platform call the AvaTrade Go for traders who prefer mobile trading.

The AvaTrade broker provides traders with 24/5 customer support. Traders can contact the AvaTrade customer support through email, phone and WhatsApp.

The AvaTrade broker provides traders with 2 main account types. These are the retail trader account and professional trader accounts. They also provide an Islamic account for Islamic traders as well.

For the retail account, the AvaTrade broker does not charge a commission and the spreads are around 0.9 pips for the Major currency pairs.

The maximum leverage provided by the AvaTrade broker is up to 1:400. This is only applicable for international retail clients and professional clients.

To start trading with the AvaTrade broker, you require a minimum deposit of $100. If you are interested in learning more about the AvaTrade broker, check our full review here or watch the video below.

3. FP Markets

Assets Available | 7 Asset Classes – Forex, Crypto, Shares, Commodities, Indices, ETFs, bonds. |

Regulated By | ASIC, CySEC, FSA SVG, FSCA, CMA |

No. Of Trading Platforms | 4 Trading Platforms – MT4, MT5, cTrader, TradingView, Iress platform and FP Markets trading app |

Leverage | Up to 1:500 |

Spreads | From 0.0 pips |

Commission | From 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Provides trading videos and articles |

Methods of Payment | Credit/Debit Cards, Bank Wire Transfer, eWallets (Neteller, Skrill, Poli Pay, and BPay), Broker-to-Broker Transfers |

Open Account |

FP Markets is another great broker for South Africians. This broker is also regulated by the FSCA in South Africa. FP markets was founded in 2005 in Sydney, Australia.

FP Markets offers an impressive selection of trading platforms to choose from. You can opt for the popular MetaTrader 4, MetaTrader 5, cTrader, and TradingView, along with the advanced Iress platform for seasoned traders. These platforms are accessible on your computer, web browser, or mobile device.

This broker provides two main account types of retail clients. These are the Standard Account & Raw Spread Account. For the standard account, the spreads start’s from 1.0 pips and commission charged is zero. For the raw spread account, the spreads start from 0.0 pips and the commission charged is $3 per side.

When it comes to customer support, FP Markets provides 24/7 customer support to answer any questions you have. You can get in touch with them easily by phone, email, or live chat.

The FP Markets broker provides traders with a maximum leverage of 1:500.

To start trading with the FP Markets broker, you require a minimum deposit of $100.

4. HF Markets

Assets Available | 7 Asset Classes – Forex, Crypto, Stocks, Commodities, Indices, ETFs, bonds. |

Regulated By | CySEC, FCA, DFSA, FSCA, FSA, CMA |

No. Of Trading Platforms | 3 Trading Platforms – MetaTrader 4, MetaTrader 5 and HFM trading platform |

Leverage | Up to 1:2000 |

Spreads | From 0.0 pips |

Commission | From 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Trading courses, webinars and articles |

Methods of Payment | Wire transfer, credit cards and online payment methods. |

Open Account |

The HF Markers broker is another good broker for South Africans. HF Markets is also regulated by the FSCA.

The HF Markets broker was founded in Cyprus in 2010.

HF Markets provides traders with 3 main trading platforms. These are MetaTrader 4, MetaTrader 5 and HFM trading platform. The HFM trading platform is a mobile trading app that supports both Android and IOS.

HF markets broker provides traders with a high leverage of up to 1:2000.

HF Markets provides traders with 24/5 customer support. You can contact HF markets customer support through live chat, email and phone.

HF Markets provides traders with 4 main account types for live trading. These are cent, zero, pro and premium account. The spreads for HF markets starts from 0.0 pips depending on the account type.

To trade with HF markets you need to a minimum deposit of $0 except for the pro account which requires a minimum deposit of $100.

5. FxPro

Assets Available | 6 Asset Classes – Forex, Stocks, Commodities, Indices, Crypto, Futures |

Regulated By | FCA, CySEC, SCB, FSCA |

No. Of Trading Platforms | 5 Trading Platforms – MT4, MT5, cTrader, FxPro web trader and FxPro mobile app |

Leverage | Up to 1:200 |

Spreads | From 0.0 pips |

Commission | From 0% |

Min Deposit | $100 |

Demo Account | Yes |

Education Provided | Webinars and articles |

Methods of Payment | Bank Transfer, Visa, Mastercard, PayPal, Skrill and Neteller |

Open Account |

FxPro is another great broker that is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. FxPro was founded in 2002 in Cyprus.

The FxPro broker provide traders with 3 main account types for live trading. These are standard account, raw account and elite account. The spreads for the standard account starts with from 1.2 pips and no commission is charged. For the raw account, the spreads start from 0 pips and the commission charged is $3.5 per side.

The elite account has the same fees as the raw account but also with additional features such as exclusive rebates and VIP perks.

The FxPro broker provide traders with 4 main trading platforms. These are FxPro trading platform, MetaTrader 4, MetaTrader 5 and cTrader.

The FxPro broker offers retail traders with a max leverage of up to 1:200 which is quite low compared to other brokers.

This broker provides traders with 24/5 customer support. Traders can contact FxPro broker through email, phone and live chat.

To trade with the FxPro broker, you need a minimum deposit of $100.

Conclusion

In this article, we talked about 5 different brokers that are great for South African Traders. All these brokers are regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and provide great features for traders.