In this article, we will talk about 3 strategies that you can follow to make money in the forex market. Before we get into that, we need to talk about why you need a forex trading strategy to make money in the forex market. And what is the best forex trading strategy?

What is the best forex trading strategy?

If you talk to a trading community, you will find out that there are 1000s of different strategies. Some strategies will work, and some will not, some will be a little profitable and some will be very profitable. In the end, it is about choosing a strategy that you understand clearly and that makes sense to trade with.

The strategy that you choose also depends on how much time you are willing to invest in forex trading. If you are a beginner we recommend you to swing trade. You can day trade as well, but stay away from scalping. We personally prefer to swing trade. With swing trading, you will stay in a trade for 2-4 days.

After you decided what type of trader you want to be then choose a forex trading strategy that suits your needs.

Let’s be honest, there is no best strategy to trade forex. It’s all about choosing a strategy that makes sense and having self-discipline. That is what makes a successful trader.

The first two strategies are our favorite strategies. Only use the 4-hour and the daily time frames when trading with the 2 strategies.

Now let us get into 3 strategies that you can use to profit in the forex market.

Strategy #1: Breakout Method

The breakout method is a very popular strategy used by a lot of professional traders. The key here is to identify certain patterns that form in the forex charts and look for a breakout of that pattern.

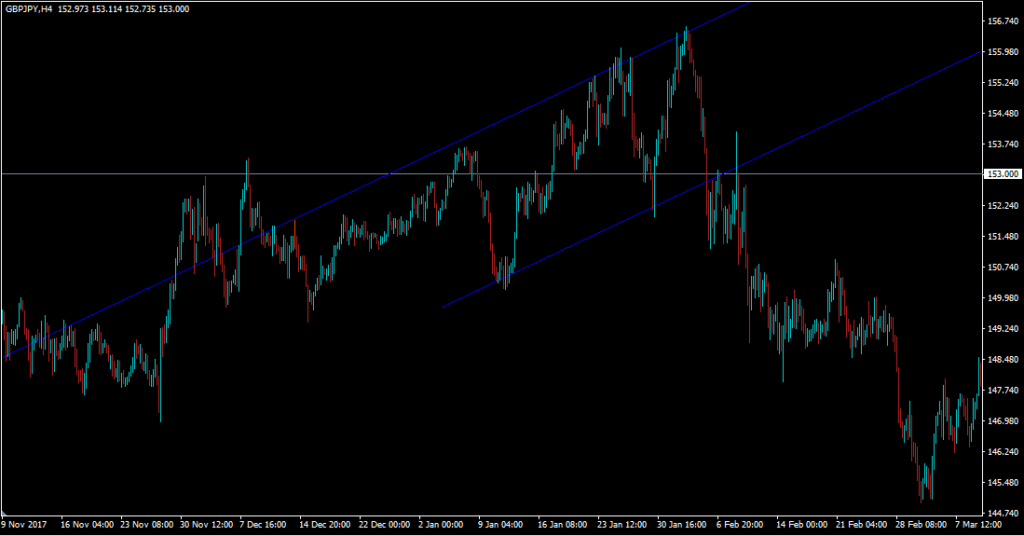

Let us look at an example. Below is an example of a channel breakout.

As you can see from the chart above, the candlesticks break out of the channel and continue in a downtrend. To trade with the breakout method, you wait for a breakout to occur and enter a trade in the direction of the breakout. You can always exit the trade if there is a confirmation of reversal. Knowing when to exit a trade is also important when using a breakout strategy. You can look for other trend reversal patterns by using the 2nd strategy in combination with this.

Channel breakout is just one type of breakout. There are other patterns that you can look for a breakout. These are triangle patterns, pennants, and wedges. We go through all these chart patterns in our trading guide and how to use them properly to enter and exit trades0. Make sure to check it out.

Strategy #2: Trading based on Candlestick Patterns.

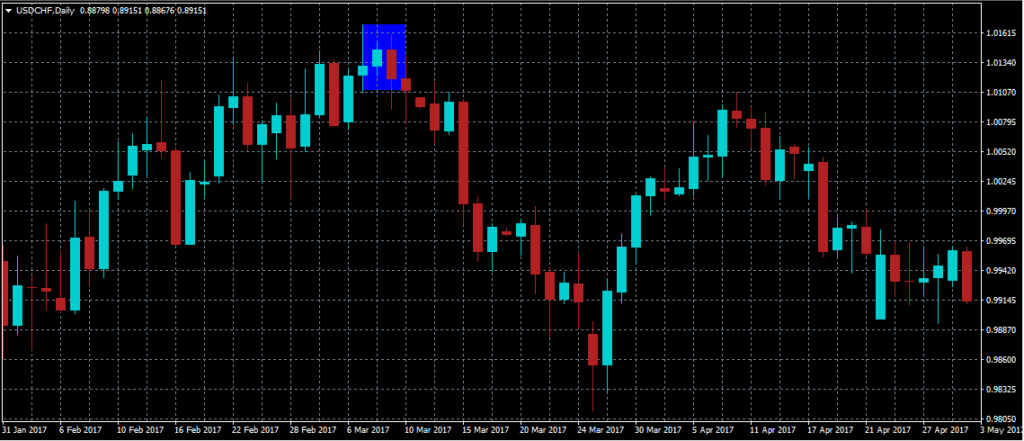

Another strategy is to trade based on certain powerful candlestick patterns. Below is an example.

The chart above shows a bearish engulfing pattern that is highlighted in blue. It is a powerful candlestick pattern that confirms the reversal in the market. As you can see the market was in an uptrend before the pattern appeared and reversed it directly after the pattern. The bearish engulfing pattern becomes more powerful if it appears on the resistance line in an up channel, down the channel, or horizontal channel.

You can enter the trade after the formation of this candlestick pattern. There are several other candlestick patterns that help you predict the direction of the market.

Tip: You can always combine the breakout method with the candlestick patterns to make the strategy more powerful.

But remember, not all candlestick patterns are powerful, and most patterns work if the market is in a clear upward or downward trend. To learn more about the most powerful candlestick patterns click here.

Strategy #3: Trading with Technical Indicators

There are thousands of technical indicators out there but to be honest most of them are pretty useless. Only a few really work. We personally do not like to depend on technical indicators. There are only a few technical indicators that we recommend and that are helpful.

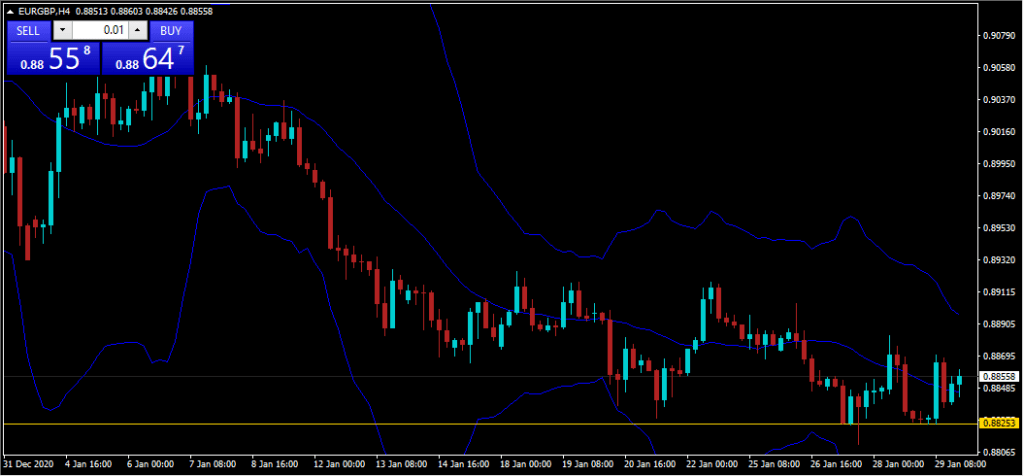

Below is an example of a technical indicator called Bollinger bands.

Bollinger bands are one of our favorite technical indicators. As you can see above there are 3 bands. The upper band, middle band, and lower band. Majority of the time the market stays within the upper and the lower Bollinger band.

The simplest way to trade with the Bollinger band is to enter a trade when the market touches the upper band or the lower band and exit the trade when the market arrives at the middle band. This method works best when the market is horizontal.

There are other powerful technical indicators out there. If you are interested in trading with technical indicators we recommend you choose 1 technical indicator and fully understand it and stick with it. You can always combine all the strategies that we talked about in this article to trade.

If you are interested in learning more about technical indicators we recommend you check out this article on different technical indicators.

What strategy should I use?

Now you may ask what strategy to use out of the 3 strategies. We recommend you start with strategy #1 and then combine it with strategy number #2. Make sure to test the strategies with a demo account first and don’t trade with real money until you fully understand how these strategies work.

Then eventually you can add strategy number 3 to your trading plan. Make sure to use only 1 technical indicator to keep things simple and reduce confusion.

Conclusion

These are 3 good strategies to make money in the forex market. You can always test these strategies by applying them in a demo account with virtual currency. If you are interested in learning how to trade the forex market, check out this guide.